Getting health insurance isnt just a matter of paying your monthly premium and calling it a day. That would decrease your exposure by.

Https De April International Com Sites Germany Files 2018 10 Myhealth Philippines Brochure Pdf

When you choose to use a High Deductible Health Plan you are then eligible to participate in a Health Savings Account.

5000 dollar deductible health insurance. Healthcare expenses that arent a covered benefit of your health plan dont count toward your health insurance deductible even though youve paid for them. All Marketplace plans cover preventive care. As long as you then use this money to pay for qualified medical expenses you arent taxed on it as it comes out of the account.

This means that if you have a claim of 5000 the insurance will pay only 2500 after you have paid the first 2500. My deductible is only 25000 with 2000 co-pay for routine office visits but the monthly premium is 1086 for just me. For example if your health insurance doesnt cover orthotic shoe inserts then the 400 you paid for a pair of orthotics prescribed by your podiatrist doesnt count toward your deductible.

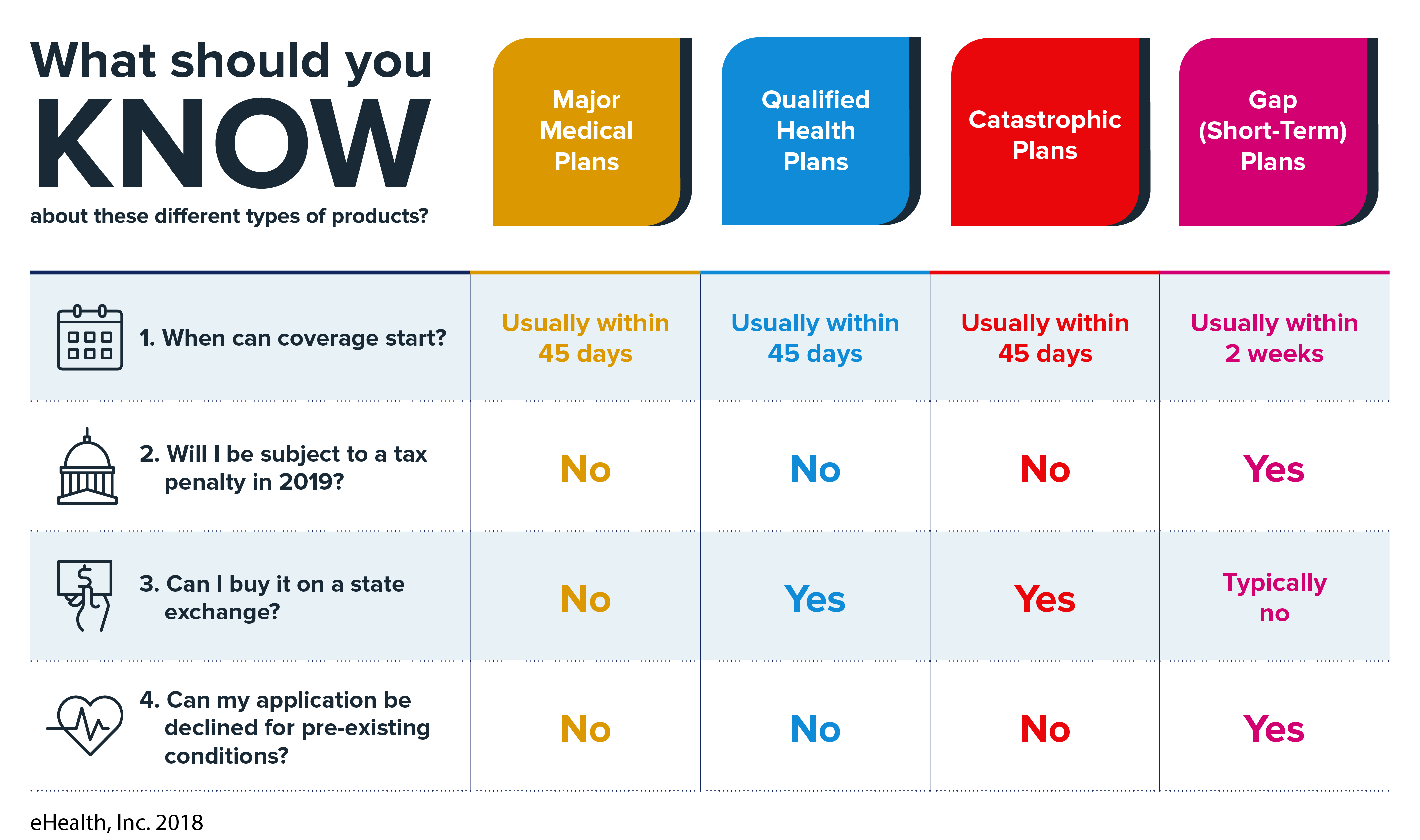

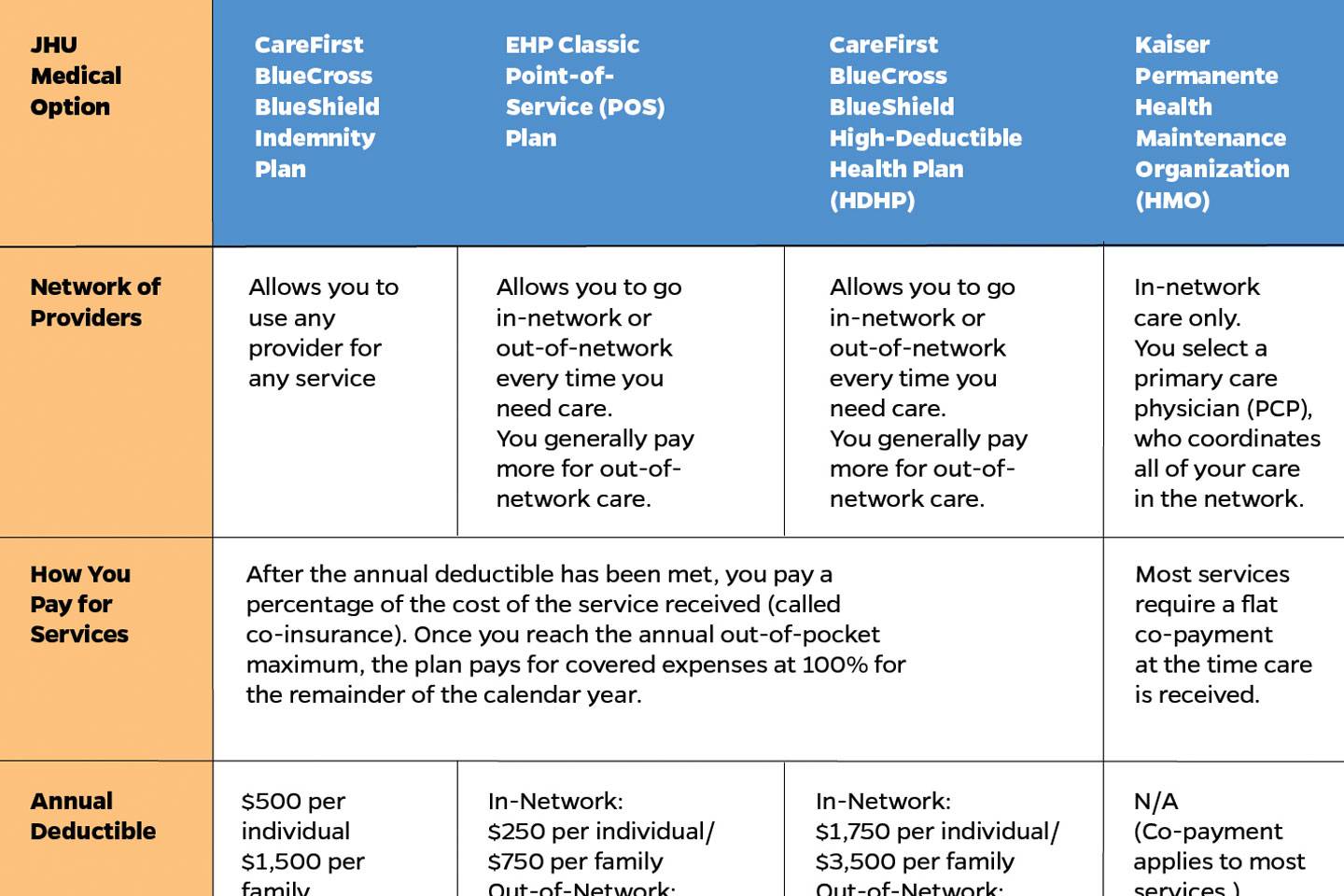

Your annual deductible can vary significantly from one health insurance plan to another. The last few dollars of third-party insurance are the most expensive. Unlike auto renters or homeowners insurance where you dont get services until you pay your deductible many health insurance plans provide some benefits before you meet the deductible.

There are other out-of-pocket costs that come with having health insurance including your deductible. You pay 500 out of pocket to the provider. Plans with higher metal levels such as gold or platinum plans tend to have lower annual deductibles but higher monthly premiums.

A health insurance deductible is different from other types of deductibles. The danger here is that when you only have small claims within the policy year you may not even get anything from insurance at all. A low deductible health plan may be referred to as an LDHP.

Similarly if your health. Depending on the type of plan you have there could be separate deductibles for prescriptions andor separate deductibles per family member. It could take as little as one visit or over the course of many months to meet your deductible.

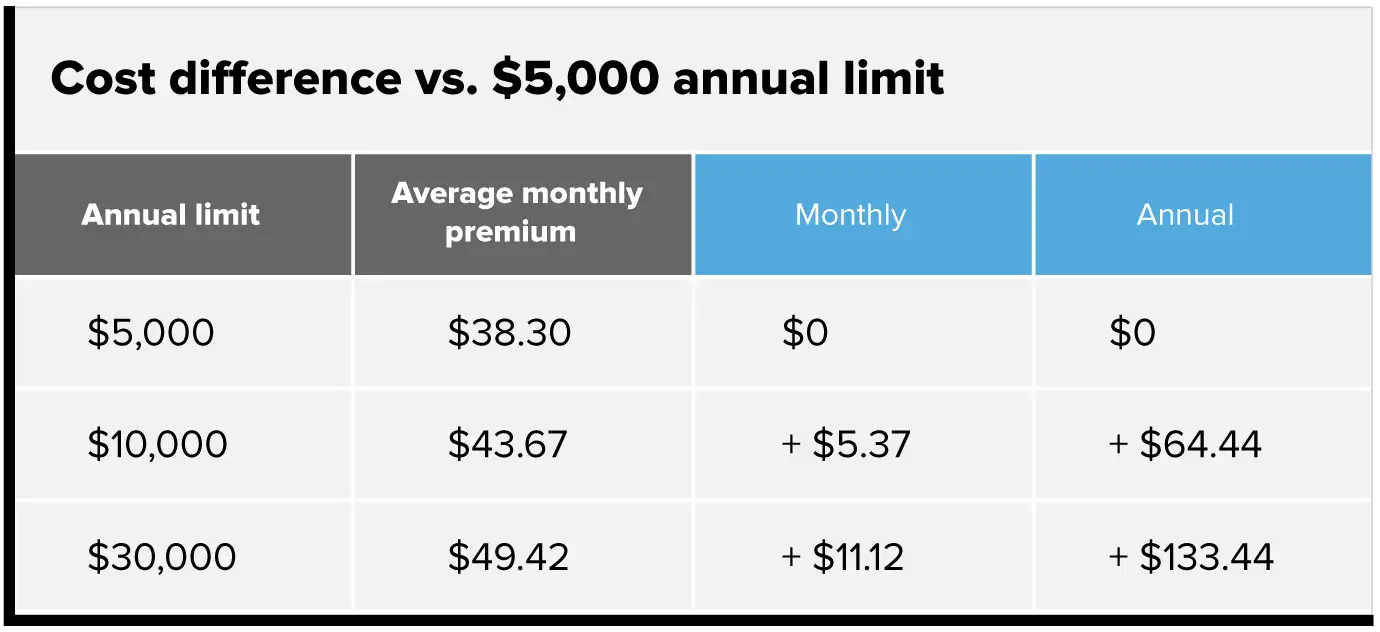

For a monthly premium of 140 within three years you can spend less than 5000 and get protection against a 10000 deductible essentially a 21 return on your money. You contribute to this account before tax meaning it reduces your income for tax calculation. Suppose you have a 10000 deductible and you are considering a 5000 deductible instead.

You can raise or lower a 500 deductible car insurance policy depending on your financial needs. It is available for individuals families businesses and self-employed persons that purchase their own coverage and want little or no out-of-pocket expenses coupled with high-quality benefits. A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs.

The remaining 5000 is covered by insurance but you may still be required to pay a percentage of the costs depending on if your plan has copays or coinsurance. Because you met the deductible your health insurance plan begins to cover the costs. Im in reasonably good health for an old lady so the insurance company has made a nice profit on my account so far I pay in more than they pay out for all my covered stuff but that could change at any time if I were to have a major injury or.

500 Deductible Insurance Policy What does it mean A 500 deductible insurance policy means that you must pay 500 toward car repairs before your car insurance coverage pays the rest of your car damage costs. A deductible is what you pay every year before the insurance company will start paying. Health insurance with no deductible is one of the most comprehensive forms of medical coverage.

Although not all major insurers are able to offer a zero deductible plan many. Enter Health Savings Account. Plans with lower metal levels like bronze plans tend to have lower monthly premiums but higher annual deductibles.