Enroll now for 2021 coverage. During the 2021 Special Enrollment Period you can enroll in an individual and family health insurance plan without a qualifying event such as job loss or birth of a child.

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

Outside the United States.

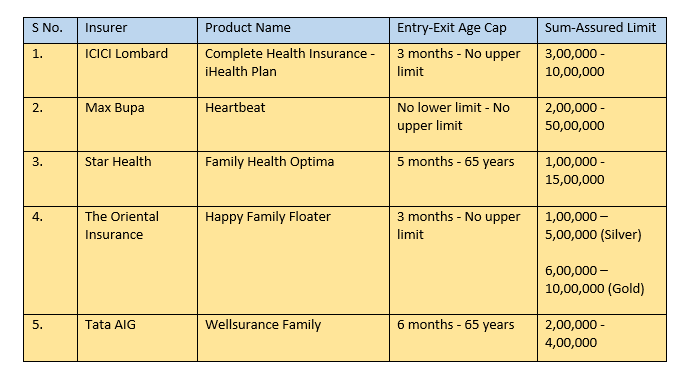

Affordable health insurance plans for individuals. Individual health insurance plans offer pre and post-hospitalization benefits like paying for the doctors consultation ambulance diagnostics and tests etc. Our selection of. We can help you assess your needs and budget and find the perfect health plan.

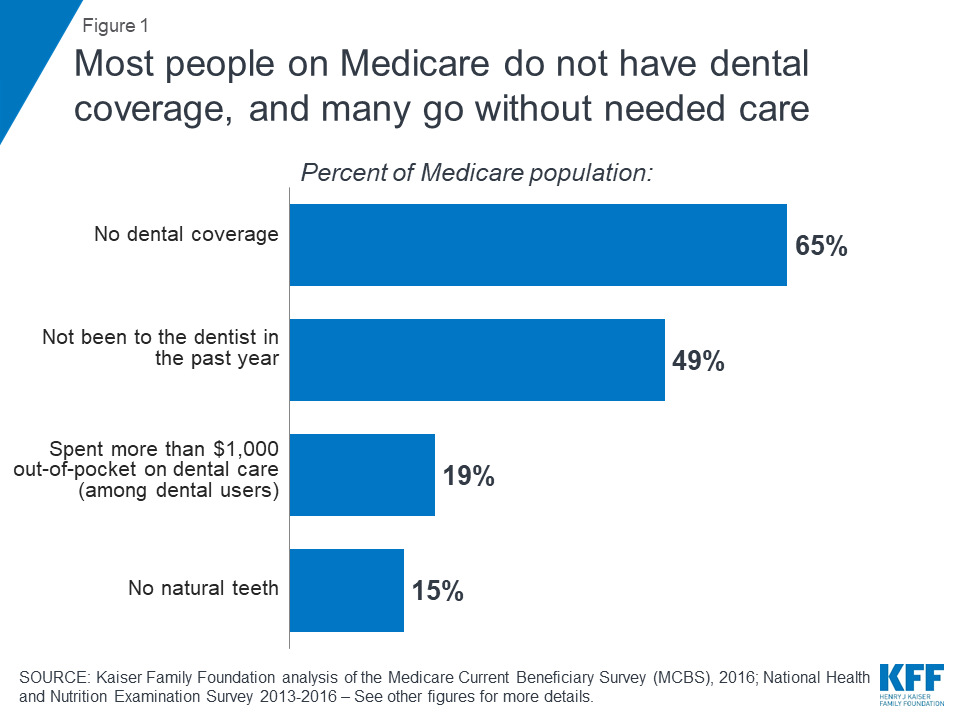

Commit to routine dentist appointments. Another difference is that you can only sign up for ACA health. With extended coverage you can.

One of the biggest differences is that individual and family health insurance plans offered through the ACA receive subsidized premiums reducing the monthly cost of coverage. We offer a variety of health plans for individuals from providers like Blue Cross Blue Shield Cigna Humana and many more. 70 up to 750calendar year.

Flexible health dental and drug coverage for individuals and families. Most but not all personal health insurance plans offer. Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States.

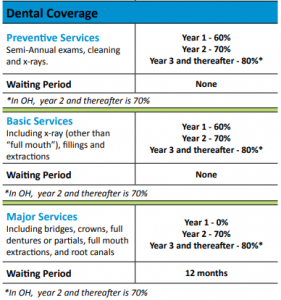

Dental coverage Prescription drug coverage Extended health benefits that include vision care homecare and para-medicals like massage therapists psychologists. Extended health and dental coverage is a convenient and affordable option for anyone whos self-employed retired or wants to supplement coverage by their existing provider. Health insurance for individuals families.

Compare plans side by side get health insurance quotes apply online and find affordable health. Health plans offered through the Affordable Care Act ACA have a few key differences from the health plans an employer might offer. Meanwhile check whether youre eligible for ACA subsidies which can make your health insurance plan.

Search for Doctors Hospitals and Dentists Blue Cross Blue Shield members can search for doctors hospitals and dentists. Vision care including eye exams. See affordable health insurance plans.

Official site of Affordable Care Act. In the United States Puerto Rico and US. We are dedicated to transforming the future of health across the entire Continuum of in the nation.

We offer a wide range of health plans and benefits for individuals families and businesses. Choose from our individual and family health and dental insurance plans at affordable prices COVID-19 Resource Centre Get details on COVID-19 and your Benefits with Pacific Blue Cross. You can enroll in or change plans due to the COVID-19 emergency through August 15.

There is a specific number of days before and after the hospitalization that the insurer provides these benefits for. Disability insurance Get help protecting your family business from an unexpected illness or accident that leaves you unable to earn an income with Manulifes disability insurance. 10 rows Explore individual health insurance plans from UnitedHealthcare.

You may also qualify for a new higher premium tax credit and a cost-sharing reduction to help lower your health insurance premium and total out-of-pocket costs. 75 up to 1000calendar year. Health insurance for small businesses.

70 up to 500calendar year. See health coverage choices ways to save today how law affects you. Plans designed for you and your family.

View the coverage options below or use our tool to help you find the plan thats right for you and your family. Personal Health Insurance is for you if you dont. Our selection of family and individual health insurance plans offers you the perfect coverage.

EHealthInsurance is the nations leading online source of health insurance. 10 rows We offer 3 Personal Health Insurance plans. Individual Health Plans Individual health plans offered by Blue Cross are uniquely designed to provide services that supplement each provinces government health plan.

One of the best strategies to save on health insurance is to shop around and compare plans. If you want to ensure that you can keep your doctor in-network shop based on cost or increase your coverage contact FMIG for a quote. Whether youre a student or a retiree selfemployed working part time or on contract our individual health plans are flexible so you can be too.

With the ongoing changes to provincial health care plans it is important to ensure you have affordable protection against unexpected medical expenses. 80 up to 1250calendar year including 50 major restorative up to 500 as part of overall maximum. Benefits are pro-rated in the first year.

Get affordable health dental benefits for yourself your family from Manulife or find your professional alumni or retail association plan. We are one of the nations largest health insurance agency throughout the United States. EHealthInsurance offers thousands of health plans underwritten by more than 180 of the nations health insurance companies including Aetna and Blue Cross Blue Shield.

:max_bytes(150000):strip_icc()/Humana-39cda00383d846bdb0519f2f0b7bcdca.jpg)