However California has now introduced a new state mandate for individual health care in 2020. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act.

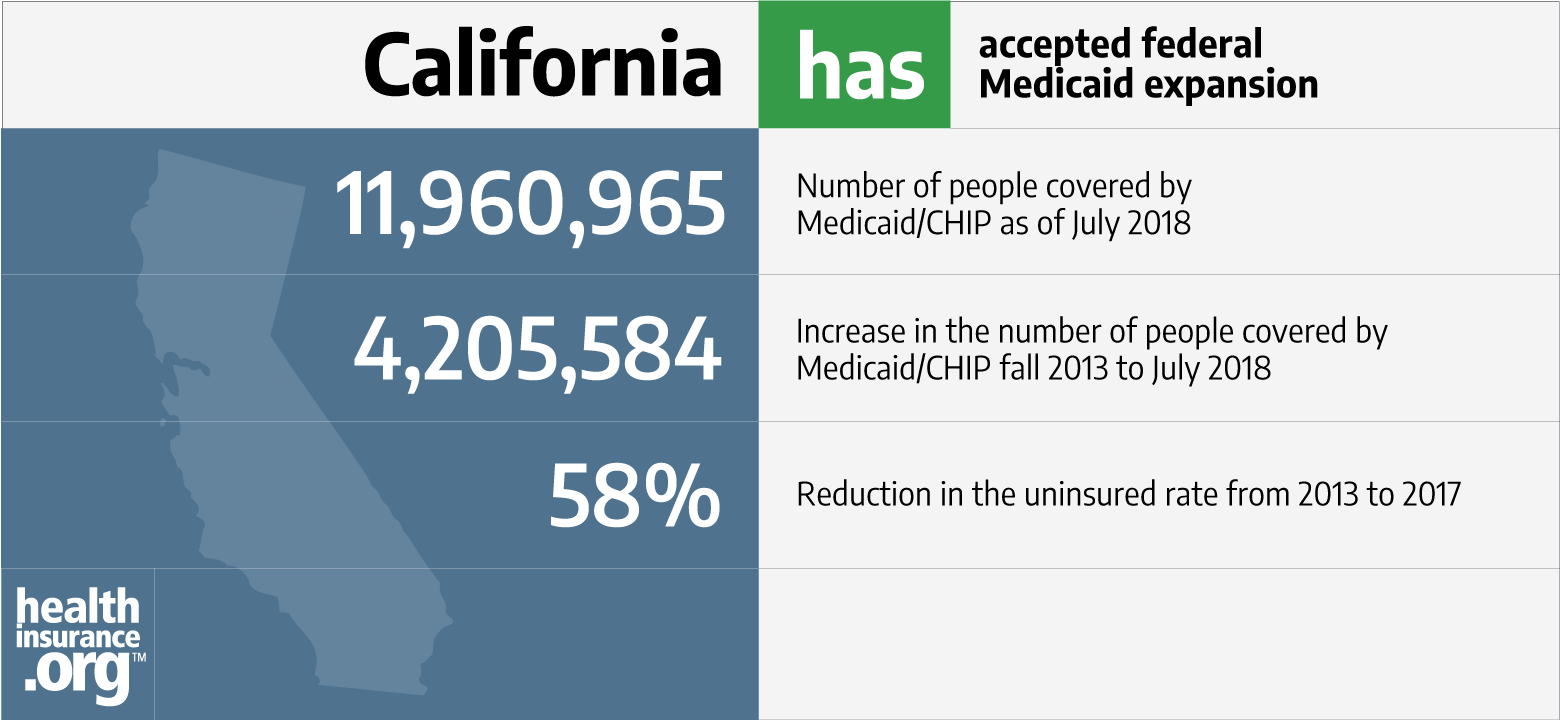

California And The Aca S Medicaid Expansion Healthinsurance Org

California And The Aca S Medicaid Expansion Healthinsurance Org

Beginning January 1 2020 California residents must either.

Do i need health insurance in california. Obtain an exemption from the requirement to have coverage. You have a health plan but your needs for benefits have changed. You may also need to get Individual Health Insurance in California if.

We have gathered resources to help you make decisions and direct you. The federal law was repealed and coverage was not mandatory in the state of California in 2019. Most types of insurance including Medi-Cal Medicare and employer-sponsored coverage will satisfy Californias coverage requirement.

The group plan you are enrolled in does not cover your dependents or spouse. There are also situations where an out of State carrier doesnt offer a provider network in California. Its the only place where you can get financial help when you buy health insurance.

Coverage is not required for part-time employees under 30 hours weekly Coverage is not required for dependents. You are enrolled in a health plan but the premiums are too high. The california public employees retirement system calpers administers health insurance coverage for state employees.

The California health insurance mandate is in effect requiring Californians to have health insurance The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty. A new state law going into effect Jan. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

Health insurance is complex confusing and often overwhelming even for the most savvy consumer. 1 requires Californians to have health insurance in 2020 or face a penalty on their state taxes. Most Medi Cal coverage is considered MEC.

Your employer does not offer a group health insurance plan. California law says that many health insurance policies must cover essential health benefits which include services like diabetes supplies maternity care cancer screening transgender health care and substance abuse treatment. There are several major changes to California health insurance in 2020.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax. Have qualifying health insurance coverage. The employer is required to fund at least 50 of the employees premium.

Starting in 2020 California residents must either. This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty. Your Form 1095-B shows your Medi-Cal coverage and can be used to verify that you had MEC during the previous calendar year.

In California you may need to purchase Individual Health Insurance in the following circumstances. Pursuant to the Affordable Care Act and the California Health Mandate most people are required to maintain health insurance coverage that meets MEC requirements every year. The coverage must meet the Bronze level at a minimum or other penalties apply.

Get an exemption from the requirement to have coverage. You may also need to get individual health insurance in california if. We regulate health insurance policies in California to ensure vibrant markets where the health and economic security of individuals families and businesses are protected and insurers keep their promises.

You are enrolled in a group plan but it does not cover your spouse or dependents. This follows the repeal of the individual mandate at the. Your health plan premiums are too high.

Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can be. The Franchise Tax Board FTB urges Californians to get health care coverage now and keep it through 2020 to avoid a penalty when filing state income tax returns in 2021. The penalty generally applies after the 20th employee.

Pay a penalty when filing a state tax return or. Have qualifying health insurance coverage or. Watch out for discount plans and limited benefit plans.

Your employer does not offer group plans. Pay a penalty when they file their state tax return. Health insurance was medically underwritten and a change of residency typically requires that the person moving must find health insurance in the new State.