Covered California is the states Obamacare exchange. Out-of-pocket limit is the most you could pay in a year for covered services.

Covered California Medicare Notices Health For California

Covered California Medicare Notices Health For California

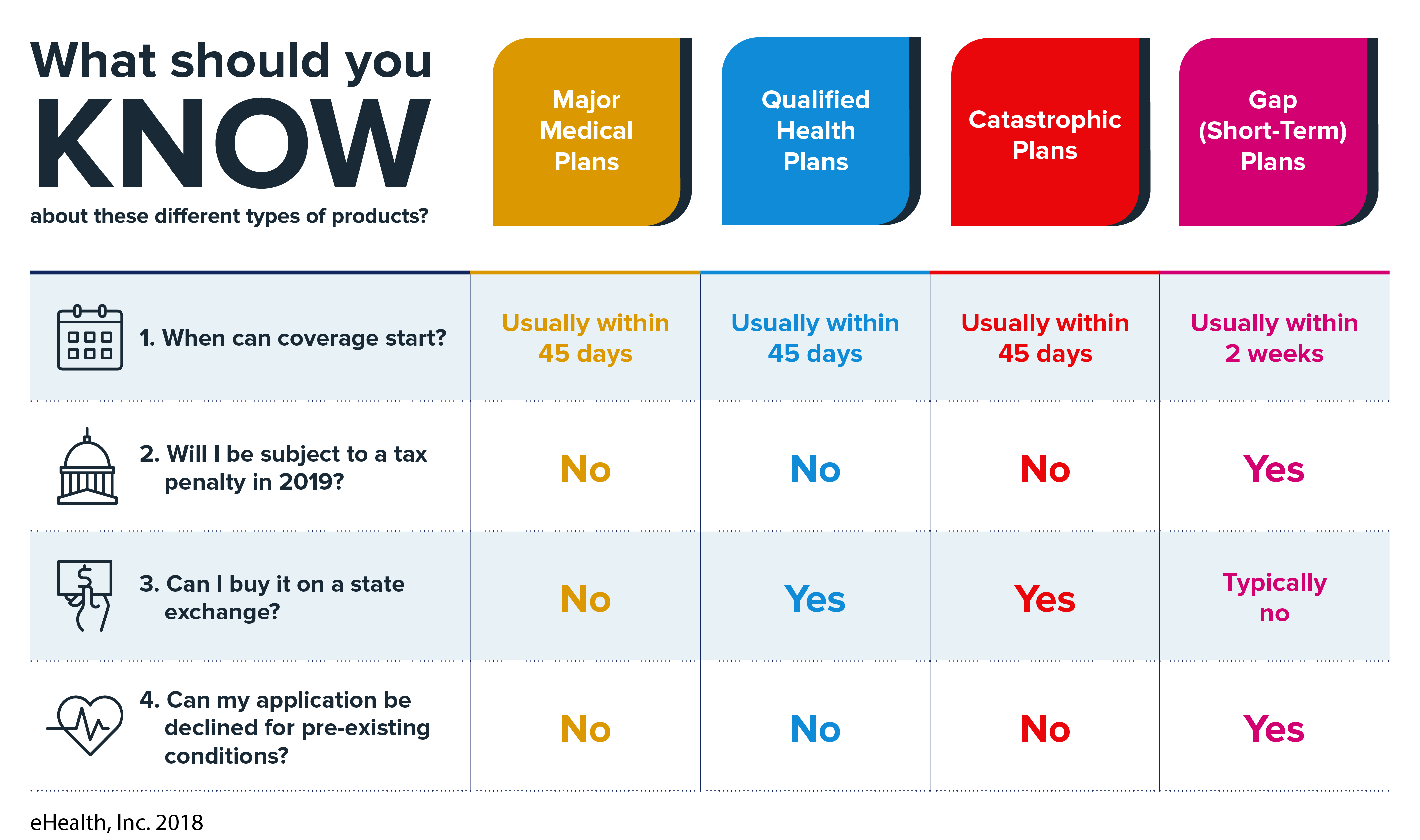

Covered California health insurance plans and all health plans in the individual and small-group markets are sold in four levels of coverage.

Covered california platinum plan. Out-of-network services are only covered for urgent or emergency care. The Platinum plan offers a much smaller out of pocket expense when it comes time for doctors visits labs prescriptions etc. Covered California Is Income Protection The increased Silver plan rates in order to guarantee the enhanced Silver plans which is good and a necessary thing adds more complications and confusion for individuals and families looking at health insurance for 2018.

Individual 6700 Family The. More often than not they provide the best bang for your buck The affordable monthly premiums mid-size deductibles and discounted fees for commonly-needed medical services make Silver Plans an attractive option for those who are trying to balance cost with benefits. In exchange for a higher premium per month.

Covered California took this a step further and streamlined all the plans they offered on-exchange. Please subscribe to our channel for more videos. When the Affordable Care Act ACA became law health insurance plans were repackaged and categorized into 4 metal tiers.

Out-of-network services are covered. 15 Mental Health Outpatient Visits and Services. Individual and Family Plan PPO Plan Platinum 90 PPO This Summary of Benefits shows the amount you will pay for Covered Services under this Blue Shield of California Plan.

The Platinum 90 plan offers good out of pocket costs for your normal day-to-day medical services. Edit Mobile Icon Path. Covered California Platinum 90 Plan.

Enrolling in the platinum 90 level Covered California plan is usually recommended for people who either have above average healthcare costs or prefer to have lower copays and deductibles when they go to the doctor. This means your Obamacare plan options are the same as your Covered California options. Low office visit and prescription drug co-pays.

If you leave Covered California you lose the income protection it provides. Plan they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has. It is only a summary and it is included as part of the Evidence of Coverage EOC1 Please read both documents carefully for details.

The plans on Covered California are divided by carrier and into four different metal tiers Bronze Silver Gold and Platinum. Its the only place where you can get financial help when you buy health insurance from well-known companies. Get coordinated care from doctors and hospitals in the same network.

Our Platinum 90 HMO plan provides you with substantial coverage and the lowest out-of-pocket expenses of all our family or individual health insurance plans with no annual deductibles and a low annual out-of-pocket maximum. This plan features an attractive 0 deductible with minimal copays of 15-30 for common services. Bronze Silver Gold and Platinum.

As the metal category increases in value so does the percentage of medical expenses that a health plan covers compared with what you are expected to pay in co-pays and deductibles. Blue Shield Platinum 90 PPO AI-AN Blue Shield Platinum 80 PPO AI-AN Blue Shield Platinum 70 PPO AI-AN. Individual and family Alaska Native and American Indian PPO plans available on exchange through Covered CA only for eligible American Indians and Alaska Natives.

Fact Sheet OCTOBER 2016 Summary The Affordable Care Act ACA requires that Covered California offer plans in metal tiers This fact sheet explains the different levels of coverage. Three Types of Plans to Choose From. Enjoy flexibility in selecting your doctors and hospitals in your plans network.

Bronze Silver Gold and Platinum. If you have not yet received a quote click. Get coordinated care from doctors and hospitals in the same network.

This would include things like doctors visits which. Getting well is a steal with a Platinum plan. Enjoy flexibility in selecting your doctors and hospitals in your plans network.

Think the Rolls-Royce of the Covered California Metal Plan Portfolio. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Out-of-network services are covered usually at a higher cost.

Out-of-network services are only covered for urgent or emergency care. If you have other family members in this. Covered California Silver Plans are a popular choice for many people.