When the partner prepares his individual tax return the 20000 of health insurance gets deducted a second time from the 80000 leaving 60000 of adjusted qualified business income. Deductible in health insurance is the amount you have to pay before the health insurance company begins paying up the claim amount.

How Much Is Health Insurance Cost Sharing Explained

How Much Is Health Insurance Cost Sharing Explained

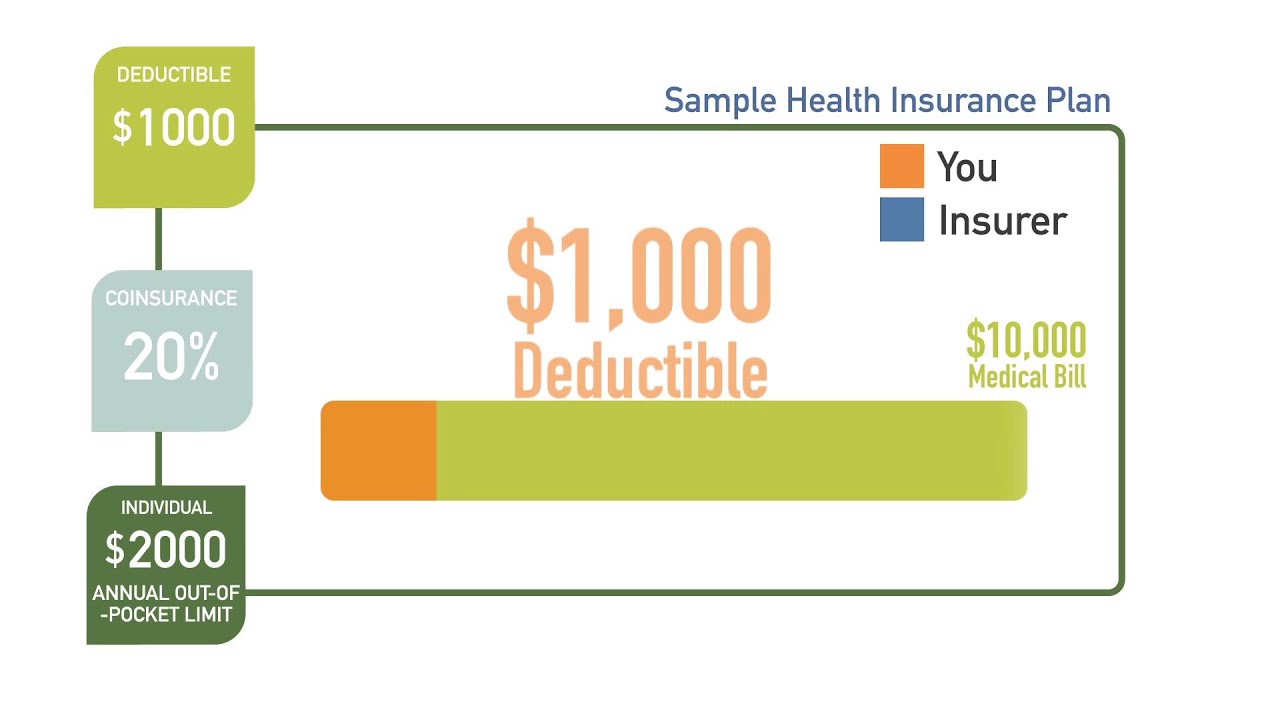

To understand the term better here is an example of how deductibles in health insurance.

20000 deductible health insurance. In your case the amount you can claim is limited by your profitability. Even if you choose a high deductible catastrophic plan your out-of-pocket costs should not exceed this limit. This means the insurer is bound to pay the claim amount after it exceeds the deductible amount.

The Section 199A deduction then equals probably 20 percent of the 60000. For a single person the average deductible in 2019 was 1396 up from 533 in 2009. For instance if the deductible.

For a single person the average deductible in 2019 was 1396 up from 533 in 2009. A typical household with employer health coverage spends about 800 a year in out-of-pocket costs not. More than a quarter 28 of all covered workers including nearly half 45 of those at small employers with fewer than 200 employees are now in plans with a deductible.

A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs. This means you are going to first spend 40 of your medical cost. You have a Bronze plan.

Since your 2000 health insurance deductible has finally been met through your procedure your insurance plan will cover between 65 75 of the remaining bill. Or say for instance your health care claim is of Rs. 20000 your insurance company will pay nothing since the amount is below the deductible limit.

Then you can decide whether you want a plan with lower monthly premiums and a higher deductible or one with a higher monthly premium and a lower deductible. For tax years prior to 2018 claim the deduction. After that you share the cost with your plan by paying coinsurance.

Your coinsurance is the percentage you have to pay once you have meet your annual deductible. Over 70 of Marketplace plans have deductibles under 3000. Health insurance like any other type of insurance comes with a monthly or annual premium the amount you regularly pay to be insured in the first place.

The biggest advantage of a deductible as a policyholder is that the higher the deductible the lower the premium. The final bill could be between 25-35 of the final procedure depending on the coinsurance associated with your health insurance. Next year 4 in 5 large employers.

When you choose a health insurance plan its important to understand what your insurance company covers without requiring you to pay your deductible. The meaning of deductibles in health insurance might not be understandable for everyone. Insurance deductible refers to the amount of money you will pay for an insurance claim before the insurance coverage kicks in and the company starts paying you the health insurance sum insured or the coverage amount.

If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. 15000 and your plans deductible amount is Rs. You cant claim an adjustment to your income for health insurance.

10000 will be paid from your pocket because it is your policy plans deductible amount. The average deductible for single coverage under employer plans this year is 1217. You now fall under high deductible.

If youre self-employed the health insurance deduction may not exceed the net profit from the business under which the health insurance premiums are paid. It is the first amount you pay yourself before your health insurance company comes to chip in its share. Thats almost double what it was in 2006.

A health insurance deductible is the amount youre responsible for paying before your health insurance provider begins to share some of the cost of medical treatment with you. Understanding High Deductible health insurance can be the answer. Deductible in Health Insurance.

Lets say you have a medical cost of 10000. A deductible is the amount you pay for health care services before your health insurance begins to pay. Deductible in health insurance is the amount that the policyholder is required to pay before that insurance company starts paying up for the treatment expenses in case of a health insurance claim.

In this article we will learn about the basics of. 20000 Deductible 1 If a brand name is dispensed when a generic is available 50 co-pay applies 2 Scott White pharmacies will dispense up to a 90-day supply of preferred generic medications for 6 co-pay. For 2018 and beyond if your health insurance premiums exceed net profit deduct the amount of the premiums that are equal to your net profit on Form 1040 Schedule 1 line 29.

If youre self-employed and claiming the self-employed health insurance deduction on Schedule 1 of the Form 1040 you dont have to worry about the 75 of income threshold because youre writing the premiums off as an adjustment to your income rather than as a deduction. Case 1 You need to visit the health care physician regularly. The trend is not going to abate.

What is Deductible in Health Insurance. A typical household with employer health coverage spends about 800 a year in out-of-pocket costs not. Simply put an insurance company is liable to pay for the claim raised by the insured only when it exceeds the deductible.