An individual or family that needs coverage for a particular procedure not covered by their dental plan may choose to purchase supplemental dental insurance to help manage costs. Delta Dental advises its customers providers and others within our communities to follow the CDCs guidelines.

Tips For Choosing Supplemental Dental Insurance Your Aaa Network

Tips For Choosing Supplemental Dental Insurance Your Aaa Network

Supplemental Dental Plans for Existing Dental Coverage.

Buy supplemental dental insurance. The cost of an individual dental insurance policy is around 350 a year. This helps reduce out-of-pocket costs so you pay less for the dental care you need. Dental insurance makes dental care more affordable.

Blue Dental SM PPO Extra 1007050 In-network preventive care is covered at 100 percent with this plan. The CarePlus Supplemental dental plan works with your current dental insurance plan by providing additional coverage to reduce or eliminate out-of-pocket expenses. Supplemental dental insurance is meant to manage the costs of dental procedures not covered by your existing dental plan.

Supplemental dental insurance is purchased to fill the gaps in a policy holders dental or medical coverage. Dental savings plans are typically priced at about half of that cost and may include savings on other healthcare services such as vision and hearing. Just show your discount card at your appointment and youll get instant savings 15 percent to 50 percent off the cost of most services.

Even if you exceed your annual dental maximum CarePlus Supplemental continues to provide savings from 25 depending on the services you require. Important information regarding coronavirus. With dental plans starting from 19 per person per month 1 and access to 93000 dentists in 297000 2 convenient locations across Cignas large nationwide network its easy to find an affordable plan to help you save your smileand your wallet.

Gaps in coverage can occur when the primary policys annual spending limit is reached or when a policy doesnt provide coverage for necessary or desired dental treatments. We have a variety of plans to fit your needs. Best Dental Insurance for Seniors on Medicare.

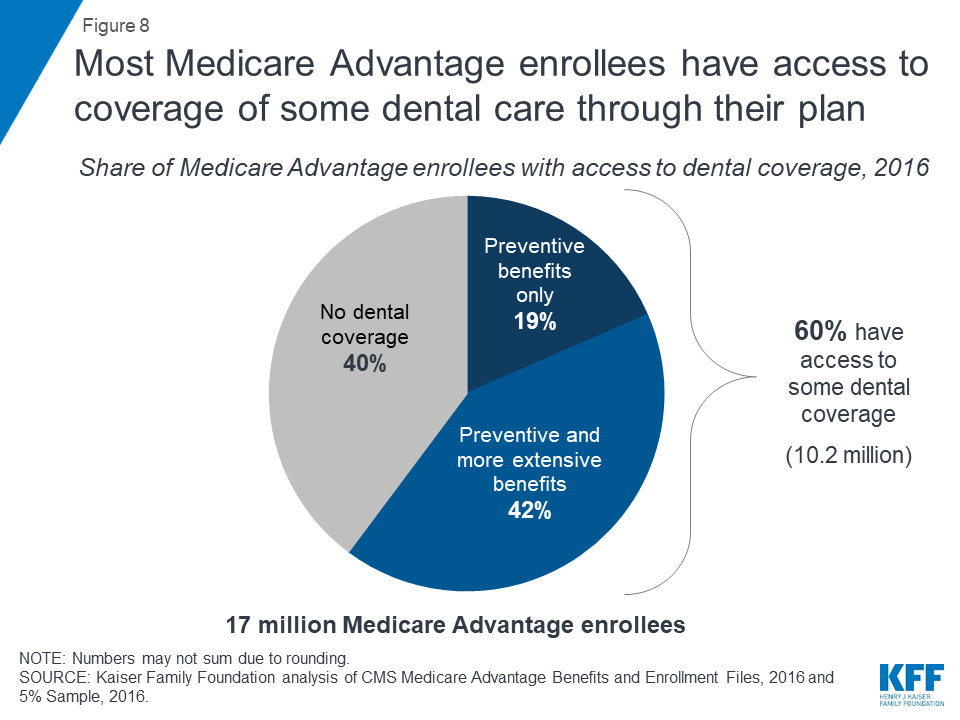

We cover more than 80 million Americans protecting more smiles than any other dental insurance providers. If you have Original Medicare and want dental coverage however you can buy a separate dental. Discover the benefits of supplemental insurance plans UnitedHealthcare.

Supplemental health insurance for seniors which can be purchased at any time includes coverage such as dental vision and hearing plans. Many dental insurance plans only pay. Get a quote or call 1-855-226-0509.

Benefits of CarePlus Supplemental. Get your dental care from in-network dentists for a low monthly cost. Blue Dental SM PPO Pediatric 805050.

Humanas variety of dental insurance and dental discount plans offers a range of coverage. For that reason most people covered by Medicare will buy a supplemental health insurance plan known as a Medicare Supplement. There are multiple dental plans with different levels of benefits to help you find the best dental insurance fit for your budget.

And since many health plans do not include dental coverage dental insurance itself is often acquired as a. 3 If youve ever bought a gym membership or a treadmill to help remind you to take care of yourself supplemental dental insurance from Golden Rule Insurance Company can be similar. See reviews photos directions phone numbers and more for the best Dental Insurance in Montour ID.

With a focus on prevention dental insurance typically covers professional services like routine check-ups cleanings and exams at 100. Supplemental health insurance for seniors which is sold by private health insurance companies is an addition to existing healthcare coverage thats designed specifically to meet seniors needs. For a family the cost is around 550 annually.

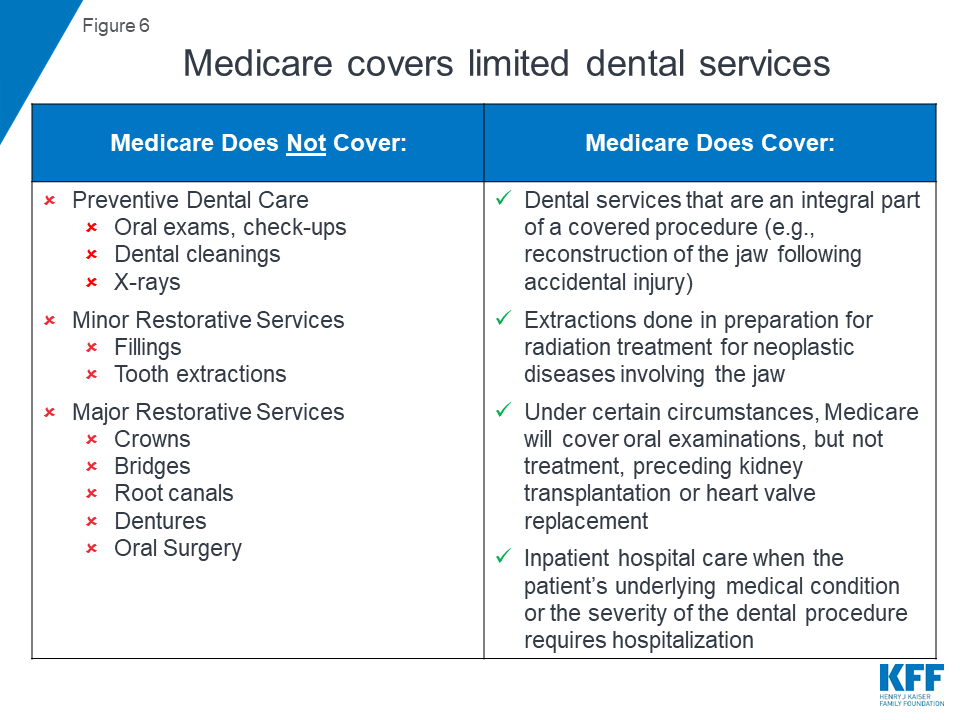

Medicare supplement plans cover the costs youre responsible for with. Some Medicare Advantage plans. For seniors over 65 Medicare insurance doesnt cover dental services but you can buy a private Medicare Advantage plan with a supplemental plan for dental coverage.

They dont actually cover any health benefits. Supplemental dental insurance is a separate plan that enhances your current dental coverage. Medicare supplement plans dont work like most health insurance plans.

Dental and vision coverage. See reviews photos directions phone numbers and more for Medicare Supplement Insurance locations in Nampa ID. Buy Aetna Dental Direct Aetna Vital Savings Dental Discount Card With Aetna Vital Savings you can choose from more than 250000 1 available dental practices across the country.