Dental plans typically dont cover cosmetic procedures such as whitening and veneers but if your child has a medical need for braces difficulty chewing or jaw misalignment your plan may provide coverage. Thats roughly half the cost of basic metal braces.

What Does My Plan Cover Horizon Blue Cross Blue Shield Of New Jersey

What Does My Plan Cover Horizon Blue Cross Blue Shield Of New Jersey

Have a maximum allowable orthodontic fee that the plan covers meaning they only pay for braces up to a certain dollar amount typically 1000-1500.

Does horizon insurance cover braces. Finding a dental insurance plan that includes coverage for adult braces can be difficult. And there is no maximum lifetime limit on savings for braces unlike dental insurance which usually covers only 1000-1500 in orthodontic treatments per person covered under the plan. My FSA benefits expire at the end of the year.

Dental insurance that covers braces for adults. Your dental insurance will adhere to a more lenient standard of medical necessity provided it includes orthodontia benefits as many do not. Remember braces are for two years and you would have to pay that deductible every January each year the patient has the braces on.

The catch is that less. Did you know that your Back Brace or Back Support is covered by your health insurance company. Plans designed to cover braces may approve your claims after the provider submits evidence of a severe handicapping malocclusion.

Braces are usually covered at 50 through dental insurance contracts according to the Canadian Association of Orthodontics CAO. Then if you have qualifying orthodontic coverage included in your dental plan well help you with your insurance claim form to get the proper reimbursement. Some policies pay a percentage of the dentists fees while others pay a flat fee.

Others consider Invisalign a cosmetic treatment unlike traditional braces and will not cover any portion. All Diamond Braces payment plans are interest-free and require no up-front costs and your costs will be pro-rated to include only the remaining balance. If approved the insurance company covers 100 after a yearly deductible for the patient.

Orthodontic coverage will vary between plans and providers. Just because you have orthodontic insurance however. Orthodontic insurance generally includes discounts and some level of coverage for treatment including exams imaging braces retainers etc.

Just utilize your major creditdebit card associated with your FSA to pay for your treatment. Dental insurance plans that include coverage for braces and related services can help pay some of the cost of orthodontic care you need. Things to know about insurance and braces.

You can save not only on the braces but also the related dental visits. All dental plans have an. The average coverage will depend on your individual insurance provider and most dental insurances will cover between 25 to 50 of the treatment fee leaving you with the balance.

In most cases it is 350 per year. Covered by Fee-for-Service when services are not given by a Horizon NJ Health doctor. Dental insurance widely varies but many larger insurance policies will cover a percentage of Invisalign.

Lifetime maximum benefit amounts for braces. NJ FamilyCare is a comprehensive health insurance program that provides a wide range of services. Plastic study models of teeth.

To understand your out-of-pocket costs you will want to look at the following. And lab tests drugs and biologicals medical supplies and devices counseling continuing. Cover all types of braces but base your benefits on total cost.

Yes thats right your insurance company will cover the purchase of back support now your insurance company will only cover back supports that have a HCPCS code pronounced hicks-picks. The medically necessary insurance only covers braces with approval from a consulting orthodontist from their insurance company. Discounts are available for every eligible procedure performed during the year.

Some policies place an age limit on orthodontic coverageusually around age 19. Young Grins along with dental coverage for parents or guardians. If your policy does have coverage for adult braces find out if there is a yearly maximum benefit or a lifetime maximum for braces.

X-rays of the jaw. Pre- and post-orthodontic treatment. If you lose your insurance andor your new plan no longer covers orthodontic treatment Diamond Braces will help you establish a flexible monthly payment plan that allows you to pay in manageable installments.

Put possible age restrictions on when they pay for braces. Horizon Family Grins Plus adds out-of-network coverage for members over the age of 19. What does it cover.

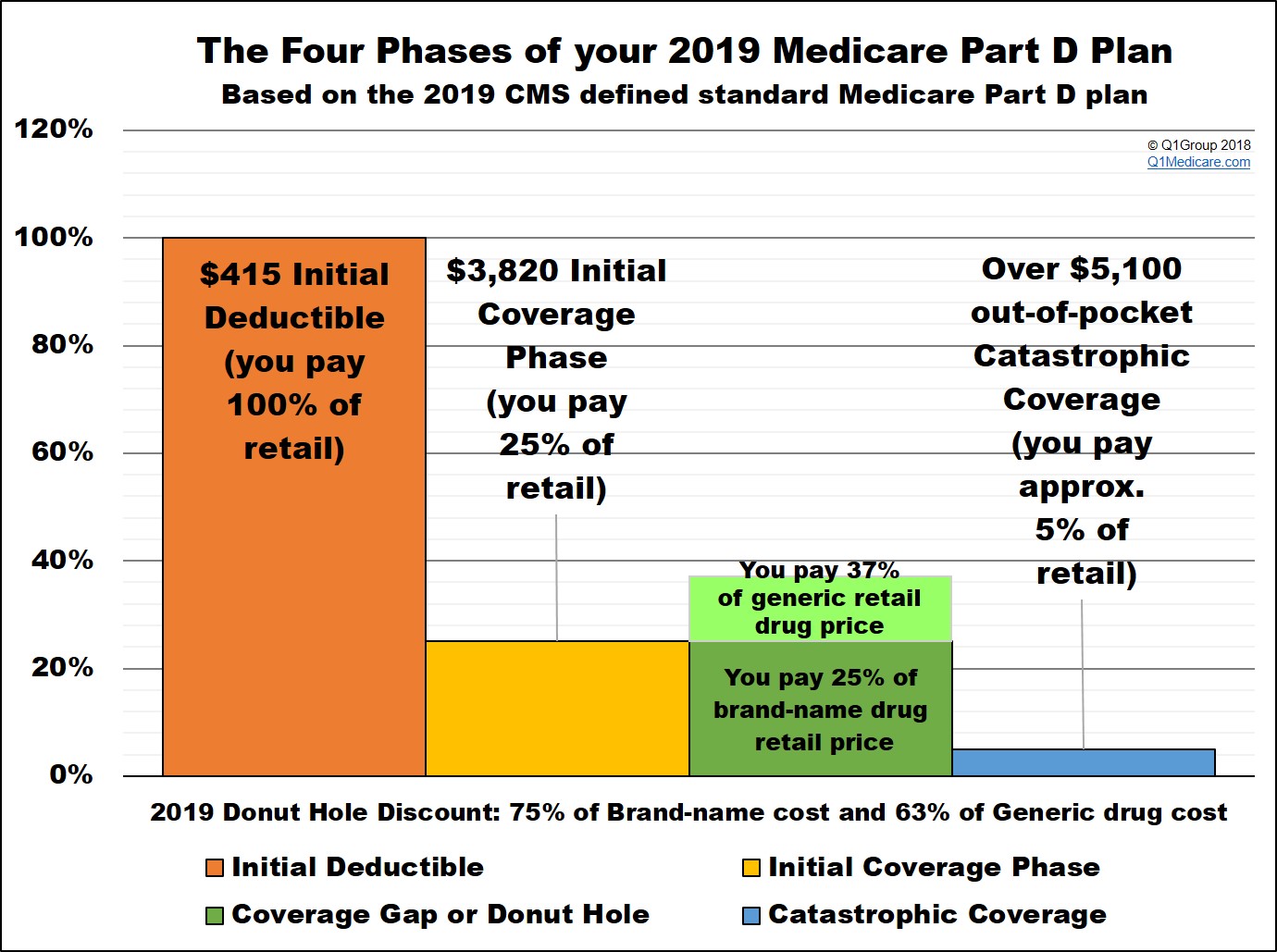

What is a HCPCS code you ask an HCPCS code is used by Medicare and Medicaid to identify products that are covered. If you choose a more expensive type of appliance such as tooth colored brackets. Horizon Healthy Smiles and Horizon Healthy Smiles Plus The Horizon Healthy Smiles Plans offer comprehensive coverage.

In this case the cost of braces is covered up to 50 making your cost 2500 and you have a remaining balance of 500 to use for future covered claims like retainers. Each plan offers coverage for cosmetic orthodontia as well. Premium A monthly rate you pay for dental insurance coverage.

Not all dental insurance plans include orthodontics so be sure to check if yours does. If you have verified that your dental insurance includes orthodontic coverage Diamond Braces can begin your treatment and bill your insurance provider immediately. Coverage includes medical history and physical exams including pelvic and breast diagnostic.