If youve paid your deductible. 200 x 80 160.

Percent Of Health Insurance Plans By Type Of Benefit Limit And Plan Download Table

Percent Of Health Insurance Plans By Type Of Benefit Limit And Plan Download Table

As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year.

Is 0 percent coinsurance good. Coinsurance After Deductible - How To Choose Between 100 And 0. There are plans that offer 100 after deductible which is essentially 0 coinsurance. The system of coinsurance is represented by a percentage where paying is concerned with the insurer taking on the bigger percentage and the insured taking on the lower one.

The best health care plans pay 90 percent of covered expenses leaving you with a 10 percent coinsurance. 100 for the ER copay 200 for remaining deductible 20 coinsurance 640. Depending on your health insurance policy you may end up paying even more out-of-pocket thanks to your coinsurance.

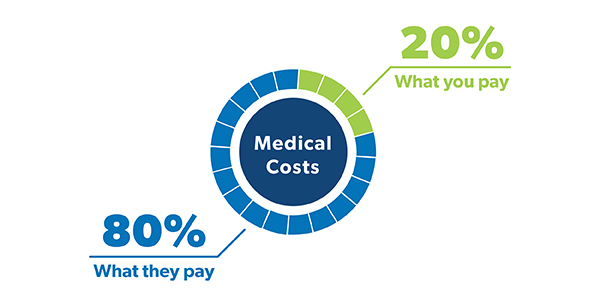

Your insurance company might make that. Your share of the medical bill is called your coinsurance. Coinsurance is the percentage of covered medical expenses you pay after youve met your deductible.

Your total bill in this instance would be 3200. Common divisions are 7030 or 8020 wherein your insurance company would pay either 70 or 80 and you would pay the remaining 20 or 30. Your coinsurance share shouldnt exceed 40 percent.

The best advice is to shop around and check out all the available options. Copays are a flat fee whereas coinsurance varies depending on the entire cost of each medical treatment or service. The most common are 0 20 30 40.

Can you provide a link to the Summary of Benefits. You see an orthopaedist a bone specialist. If you purchased less than required the insurance company might reduce your claim payment in proportion to the.

Generally there is a health savings account. It is less rare for HMO plans than PPO plans. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20.

A coinsurance amount of between 10 and 50 is common. You pay 20 of 100 or 20The insurance company pays the rest. If this is for a tax qualified high deductible health plan yes you pay your deductible and then everything is covered at 100 after that.

In fact its possible to have a plan with 0 coinsurance meaning you pay 0 of health care costs or even 100. That means the insurance company pays 160 and you pay the rest 40. Coinsurance comes after a deductible or co-payment.

This is effective only when the insured has paid the deductible in full. Coinsurance Percentage Breakdown The insurance company generally bears a higher burden paying the majority of the cost the greater percentage of any medically necessary health care service. If you have 80-20 coinsurance your insurance company will say.

So the average cost-sharing value for the tier of your insurance plan may not be the same as your coinsurance percentage. I recommend seeking advice from a professional for a complete understanding of how coinsurance works and applies to your situation. Your health insurance plan pays the rest.

Meeting your deductible doesnt mean youre done paying bill. Most insurance pays at least 70 to 80 percent leaving 20 to 30 percent for you to pay out of pocket. If you can afford to have a 0 coinsurance plan it is highly recommended that you chose this type of plan over a plan that has a 20 30 or 40 coinsurance.

Coinsurance percentage refers to the amount that either the insured or the insurer pays for a service. Coinsurance sometimes even kicks in before you meet your deductible. Therefore if the cost of service was 500 your coinsurance may require that you pay 20 percent of the service if the deductible has already been met and if you havent yet reached your out-of-pocket maximum.

Therefore you could owe 20 percent of 500 or. The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. With coinsurance youre splitting the cost of medical services with your health insurance until you reach your out-of-pocket maximum.

Some policies have the same coinsurance no matter what type of service you receive. The coinsurance clause has no effect unless theres a property loss. 0 coinsurance is rare and high conservative for the insured in todays insurance market.

This means that once your deductible is reached your provider will pay for 100 of your medical costs without requiring any coinsurance. These subsidies reduce coinsurance copayments deductibles and out-of-pocket maximums by increasing the actuarial value of the plan see below for information on actuarial value. The 6040 cost sharing factors in copays coinsurance and the costs you will pay before and after hitting your deductible.

Heres the good news. When you look at your policy youll see your. 100 coinsurance would mean the plan would pay 100 after you met your deductible.

There are several types of Coinsurances out there. That 1700 is your 20 coinsurance responsibility and it is on top of the 1500 deductible that you have paid already. For example if you have an 8020 plan it means.

He charges you 200. For instance 20 percent coinsurance for a checkup and 30 percent. If a loss occurs the insurer will compare the insurance limit on your policy to the amount of insurance you were required to purchase based on the coinsurance percentage.

Her health plan will pay 80 or 2560 leaving Prudence with a 20 coinsurance of 640. Coinsurance of 10 percent may seem like a small cost but if you need care for serious medical problems like cancer it could still amount to thousands of dollars.