California CPI in June 2019 280956. Covered california california health benefit exchange and the covered california logo are registered trademarks or service marks of covered california in the united states.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

That means you can earn no more than 134960.

Covered california maximum income. There are limits to the amount you may need to repay depending on your income. Its the only place to get financial help to pay for your health insurance. The 2020 applicable dollar amount for adults is 750 calculated as follows.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Providing You With Financial Support To Help Ensure You Make A Full Recovery. This web site is owned and operated by health for california which is solely responsible for its content.

Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income 200-250 FPL 2-4 household income 250-300 FPL 4-6 household income 300-400 FPL 6-85 household income. Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price. Medi-Cal for Pregnant Women.

Excluded untaxed foreign Income. So lets say youre a family of six. Their maximum contribution would be 1485 and their benchmark plan would be 644.

You can start by using your adjusted gross income AGI from your most recent federal income. Medi-Cal has free or low-cost coverage if you qualify. 70 73 87 and 94.

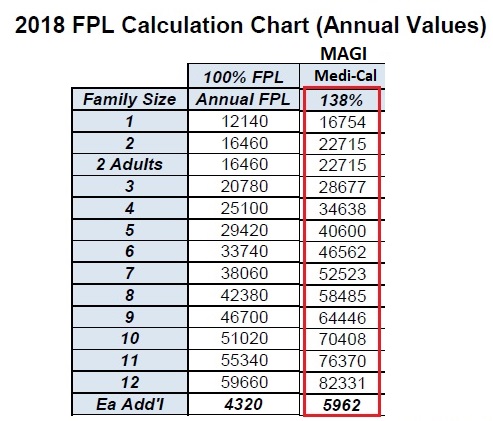

California CPI in June 2016 255576. Use the Shop and Compare Tool to see if you can get extra savings with Silver 73 87 and 94. If you make over 138 of the FPL you are unlikely to qualify for Medi-Cal unless youre pregnant or otherwise medically needy.

Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price. Which one you qualify for depends on your household income. The subsidies are for individual Californians who earn.

All plans cover treatment and vaccines for COVID-19. Because their benchmark plan costs less than their maximum contribution there is no State credit to make up the difference. Social Security Disability Income SSDI Retirement or pension.

California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families. Pandemic Unemploment Compensation 300week Social Security. Cost-of-living adjustment 280956 255576 10993.

Medi-Cal Eligibility and Covered California - Frequently Asked Questions Back to Medi-Cal Eligibility. Less than 200 FPL. To qualify for government subsidies you must purchase your coverage through Covered California and your annual gross income cannot be more than 400 percent of the FPL.

What is the max income you can have and still qualify for Medi-Cal. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. 200 - 300 FPL.

Providing You With Financial Support To Help Ensure You Make A Full Recovery. Applicable dollar amount in 2019 695. Applicable dollar amount in 2020 10993 695 76402.

Family size adjustments HUD applies to the income limits and 4 determining income limit levels applicable to Californias moderate-income households defined by law as household income not exceeding 120 percent of county area median income. Typically if you make between 0 and 138 of the FPL you will qualify for Medi-Cal. If you do you are not eligible for a subsidy.

Both Covered California and Medi-Cal have plans from well-known companies. This site is not maintained by or affiliated with covered california and covered california bears no. These are the repayment limits for the federal tax credit received in 2020.

The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple and 154500 for. Alimony only if divorce or separation finalized before Jan. A 30-year-old couple with a household income of 100000.

Silver Coverage Silver Comes in Four Varieties. Without coverage you could end up with a medical bill in the tens or hundreds of thousands of dollars but with this plan the highest your medical bill could reach in one year is 7800 for one person or 15600 for a family on the standard Bronze Plan or 6550 for one person or 13100 for a family on the Bronze HDHPHSA Plan.