Each one is just a different balance point between benefits vs. Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family.

According to Value Penguin the monthly average premium on a PPO was 251 in 2018.

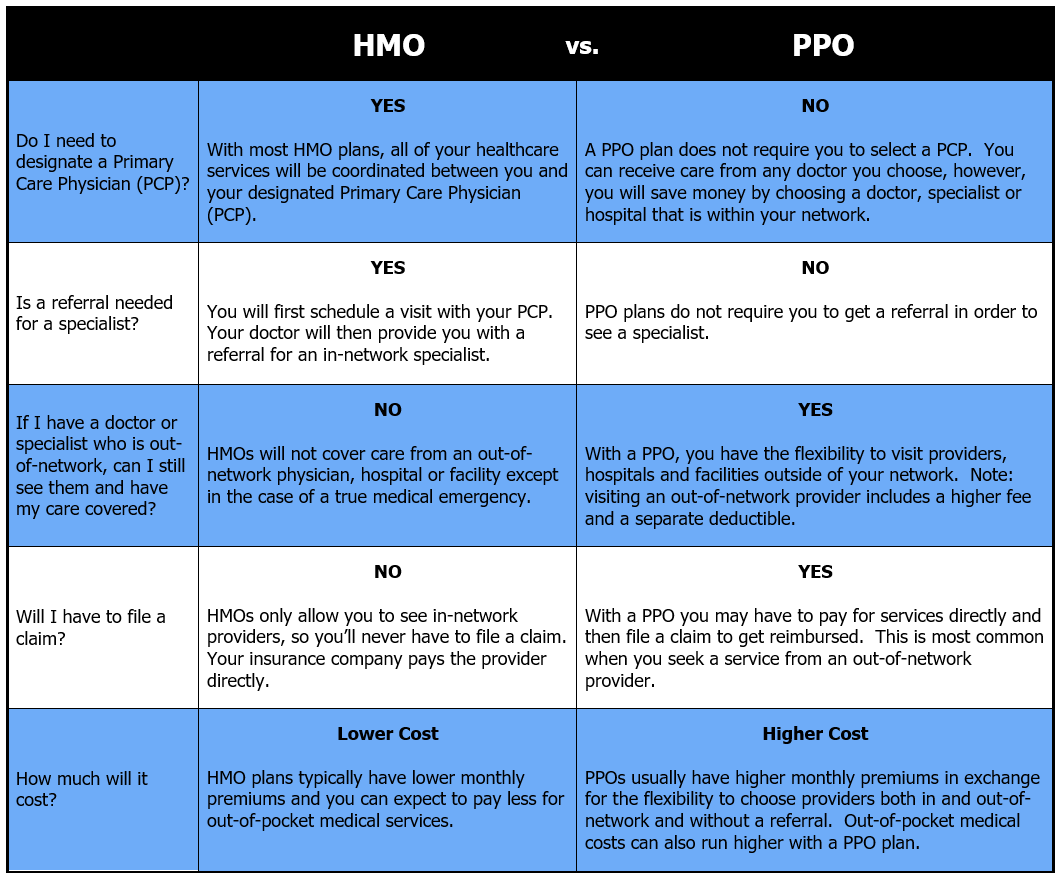

Whats the difference between a ppo and an hmo. One of the main differences between HMOs and PPOs is the flexibility of network providers. In 2018 the average PPO cost 3019 annually compared to an HMO which cost 2764 annually. The most significant difference between the two organizations is the option to select health care providers.

HMOs and PPOs are distinct healthcare plans and networks and each provides members with quality care and benefits. However if you have health issues and require frequent visits to the doctor then you must be looking for greater flexibility in your plan and hence a. Compared to PPOs HMOs cost less.

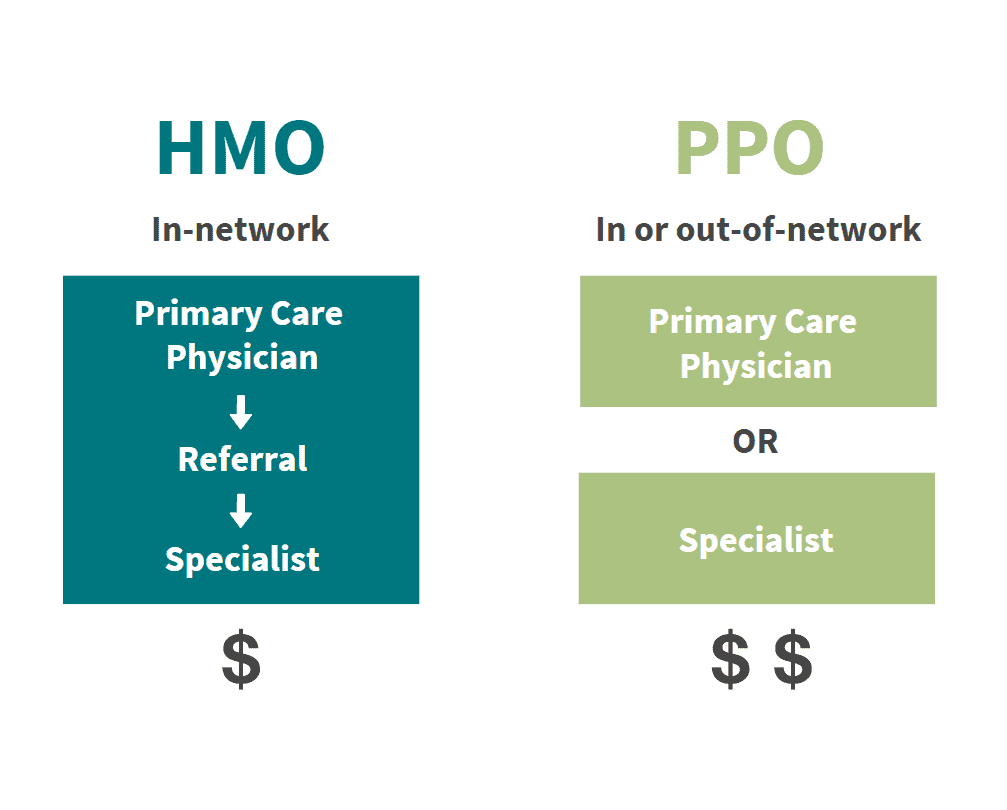

The central differences in HMO vs PPO vs POS plans are. Both HMO and PPO plans rely on using in-network providers. However PPO plans offer flexibility by covering out-of-network providers at a higher cost.

They also have their own pros and cons. Restrictions and between spending a lot vs. The main differences between them usually pertain to cost network size ability to see specialists and out-of-network coverage.

However visiting an out-of-network provider will include a higher fee and a separate deductible. A health maintenance organization HMO and a preferred provider organization PPO have several differences such as which doctors patients can see how much services cost and how medical records are kept. But the major differences.

You need to see your primary care physician before getting a referral to a specialist. Think lower cost with less flexibility to choose health care providers. The major differences between an HMO and PPO plan are in terms of cost plan-network size access to specialists and coverage for out-of-network services.

Patients in with an HMO must. PPOs preferred provider organizations are usually more expensive. A PPO plan might be right for you if you already have a doctor or team of specialists you want to continue seeing but might not be in your employers HMO plan network.

A decision between an HMO and a PPO should be based on whats most important to you. As we discussed above the availability of coverage within each plan type differs due to how they treat their network. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization.

A PPO might say it covers 60 percent. There also may be some differences in. Whether or not you have to select a primary care physician who refers you to specialists.

The differences besides acronyms are distinct. With a PPO you have the flexibility to visit providers outside of your network. This additional cost is something to consider.

5 Zeilen The biggest differences between an HMO and a PPO plan are. How much you have to pay if you see a provider who is out of network. That marks an average of 21-a-month higher than an HMO.

Out-of-pocket medical costs can run higher with a PPO health plan as well so they are a more expensive option than an HMO. Theres no perfect health plan type. An HMO plan might be right for you if lower costs are important and you dont mind choosing your doctors from within the HMOs network.

While HMOs place a strict wall around their network offering few if any exceptions for coverage outside those. Ultimately when choosing between an HMO or a PPO you have two different considerations cost and availability and they go hand in hand. According to Norris youre more likely to find PPO options among employer-sponsored health plans a plan offered by the company you work for where there might even be several PPO options.

Individuals who are healthy with not many healthcare needs should opt for an HMO plan. HMOs give you access to doctors within a specific network and you are covered if you stay within that network unless there is a medical emergency or have prior approval. HMOs and POS plans require a primary care physician and referrals while PPO plans do not.

HMOs health maintenance organizations are typically cheaper than PPOs but they tend to have smaller networks. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage.