With self funding insurance companies pay for healthcare expenses out-of-pocket as they are received. What Is Self-Insured Health Insurance.

What Are Self Funded Health Plans Aka Self Insured Benefit Plans

What Are Self Funded Health Plans Aka Self Insured Benefit Plans

Depending on the insurance company that we find for you if you have a favorable claims year compared to the claims funding you get some of the excess funding returned.

Employer self funded health insurance. Self-insurance is also called a self-funded plan. Annonce Get 247 Virtual Appointments Via Video or Phone With Our Global Network Of Consultants. Stop-loss insurance comes in two forms.

With self insurance your company can cut out the carrier that manages claims for a marked-up fee. Self-funded insurance is a compensation plan in which an employer chooses to provide health disability andor workers compensation insurance benefits to employees itself with claims to be paid from its own coffers rather than pay premiums and file claims through a typical insurance provider called a fully insured plan. A Self Funded or Self-Insured plan is one in which the employer assumes the financial risk for providing health care benefits to its employees.

This makes it easier for employers to utilize self funded insurance. Self-funded is a financial solution that allows employers to pay only for claims that are actually incurred. A Self Funded health plan may be just what you need.

Self funding otherwise known as self-insured insurance is a plan in which the employer takes on the financial risk of providing certain healthcare benefits to his or her employees. Employers with self-funded health plans typically carry stop-loss insurance to reduce the risk associated with large individual claims or high claims from the entire plan. If total claims costs are lower than expected you retain the savings and can earn interest on your reserve.

Self-Insurance is a solution for many employers. The employer self-insures up to the stop-loss attachment point which is the dollar amount above which the stop-loss carrier will reimburse claims. It can feel that way sometimes especially when some months.

A self-funded plan is a health plan that is sponsored by an employer rather than an insurance company. In a self-funded health insurance model the employer is responsible for collecting storing and managing the premium amount. BenaVest allows small midsize employers to make monthly payments that includes all administration fees stop loss premium and claims liability charges.

This employer-operated health care plan requires businesses to calculate the number of claims they expect to pay monthly. The Next Level Of International Private Healthcare With Cover Across The World. Self-insured health insurance means that the employer is using their own money to cover their employees claims.

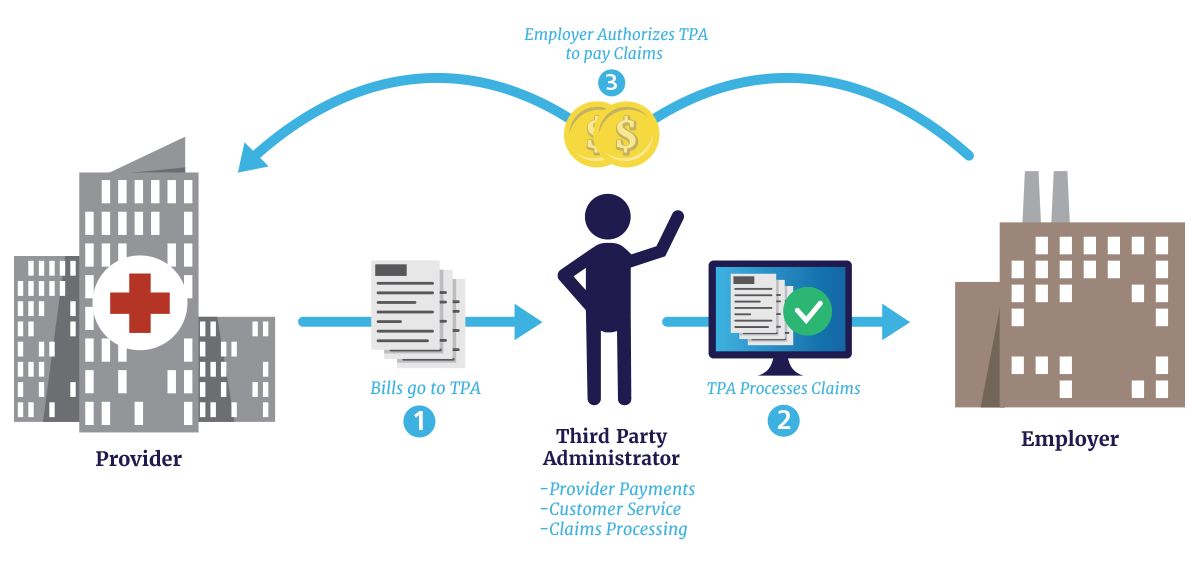

In practical terms Self-Insured employers pay for claims out-of-pocket as they are presented instead of paying a pre-determined premium to an insurance carrier for a Fully Insured plan. Self-Funded Employee Health Insurance plans or self-funded employee health insurance plans are risky for companies to offer but they are incredibly common. Employers sponsoring self-funded plans typically contract with a third-party administrator or insurer to provide administrative services for the self-funded plan.

This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The insurance company manages the payments but the employer is the one who pays the claims. Its also known as a self-insured health plan or self insurance.

A Level Funded plan may be the stepping stone you need to take back control. During years when the utilization level is low ie there is a lower-than-average number of claims the. The Next Level Of International Private Healthcare With Cover Across The World.

That means the employer pays health claims based on the healthcare thats used. Our Employer Self Funded Health Insurance makes self funding simple. What is a Self-Funded Health Plan.

The employer self-insures up to the stop-loss attachment point which is the dollar amount above which the stop-loss carrier will reimburse claims. Annonce Get 247 Virtual Appointments Via Video or Phone With Our Global Network Of Consultants. Instead you assume the responsibility and risk for paying your employees healthcare.

Most self-insured employers contract with an insurance company or independent third party administrator TPA for plan administration but the actual claims costs are covered by the employers funds. In some cases the employer may. Stop-loss insurance comes in two forms.

Stop-loss insurance mitigates the financial risk of a self-funded plan by putting a limit on the financial impact claims can have on your company. Employers with self-funded health plans typically carry stop-loss insurance to reduce the risk associated with large individual claims or high claims from the entire plan.