Name shown on your return. Its specifically designed to cover health insurance and reconcile the credit given to such people through Health Insurance Marketplace.

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Filing IRS Form 8962 can save you some money you spend on your Health Plan.

8962 form 2019. When you dont file Form 8962 the IRS will call this a failure to reconcile and you could be prevented from applying for Market premium tax credit. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return 2020 Attach to Form 1040 1040-SR or 1040-NR. Form 8962 OMB No.

Start a free trial now to save yourself time and money. The 8962 form also known as Premium Tax Credit is a document used by individuals or families whose income is below average. View i8962--2019pdf from ECE 540 at Grand Canyon University.

2019 Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. You may be able to enter information on forms before saving or printing. So if your claims are accepted you can either pay fewer taxes or get greater refunds.

Add your own info and speak to data. Go to wwwirsgovForm8962 for instructions and the latest information. Form 8962 Premium Tax Credit Copy of your Form 1095-A Health Insurance Marketplace Statement A copy of the IRS letter that you received.

The deadline for the IRS Form 8962 for the year 2020 is 15 April 2020. Available for PC iOS and Android. Use your indications to submit established track record areas.

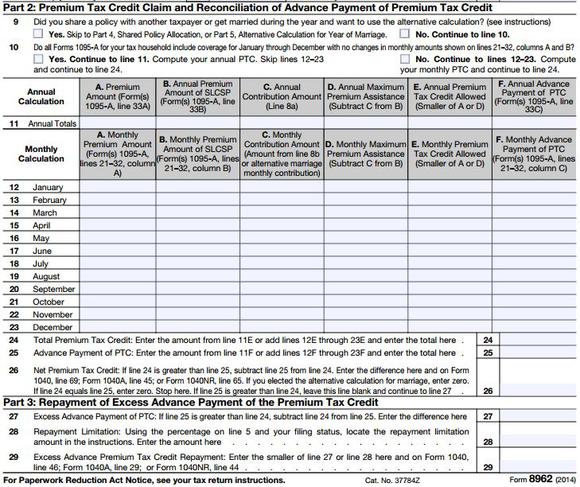

Tax credit receiving If you happen to receive tax credits monetary help in 2019 and you do not file your tax return with IRS Form 8962 to reconcile your tax credit you are not going to be capable of receiving tax credit in future years until you file your 2019 tax return. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. When saving or printing a file be sure to use the functionality of Adobe Reader rather than your web browser.

Below we do a walkthrough of filling out the PTC form and we simplify the terms found within. About Form 8962 Premium Tax Credit Internal Revenue Service. 15 Zeilen 2019 Form 8962.

Select a category column heading in the drop down. How to complete any Form Instructions 8962 online. Form 8962 is an essential tax form that not only helps relieve the pressure of your return but also makes affordable health insurance through the marketplace viable to everyone.

Go to wwwirsgovForm8962 for instructions and the latest information. Irs Form 8962 Printable. Start by providing your household income and modified AGI.

Use Get Form or simply click on the template preview to open it in the editor. Your social security number. How to fill out the form 8962 for health insurance market place coverage.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. View andor save documents. If your family fits the requirements and you have spent any money on Marketplace health insurance premiums you can claim your Premium Tax Credit for that reason.

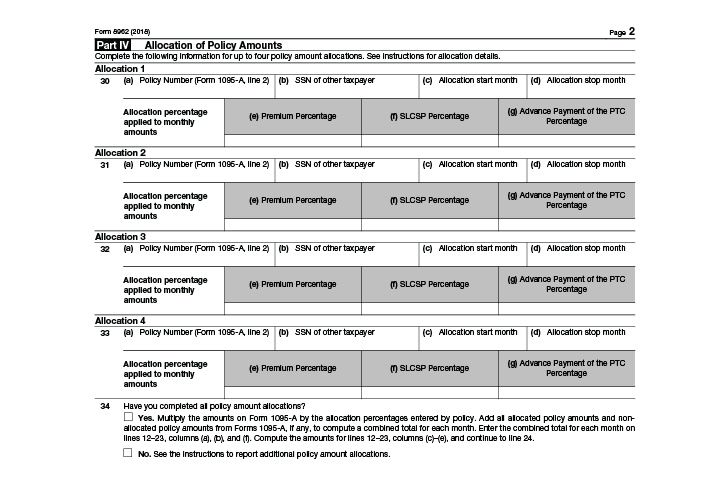

Submit this form with a copy of the form 1095A as well as a modified second page of. Start completing the fillable fields and carefully type in required information. On the site with all the document click on Begin immediately along with complete for the editor.

Click on the product number in each row to viewdownload. Fill out securely sign print or email your 2019 Form 8962. Form 8962 Premium Tax Credit PTC is the form you will need to report your household Modified AGI MAGI your Federal Poverty Level amount your familys health insurance premium exemptions and the cost assistance you received.

2019 Federal Tax Forms And Instructions for Form 8962 We recommend using the most recent version of Adobe Reader -- available free from Adobes website. Quick steps to complete and e-sign Form 8962 Instructions online. Premium Tax Credit 2018 Inst 8962.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Click on column heading to sort the list. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Instructions for Form 8962. Add form 8962 to filed taxed 2019. 2019 Instructions for Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Section references are to.

Premium Tax Credit PTC instantly with SignNow. Part I of Form 8962 allows you to calculate the maximum possible premium assistance you were eligible for during the tax year. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)