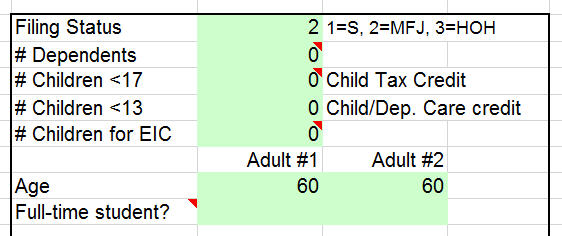

If you are likely eligible for a cost sharing subsidy the calculator also shows what your silver plans actuarial value would be. 3900 - 36480 353520.

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

For a single person in 2021 thats 51040.

Medical insurance subsidy calculator. Get the Best Quote and Save 30 Today. Toms premium tax credit subsidy will be 258210 per year or 29460 per month. The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

Premiums will drop on average about 50 per person per month or 85 per policy per month. And the law and regulations are subject to change. Health Insurance Comparison and Offer.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. The information on Healthcaregov including the Subsidy Calculator is based on the Affordable Care Act and subsequent regulations issued by Health and Human Services and the Internal Revenue Service. This subsidy calculator will help you determine.

You need to know your annual modified adjusted gross income from your 1040 tax form. Compare your current Health Insurance Premiums in just 2 minutes without obligation. To see if you qualify for the Federal Subsidy to pay a portion of your health insurance premium for 2020 use this helpful tool.

Enter the required information into the fields below then calculate your results. Anzeige Compare Top Expat Health Insurance In Switzerland. If you already enrolled in an ACA plan and got a subsidy you.

Premium subsidies in the health insurance exchange are only available if your MAGI doesnt exceed 400 of the poverty level. Health Insurance Comparison and Offer. Anzeige How much can you save in your canton.

You qualify for subsidies if pay more than 85 of your household income toward health insurance. For the 2019 tax year please review line item 8b for the 1040 or 1040A. They are higher in Alaska and Hawaii where the federal poverty level amounts are higher.

This insurance subsidy calculator illustrates health insurance premiums and subsidies for people purchasing insurance on their own in new health insurance exchanges or Health Insurance Marketplaces created by the Affordable Care Act ACA. Affordable healthcare plans are now more standardized and simplified. Get the Best Quote and Save 30 Today.

Cost of the benchmark plan expected contribution amount of the subsidy. Their tool will help clarify various health insurance premiums and subsidies for people purchasing insurance on their own. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

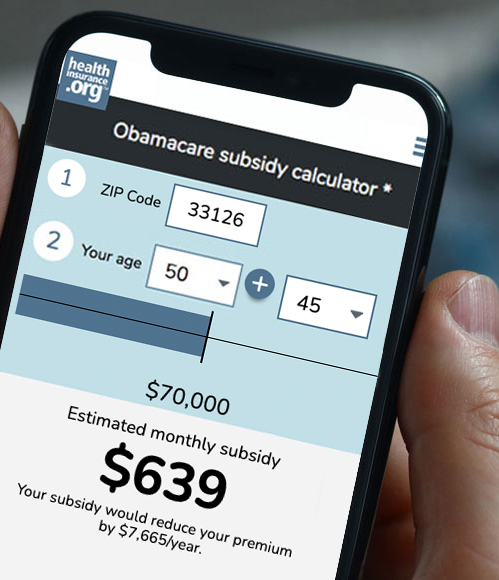

Anzeige Compare Top Expat Health Insurance In Switzerland. The Subsidy Calculator is not intended to be relied upon for legal or tax advice. About the 2020 2021 Obamacare Subsidy Calculator.

Compare your current Health Insurance Premiums in just 2 minutes without obligation. If you already have affordable insurance from your employer or a government program like Medicare or Medi-Cal you will not be eligible for these cost-saving programs and the calculator will. If you qualify for a monthly tax subsidy from the federal government also known as a health insurance premium tax credit to help pay for your monthly health insurance premium.

CALCULATING POTENTIAL INSURANCE COST IN 2021 This online calculator will help you estimate how much it will cost you to purchase health insurance in 2020 and the amount of your financial assistance. The Health Insurance Marketplace Calculator estimates whether you may be eligible for cost staring subsidies. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov.

How much that subsidy could be. In the calculator you can enter different information about your household to get an estimate of eligibility for subsidies and how much you. For the 2018 tax year you can review.

Our calculation is based upon the federal poverty level data provided by the government. Anzeige How much can you save in your canton. For a family of four its 104800 these limits are for the continental US.

The Health Insurance Marketplace Calculator was developed by the Kaiser Family Foundation and is based on the Affordable Care Act. If Tom chooses the benchmark plan or another 325 per month plan hell pay about 30 per month for his health insurance.