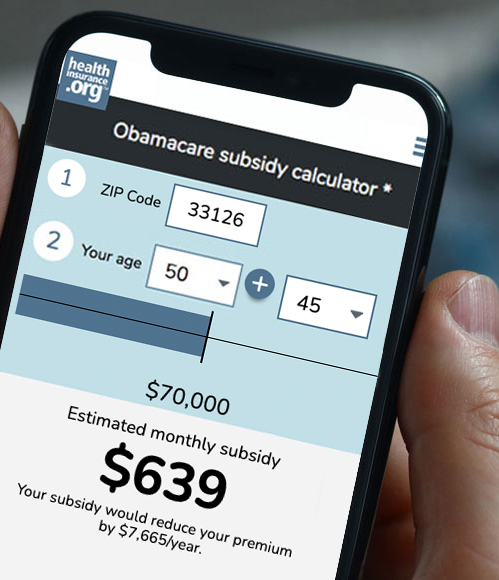

The Health Insurance Marketplace Calculator allows you to enter household income in terms of 2019 dollars or as a percent of the Federal poverty level. This calculator shows how much of your monthly premium will be reimbursed by the government and how much if any youll have pay yourself.

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace.

Obama care income calculator. And yes the output even includes a helpful pie chart. To assist your Obamacare planning for 2020 Ive used the Javascript programming language to create an interactive online calculator. Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income.

And yes the output even includes a helpful pie chart. MAGI is used to determine ObamaCares cost assistance and to claim and adjust tax credits on the Premium Tax Credit Form 8962. Household income includes incomes of the.

Use this tool to help calculate someones income. You can find more details on Modified AGI from the IRS here or you can see the form 8962 instructions for calculating Modified AGI for the tax credit TIP. Estimating your expected household income for 2021.

The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act. Divorces and separations finalized on or after January 1 2019. Use command find on those documents to find what you are looking for.

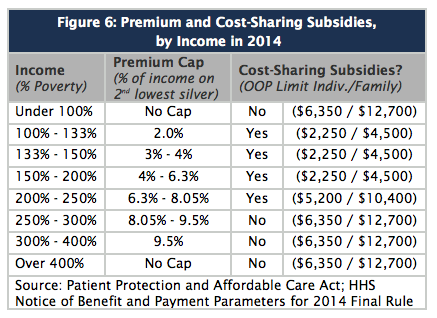

Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. Our calculation is based upon the federal poverty level data provided by the government annually. Marketplace savings are based on your expected household income for the year you want coverage not last years income.

This calculator shows how much of your monthly premium will be reimbursed by the government and how much if any youll have pay yourself. The Health Insurance Marketplace Calculator updated with 2021 premium data and to reflect subsidies in the American Rescue Plan Act of 2021 provides estimates of health insurance premiums and. I Make Less Than 48560 100400 for a Family of Four - If your income is under 400 of the poverty level you pay no more than 978 of income for the Silver Plan.

To qualify for an Obamacare tax credit you have to estimate your household income for the following year in your application. Income is counted for you your spouse and everyone youll claim as a tax dependent on your federal tax return if the dependents are required to file. Answer For 2020 coverage those making between 12490-49960as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. Select your income range. ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

See details on retirement income in the instructions for IRS publication 1040. As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions. Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance.

You can probably start with your households adjusted gross income and update it for expected changes. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. 1 Find out how to estimate your expected income Healthcaregov.

Divorces and separations finalized before January 1 2019. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022.

Calculator Instructions To assist your Obamacare planning for 2021 Ive created an interactive online calculator. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff. Use this quick health insurance tax credit guide to help you understand the process.

The types of assistance offered under the Affordable Care Act are. Use Healthcaregovs subsidy calculator to find out how much. You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year.

Dont include qualified distributions from a designated Roth account as income. Include their income even if they dont need health coverage. In other words your subsidy is the cost of the second lowest Silver Plan minus 978 of your income.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

2019 Health Insurance Marketplace Calculator Kff

2019 Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.