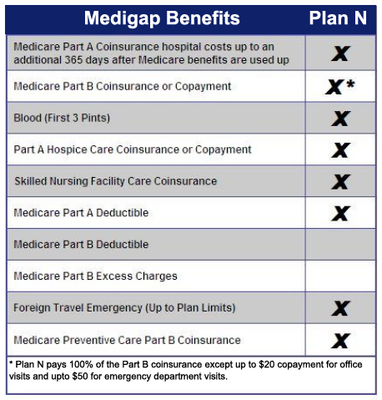

Plan N pays 100 of the Part B coinsurance except for a copayment of up to 20 for some office visits and up to a 50 copayment for emergency room visits that dont result in inpatient admission. Medicare Supplement Plan N.

Best Medicare Supplement Plan N Rates Medicare Plan N Benefits

Best Medicare Supplement Plan N Rates Medicare Plan N Benefits

Mon-Fri 830 am-830 pm ET.

Supplement plan n. Medicare Supplement also known as Medigap or MedSupp insurance plans help cover certain out-of-pocket costs that Original Medicare Part A and Part B doesnt cover. Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible excess charges and some copays for doctor and emergency visits. For instance they both cover.

Medicare Supplement Plan N offers similar coverage to other popular plans like Plan G and Plan D but with a little more flexibility. Medicare Supplement Plan G and Plan N both cover many of the larger costs leftover from your Original Medicare coverage. Medicare Supplement Medigap Plan N is a standardized Medicare Supplement insurance plan meaning it has the same benefits across all carriers.

Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. A B C D F G K L M and N. Aetna Health and Life Insurance Co offers it some areas see above because it helps seniors fill the gaps in their original Medicare benefits in a slightly different way.

This plan offers good value. Medicare Supplemental Plan N is one of 10 standardized Medigap plans available in most states. There are 10 Medicare Supplement plan options available.

Each plan has different yet standardized benefits and coverage that must follow federal and state laws and must be clearly identified as Medicare Supplement Insurance. In every market prices varied significantly. Medicare Supplement Plan N Although it may not be one of the Medigap plans you hear the most about Plan N is an excellent option for many people.

There are 10 plan types available in most states and each plan is labeled with a different letter that corresponds with a certain level of basic benefits. Medigap Plan N Similar to the other nine supplement plans Plan N offers standardized benefits for all its beneficiaries. Like other Medigap basic benefits this plan helps with certain costs that Original Medicare doesnt cover including cost-sharing expenses you may have for hospital services or doctor visits.

Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. Find the best Medigap Plan N Policies and Prices Best Medicare Plan N Prices. Its the plan for those who prefer lower monthly.

These plans can cover costs like premiums copays and. It has been popular since it was first introduced in 2010. Up to 20 for a doctors visit and 50 for emergency visits.

Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance. Medicare Plan N Pricing. Medicare Supplement Plan N also known as Medigap Plan N was introduced in June of 2010.

To lower monthly premium costs Plan N uses copays which include. You live in Massachusetts Minnesota or Wisconsin If you live in one of these 3 states Medigap policies are standardized in a different way. This plan provides coverage for out-of-pocket costs that are not covered by Medicare Part A and Medicare Part B.

5 rows Learn more. Women turning 65 may pay less than men. Plan N is one of the newest Medicare supplements.

Medigap Plan N Coverage Medicare supplement N coverage includ. The difference could be 300 or more. While all Medicare Plan N offer identical benefits the same cannot be said when it comes to what you might pay.

Medigap Plan N covers 100 of the Medicare Part B coinsurance costs with the only exception being that it requires a 20 co-payment for office visits and up to 50 for emergency room visits. Medicare Supplemental plans or Medigap cover the costs youre responsible for with Original Medicare.