Er zijn twee soorten uitgaven buiten de zak waaronder copay en coinsurance. The copay is usually too small to cover all of the providers fees.

:max_bytes(150000):strip_icc()/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met.

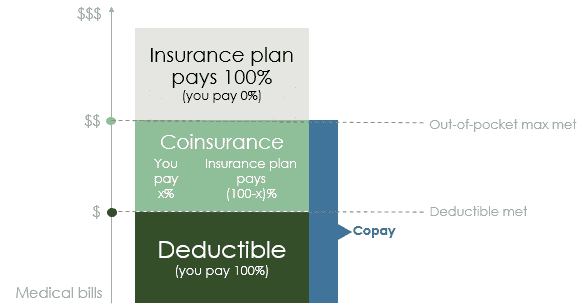

Copay or coinsurance. Coinsurance refers to the percentage of treatment costs that you have to bear after paying the deductibles. Whereas coinsurance is the percentage you pay for medical costs after your deductible your copay is a set amount you have to pay for other covered expenses. The amount A deductible is the fixed amount that you have to pay as a share of your medical bill upon which your policy comes into effect.

Both copays for primary care. What Is a Copayment. Another difference is that some copays can be in place before you hit your deductible depending on the specifics of your plan.

Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. It is similar to the copayment provision under health insurance. Copay vs Coinsurance Medische verzekeringen dekken meestal niet 100 van de kosten en het gedeelte van de kosten die de medische verzekering niet dekt is een onkosten voor de klant.

Difference between Copay and Co-insurance Copay is the fixed amount that you have to pay for your treatment. Its a bit more complicated to. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills.

Both copay and coinsurance provisions are ways for insurance. If the provider is in-network the insurance company first lowers the allowed amount to the pre-negotiated rate for that service more about this in the example below. The most notable difference between copays and coinsurance is that copays are always a flat amount and coinsurance is always a percentage of the cost of the service.

You pay a copayment in addition to your monthly premium. Coinsurance differs from a copay in that a copay is generally a set dollar amount an insured must pay at the time of each service. Health insurance plans usually charge lower rates for in-network primary care physician visits than specialists.

This amount is generally offered as a fixed percentage. A copay is what you pay at health care visits such as a doctors office or for prescription drugs. Copays are predetermined and should be outlined in your health insurance plan.

The percentage of costs of a covered health care service you pay after youve paid your deductible. The provider collects the copay from the patient at the time of service and bills the insurance company. For example a prescription medicine.

A copay is a fixed fee that you the patient are required to pay for specific medical services. Coinsurance works similarly to your copay. With coinsurance you have to hit your deductible first.

Two such important terminologies and phenomenon related with insurance are coinsurance and copay which is short for copayment. Coinsurance is a portion of the medical cost you pay after your deductible has been met. Coinsurance is used to describe the spreading or splitting of risk involved in insurance among a number of parties so as to ensure that one person does not have to incur all the losses in the case of the worst happening.

It can be a fixed amount per the nature of the treatment of a fixed percentage. The difference between a copayment and coinsurance is how the costs are split up. Coinsurance is the other method used to calculate your share of medical expenses after paying your deductible each year.

Both copays and coinsurance are forms of cost-sharing meaning you are splitting medical bills with your health insurance company.

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Copays Vs Coinsurance For Health Insurance

Copays Deductibles Plus Coinsurance What Does It Mean 50 Coinsurance After Deductible

Copays Deductibles Plus Coinsurance What Does It Mean 50 Coinsurance After Deductible

Open Enrollment Part One How To Choose For Next Year

Open Enrollment Part One How To Choose For Next Year

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Difference Between Coinsurance And Copay Difference Between

What Is The Difference Between Copay Coinsurance

What Is The Difference Between Copay Coinsurance

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.