Federal tax credit Silver 94 87 73 plans and AIAN plans. You may qualify for no-cost or low-cost Medi-Cal and may be able to switch plans if you currently.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

This brings the couples income limit to 2081 month 1481 month for the applicant spouse and 600 month as a maintenance needs.

California medicare income limits. For married couples the. Your Covered California plan wont be automatically canceled when you become eligible for Medicare even if you enroll in a Medicare plan with the same insurance company. California Medicare beneficiaries who struggle to afford their premiums may qualify for a Medicare Savings Program MSP with monthly incomes up to 1436 single and 1940 married.

You must cancel your plan yourself at least 14 days before you want your coverage to end by contacting Covered California. Under the new 2021 income limits. Or Medi-Cal Beneficiary Medi-Cal income levels have.

The Qualified Individual QI program helps people with low income pay for their Part B premiums with a higher income limit than QMB or SLMB programs. In order to qualify for Medi-Cal adults must have a household income of less than 138 of the FPL. HUD references and estimates the MFI in calculating the income limits.

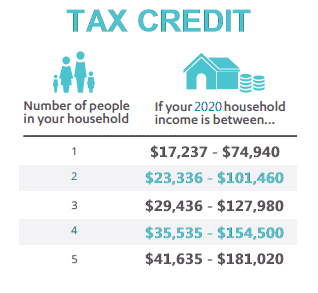

HUDs calculations of Section 8 Income Limits begin with the production of MFI estimates. Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. Qualified Medicare Beneficiary QMB program You can qualify for the QMB program if you have a monthly income of less than 1084 and total resources of less than 7860.

Ave Medi-Cal with a Share of Cost Buy medical insurance to end your Medi-Cal Share of Cost. Most consumers up to 138 FPL will be eligible for Medi-Cal. Keep in mind that these are countable income limits which is your gross income minus certain deductions.

How to Qualify To qualify for QI your monthly income cannot exceed 1449 if you are single 17338yr or 1960 23517yr if you are part of a couple. The 250 California Working Disabled CWD program helps Californians who are working disabled and have income too high to qualify for free Medi-Cal. Medi-Cal and Covered California have various programs with overlapping income limits.

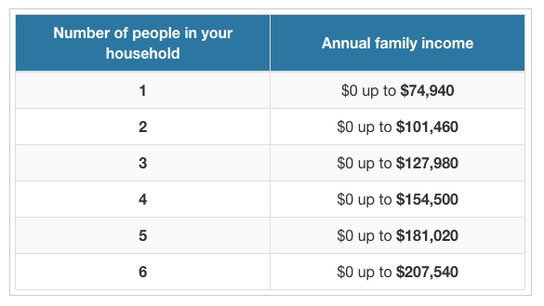

To see if you qualify based on income look at the chart below. When only one spouse of a married couple applies for regular Medi-Cal the income limit is a combination of an income limit for the applicant spouse plus a maintenance needs allowance for the non-applicant spouse. Californians who qualify may be able to receive Medi-Cal by paying a small monthly premium based on their income.

In California applicants can qualify for Medicaid ABD with monthly incomes up to 1467 single and 1982 married. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. Eligibility criteria include being elderly blind disabled or a person whose income is low and assets are limited.

This means a single adult now has to have an annual Modified Adjusted Gross Income MAGI of 17237 to be eligible for Covered California if they apply for health insurance in 2019. Be eligible for Medicare Part A and Part B Have countable income at or below 100 of the Federal Poverty Guidelines FPG 1074 per month 1452 for couples Have resources at or below the limit 7970 for individuals 11960 for couples Meet Medi-Cal requirements besides income and assets limits. However Children qualify for Medi-Cal when their family has a household income of 266 or less.

California law and State Income Limits reference Area Median Income AMI that pursuant to Health Safety Code 50093c means the MFI of a geographic area estimated by HUD for its Section 8 Program. In order to qualify children must be under 19 years old. The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults.

The all important Covered California premium tax credit eligibility income 138 of the FPL for a single adult increased from 16754 for 2018 to 17237 in 2019. Income numbers are based on your annual or yearly earnings. For 2018 the income limit for an individual is just 91072 per month and for a couple it is 153214.

Your gross income can be much higher than your countable income. People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days and will usually need to cancel their Covered California. In addition an individual may not have more than 2000 worth of non-exempt assets and a married couple not more than 3000.

Premiums range from 20 to 250 per month for an individual or from 30 to 375 for a couple. Have countable income less than 250 of the Federal Poverty Level 2683 per month for individuals and 3629 for couples.