As Certified Covered California Agents our services are free. The unshaded columns are associated with Covered California eligibility ranges.

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

COVERED Household Size For each additional person.

Covered california salary limits. If you do not find an answer to your question please contact your local county office from our County Listings page or email us at Medi-Cal Contact Us. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

100 Covered California employees have shared their salaries on Glassdoor. MONTHLY SALARY Effective April 2020. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

100 salaries for 63 job titles Updated Mar 25 2021. The minimum salary requirement for 2021 for white-collar workers is 54080 for employers with 25 or fewer employees and 58240 for employers with 26 or more employees. The income table shows the minimum amount of annual income to qualify for either Medi-Cal or tax credits for a private plan through Covered California.

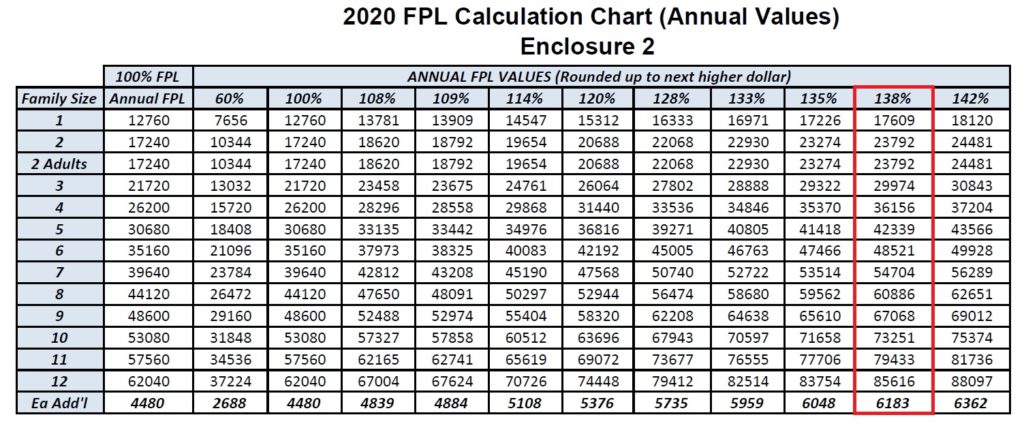

Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance. The federal threshold is 400 percent of the federal poverty level FPL.

So lets say youre a family of six. The good news is that you can change the estimated income listed on your Covered California application anytime throughout the year. Call usyou will be Pleasantly Surprised.

Select your job title and find out how much you could make at Covered California. Chief Deputy Executive Director Program Plans Sales Service 24838 Kathleen Keeshen. Add 100 S15930 S20090 S24250 S32570 96730 S4160 MAGI Medi- Cal 13800 S16394 S22107 S27820 93534 99247 S56428 Program Eligibility by Federal Poverty Level FPL for 2016 Coverage Year Eligible for Premium Tax Credit PTC 2100 to.

The parents are a household of two. Income above this number may make you eligible for premium assistance through Covered California. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

Covered California is a partnership of the California Health Benefit Exchange and the California. To qualify for government subsidies you must purchase your coverage through Covered California and your annual gross income cannot be more than 400 percent of the FPL. That means you can earn no more than 134960.

Covered California Income Tables. Actually it is highly recommended that you report any income changes of 10 or more to Covered California within 30 days of the event that caused your income to change ie. Covered California income table revised to reflect new subsidy eligibility.

If you do you are not eligible for a subsidy. As certified Covered California agents there is no cost for our services. 48240 - below this annual income he or she is eligible for premium assistance through Covered California with no assistance above that number.

16644 - below this annual income you are eligible for Medi-Cal. It can be confusing to compare health plans on your own. Back to Medi-Cal Eligibility.

Can anyone get Covered California. Call us at 800-320-6269 and well go through the pros and cons the plans with you based on your situation. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Chief Deputy Executive Director Operations 20518. To view the monthly Medi-Cal eligibility income amounts please visit my Medi-Cal Page. Find Covered California Salaries by Job Title.

You can start by using your adjusted gross income AGI from your most. In order to be eligible for assistance through Covered California you must meet an income requirement. In 2020 that number will be 49460 for an individual 67640 for a couple and 103000 for a.

If an exempt employees salary drops below the minimum salary requirement the employee may no longer be considered exempt. Laid off fired raise or new job. Our goal is to make it simple and affordable for Californians to get health insurance.

What is Covered California. We are licensed Covered Ca agents with in-depth knowledge of their plans process and tax credits.

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Covered California Income Limits Explained

Covered California Income Limits Explained

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Covered California Health Insurance Income Guidelines

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.