We will reimburse you based on your annual premiums. All costs Home healthcare.

Bcbs And Medicare For Federal Retirees Blue Cross And Blue Shield S Federal Employee Program

Bcbs And Medicare For Federal Retirees Blue Cross And Blue Shield S Federal Employee Program

55 copay Tier 3.

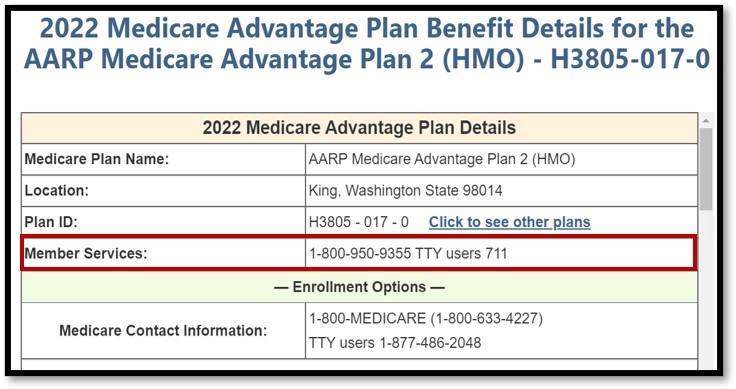

Fepblue org medicare reimbursement. See Whats New in 2021 Access Member-Only Resources with MyBlue Learn About Incentives Discounts Register for a Medicare Reimbursement Account. Find your best rate from over 4700 Medicare plans nationwide. Username Name selected when you registered.

65 copay Tier 5. Each member in your household with Medicare Part A and B is eligible to receive this benefit. The online Claims and Activity page details all your account activity.

Each eligible active or retired member on a contract including covered spouses can get their own 800 reimbursement. Proof of Payment. The Blue Cross and Blue Shield Service Benefit Plan will reimburse these members up to 600 every calendar year for their Medicare Part B premium.

Each year Basic Option members enrolled in Medicare Part A and Part B can get cash back in their bank accounts. Receive reimbursement by direct deposit or check depending how you set up your account. Protect the best years ahead.

As a Basic Option member enrolled in Medicare Part A and B you can get reimbursed up to 800 per calendar year for paying your Medicare Part B premiums. 60 of our allowance 75 minimum Tier 4. Advertentie Shop 2020 Medicare plans.

Upload your receipts proof of premium payment. Your monthly reimbursement will not be more than the current balance in your account or the maximum benefit available of 600. Members with Medicare Part A and Part B can get up to 800 back a year.

Advertentie Shop 2020 Medicare plans. Get more out of your coverage on the go with the fepblue app available for free on the App Store or Google Play. Months if you pay out-of-pocket on a monthlyquarterly basis.

70 copay Tier 5. Preferred Retail Pharmacy Tier 1. Section 2 Medicare Part B Healthcare Premiums Not Deducted from Your Social Security Check 1.

Attach proof of Medicare Part B premium payment. Frequently Asked Questions about Medicare vs FEHB Enrollment. Your FEHB Plan must also pay benefits first for you or a covered family member during the first 30 months of eligibility or entitlement to Part A benefits because of End Stage Renal Disease ESRD regardless of your employment status unless Medicare based on age or disability was your primary payer on the day before you became eligible for Medicare Part A due to ESRD.

Before making a final decision please read the Plans Federal brochures Standard Option and Basic Option. Who doesnt love getting money back. Terms of Use PDF opens in new window Privacy Policy PDF opens in new window CA Privacy Rights PDF opens.

Usually if youre retired Medicare is primary. Fill in the total annual or monthlyquarterly amount of your Medicare Part B payment. Register or Log In Register for your Medicare Reimbursement Account online.

Protect the best years ahead. Find your best rate from over 4700 Medicare plans nationwide. 95 copay Preferred Retail Pharmacy.

90 copay Mail Service Pharmacy Available to members with Medicare Part B primary only. Your service end date is either December 31 of the year for which you are requesting reimbursement or the last day of the. Are you eligible for a Medicare reimbursement.

If youre submitting a reimbursement claim for a 2019 premium we will reimburse you up to 600. 10 copay Tier 2. 341 per day Days 91 and beyond 682 per each lifetime reserve day Beyond lifetime reserve days.

Managing Your Account You can manage and keep track of your account online or by phone. Each member of a Basic Option plan who has Medicare Part A and Part B can get reimbursed up to 800 per year for paying their Medicare Part B premiums. Complete this section if your Medicare Part B premiums are.

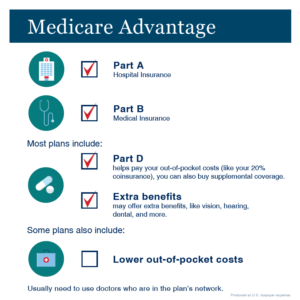

As an active or retired Federal employee covered by both the Federal Employees Health Benefits FEHB Program and Medicare you probably have had questions from time to time about how the two programs work together to provide you with your health benefits coverage. That means Medicare pays for your service first and then we pay our portion secondary coverage. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan.

Our fepblue app provides members with 247 access to helpful features tools and information related to your Blue Cross and Blue Shield Service Benefit Plan benefits. Specialty Pharmacy Tier 4.