Other documents you can use include a copy of last years federal tax return if you still have the same income or a signed statement from your employer. We provide information about each health insurance plan explained in.

Covered California Income Verification Attestation Affidavits

Covered California Income Verification Attestation Affidavits

If your income changes during the year or at your annual renewal you may qualify for other health insurance and premium assistance through Covered California.

Coveredca com proof of income. For coverage beginning January 1 2016 enroll by December 15 2015. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency. Proof of current household income California ID or drivers license for adults Social Security number or Individual Taxpayer Identification number if you have one Birth date Home ZIP Code Proof of citizenship or satisfactory immigration status eg US.

Award Letters unemployment disability benefits social security benefits etc Proof of current income of all family members applying. Documents to Confirm Eligibility. A dependents income should only be included if their income level requires them to file a tax return.

Providing a current pay stub to show proof of income would be a good example of this. How do I apply through Covered California. Child support money gifted supplemental security income or SSI state disability insurance Veterans disability and workers compensation.

Changes to things like your address family size and income can affect whether you qualify for Medi-Cal or get help paying for your health insurance through Covered California. Just make sure it includes your name and is not older than 45 days. Here are just a few common sources of income that are not counted.

If you have been asked to provide proof please click on these categories for a more detailed list of acceptable documents. State of California established under the federal Patient Protection and Affordable Care Act. When the information that you put on your application changes during the year you must report it.

The federal IRS Form 1095-A Health Insurance Marketplace Statement and the California Form FTB 3895 California Health Insurance Marketplace Statement. People with Medi-Cal must report changes to their local county office within 10 days of the change. It is administered by an independent agency of the government of California.

Covered California compares the information you enter on your application with government data sources or information youve provided before. The persons first and last name and company name. Sometimes Covered California is unable to verify information on an application through electronic sources so they may ask you to provide a document for proof.

During tax season Covered California sends two forms to our members. Otherwise Covered California may not accept it. If Covered California is unable to verify through external sources they may ask for document proofs in one or more of the categories below.

Generally they give you 90 days from when you complete your Covered California application to submit this information. If you submit a pay stub make sure that it is current and within the last 45 days. The exchange enables eligible individuals and small businesses to purchase private health insurance coverage at federally subsidized rates.

One of the most common proofs is a pay stub. Youll be asked to provide pay stubs federal income tax forms or your latest W-2 or 1099 statements. Proof of Income.

Choose one Past 30 days of Pay Stubs. Dates covered and the net income from profitloss. Most people are required to have health insurance or pay a tax penalty.

Covered California is the health insurance marketplace in the US. Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement or a self-employment ledger. Attestation of Income No Documentation Available I last name attest that my households projected annual income for the benefit year in which I will receive financial assistance for my health plan is annual income xI acknowledge that the information provided on this form will only be used for purposes of.

Passport legal resident card certifcate of citizenship or naturalization document. Or those who can prove financial hardship. A pay stub is the most common proof of income.

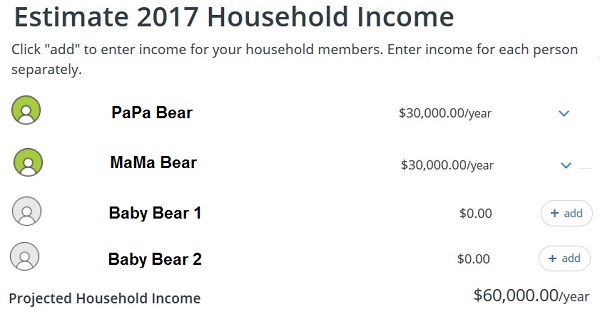

A household is defined as the person who files taxes as primary tax filer and all the dependents claimed. A dependents income should only be included if their income level requires them to file a tax return. A dependents income should only be included if their income level requires them to file a tax return.

If the data is inconsistent we ask you to submit documents to confirm the. In 2016 the penalty will be 25 of your yearly household income or 695 per. These requests are common so dont be.

You can apply for health insurance through Covered California in the following ways. Income can be verified by providing various types of documents such as the acceptable list below. A family is defined as the person who files taxes as head of household.

A household is defined.