Exclusive Provider Networks are a hybrid between the PPO and HMO model. This means that in an HMO plan you do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network.

Epo Health Insurance Picshealth

Epo Health Insurance Picshealth

In comparison EPO insurance is often termed as a self-insured product in which the employer pays the costs.

What is the difference between an hmo and epo. The new Bronze Silver Gold and Platinum plans in many states will offer EPOs. Health maintenance organizations HMOs High deductible health plans HDHPs Point of service plans POS Exclusive provider organization plans EPO The two most common health plans have been generally HMOs and PPOs but HDHPs have become a lower-cost health insurance option for employers over the past decade. You should recognize the difference between HMO and PPO plans first.

HMO insurance is often termed as an insured product meaning that the insurance company will pay the cost of the claim if it meets all coverage guidelines. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. Difference Between HMO and POS HMO vs POS POS or Point of Service and HMO or Health Maintenance Organization are the various types of Managed Healthcare Plans in the US.

They have exclusive networks like HMOs do which means they are usually less expensive than PPOs. The member doesnt need a primary care physician for most visits to a specialist. Similar to a PPO a member can make an appointment with any doctor in the network.

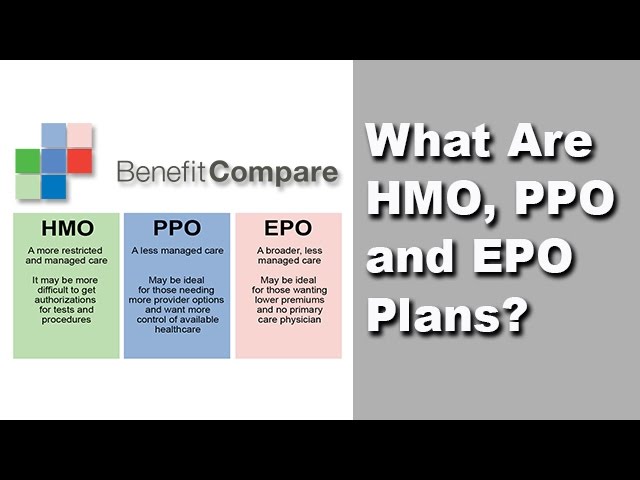

While these names may be somewhat confusing they describe how you will get your health care from physicians and hospitals. But as with PPOs youll be able to make your own appointments with specialists. An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization.

But an EPO plan is like an HMO plan in that youre responsible for paying all. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. Looking for more help deciphering health insurance terms.

These health care insurances help the employees with their medical bills. Understanding the differences between these options is an important first step to determining which kind of plan is right for your company and employees. When considering a HMO plan it is more restrictive than the POS.

Youve probably heard of HMOs and PPOs but EPO is not as widely used until now. A person who has taken a HMO. 5 Zeilen PPO HMO EPO exclusive provider organization and POS point of service plans have.

The EPO shares the HMO design of not recognizing any medical health care expense outside of the network. Then you can see where the EPO fits in as a hybrid of the other two. Another major difference between the two relates to flexibility.

EPO plans differ from Health Maintenance Organizations HMOs by offering participants a greater amount of flexibility when selecting a healthcare provider. Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. Of the three plan types HMO PPO and EPO you have HMO and PPO at two opposite ends of the spectrum with EPO plans somewhere in the middle.

The differences between health care plans can be confusing when choices include HMO PPO POS and EPO plans. EPOS exclusive provider organizations combine features of HMOs and PPOs. To make it easier we decided to explain the difference between all three so.

Health maintenance organization HMO preferred provider organization PPO point of service POS and exclusive provider organization EPO plans are all types of managed healthcare. The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO. They may or may not require referrals from a primary care physician.

If youre buying your own coverage as opposed to getting it from your employer you may not have any PPO options as individual market plans have increasingly switched to the HMO or EPO model. And if youre getting coverage from your employer the scope of your plan options will generally depend on the size of your employer. A larger network makes life easier An Exclusive Provider Organization EPO is a lesser-known plan type.