Use the Health Care Law and You chart to see how the law will affect you. You can indicate on your return that you have health insurance.

Are Health Insurance Premiums Tax Deductions In Canada

Are Health Insurance Premiums Tax Deductions In Canada

The IRS receives notices from all companies that provide health insurance and all insurance companies that provide health insurance send in proof.

Do i need proof of health insurance for 2019 taxes. Although they are not necessary to file your tax return 1095 forms can be used as documentation for any extra deductions you want to claim on your taxes. Some states have their own individual health insurance mandate. No cash value and void if transferred or where prohibited.

If you enrolled in coverage through the Marketplace you will receive a Health Insurance Marketplace Statement Form 1095-A. Affordable Care Act Taxes - At a Glance. If the IRS asks for the proof they will send you a letter asking for it and then you can mail it in.

You need to have health insurance that meets a standard called Minimum Essential Coverage MEC. Beginning in the 2019 tax year the federal penalty for failing to enroll in health insurance was discontinued. However according to the IRS website youre not required to actually send the IRS any forms when filing your taxes so take a deep breath.

This chart explains how the health care law affects your tax return. Please remember the Form 1095-B is not required to file your state or federal taxes and you may selfattest your health coverage without it. The following types of MassHealth coverage are MEC.

1 If you receive Form 1095-B You should have it by mid-March. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption youll be charged a fee when you file your 2020 state taxes. May 31 2019 1121 PM.

With 274 million Americans currently uninsured it is best to know about the current tax laws. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Form 1095 information forms.

Check with your state or tax preparer. A 1095 form acts as proof of your health insurance and is useful to keep for your own personal records. And theyll give you a Health Coverage Information Statement Form 1095-B or Form 1095-C as proof you had coverage.

Under the recently enacted Tax Cuts and Jobs Act taxpayers must continue to report coverage qualify for an exemption or pay the individual shared responsibility payment for tax years 2017 and. The Wisconsin Department of Health Services DHS is not sending out 2020 IRS 1095-B tax forms to members. Well create this for you when you enter your info.

This ability to make requests at the Annual Taxpayer Bill of Rights Meeting is a California State Right pursuant to Revenue and Taxation Code section 21006 b 2. But it does say that its a good idea to have certain. You can learn more about this topic at the IRS website or talk with your tax advisor.

It should be kept with your other tax information in the event the Internal Revenue Service IRS or Franchise Tax Board FTB require you to provide it as proof of your health care coverage. You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. In 2017 2018 see 346 and 2019 see 354 I requested that FTB do a better job of disclosing this right to.

However if you wish to you can request this form. Starting with the 2019 tax year the federal penalty or fine for not having health insurance no longer applies. Up until last year FTB effectively hid this right from the public.

Do I need to send proof of health insurance to the IRS. If you had coverage through Medicare Medicaid the Childrens Health Insurance Program CHIP or another source depending on the coverage you had you may get Form 1095-B Health Coverage to help you complete your taxes. 2019 will be the first tax year in almost a decade without an individual mandate on health insurance.

While the ACA technically still exists Americans who choose not to maintain health insurance for themselves or their family members in 2019. Starting in 2019 theres no longer a penalty for not having health insurance. How to request a 2020 1095-B tax form.

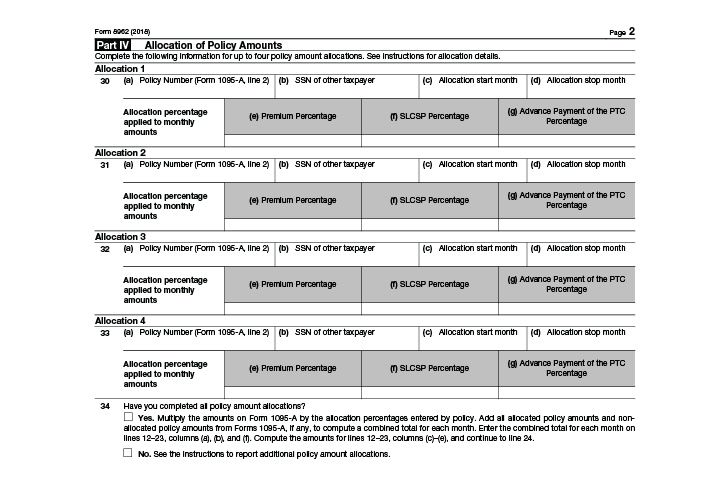

However its a good idea to keep these records on hand to verify coverage. However if you had health insurance through Marketplace or received a Form 1095-A youll need to fill out a Form 8962 to reconcile the Premium Tax Credit. The Affordable Care Act ACA has rules about health insurance coverage.

Beginning with tax year 2019 there is no federal tax penalty for not meeting MEC. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Accordingly individual tax payors no longer have to report or certify on their federal returns whether they had health insurance during the tax year and do not need.

Statements from your insurer. Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return You will begin reporting your health care coverage on your 2020 tax return which you will file in. This is known as a 1095 form which provides details about the amount along with the period of time you received coverage.

You will NOT get Form 1095-A. The IRS tax codes can be tricky and a lot of Americans dont know about the health insurance penalty they can face when tax time arrives.