Clips of AP 0177. Taxes arent due until April but as a business owner you must send a 1099 by January 31.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Do I Have To Issue A 1099 - MISC For An Overseas Virtual Assistant.

How to issue a 1099. Youll also need some blank 1099 forms. Prepare a new Form 1099. Each Form 1099 comes with 5 copies so make sure to write or type on the top copy so it transfers down onto each copy like carbon paper.

The 1099 correction form is the same as the original form. The most effective way to obtain the information needed to prepare the Form 1099. Including 1099 Income on Your Tax Return.

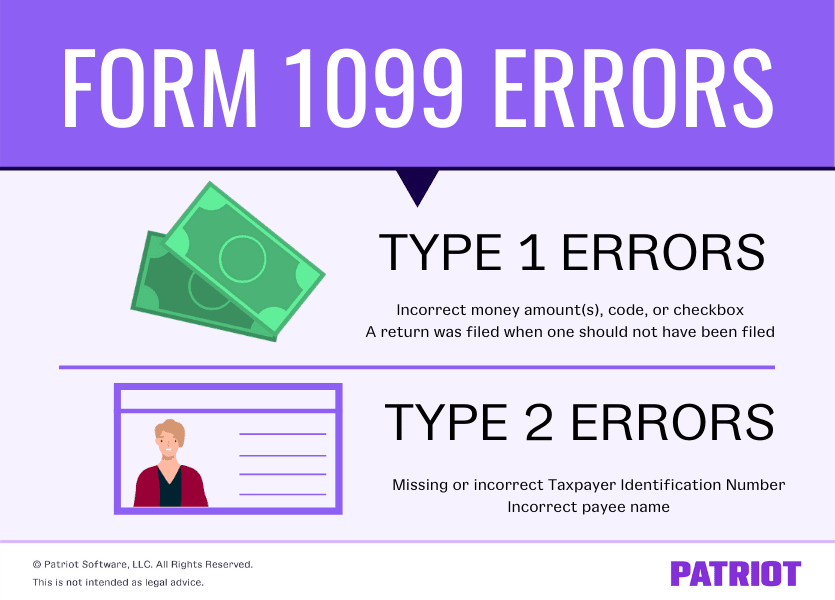

Once you do that youll need to be sure and fill it out properly. Include the correct information money amount code or checkbox. Prepare a new Form 1096 with corrected information to send with Copy A to the IRS Is there.

For your business you should include your business name address phone number and. Before you can send out IRS Form 1099-MISC you must have the Social Security number or the Tax Identification Number and the address of the person to whom you plan to make payments during a calendar year. Use accounting software to fill out a Form 1099-NEC for each contractor and consult with a certified public accountant CPA regarding the 1099 forms your business must provide.

Enter the persons state income any state taxes you might have withheld and identify the state or states to which youll be reporting. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099. Only a few steps are required to get it done.

Complete an additional 1099-NEC for this information if you must enter data for more than two states. A lot of businesses use promotional giveaways and contests to market a rebranding or new service. When do you need to issue a 1099-MISC1099-NEC.

You can find a 1099 employee form online. If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to. There are currently no snippets from AP 0177.

To correct a Type 1 Error you must. This is required whether these payments are spread out over the course of the year or are paid in one lump sum payment. Youll need the names addresses and Social Security Numbers or Employer Identification Numbers for each contractor.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Issuing a 1099-K depends on the number of transactions and the total dollar amount paid. How do I fix a 1099 issued error.

Information Returns which is similar to a cover letter for your Forms 1099-NEC. If on the other hand your. Your businesss obligation to issue a 1099 form will depend on how the gift was distributed.

If the item your business purchases for one of these prizes or giveaways is more than 600 you will need to collect a W-9 and distribute a 1099 at the end of the year. Issuing a 1099 isnt difficult once you know the process. Follow this 1099 Decision Tree to help you decide who you need to supply a form to.

Youll need to write in your federal tax ID number the contractors SSN or EIN and the amount of money you paid the contractor or vendor this year. How you report 1099-MISC income on your income tax return depends on the type of business you own. Since contractors and LLCs will need time to file their own taxes theres a different deadline for issuing 1099-MISC1099-NEC forms.

1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. First make sure your information is correct. How to File 1099s.

Enter an X in the CORRECTED box. Here is the information that must be provided on the form. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US.

You can also create your own 1099 forms using a software program such as QuickBooks or order forms from your local office supply store. Code Section 6041 which covers most 1099 situations simply says a reporting form a 1099 must be issued for payment of rent of 600 or more to any one. How to issue a corrected 1099 paper Unlike Form W-2s correction form Form W-2c there is not a separate 1099 correction form.

The deadline to file in 2021 was February 1st because January 31st fell on the weekend. If you miss the deadline for issuing 1099s you. If youre not sure how to issue a 1099 dont worry.

The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. Issue a 1099 to a Hotel for Rent Expense. When you complete Schedule C you report all business income and expenses.

Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have paid. Do I Have To Issue A 1099 - MISC For An Overseas Virtual Assistant. The actual deadline is January 31st unless this is the case.

How to Issue a 1099. -The no 1099s to a corporation rule is true unless you paid the corporation for medical or legal services in which cases a 1099 must still be issued. Fill out the 1099.

Snippets are an easy way to highlight your favorite soundbite from any piece of audio and share with friends or make a trailer for AskPat. You must use a regular copy of Form 1099 either NEC or MISC and mark the box next to CORRECTED at the top. From the IRS website download the latest W-9 form Request for Taxpayer Identification Number and mail or give it to the supplier vendor attorney or.

The Internal Revenue Service IRS requires businesses including not-for-profit organizations to issue a Form 1099 to any individual or unincorporated business paid in excess of 600 per calendar year for services rendered. If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From Business. Obtain a blank 1099 form which is printed on special paper from the IRS or an office supply store.