Payments of the premium tax credit went directly to the. Some people do not need to file taxes since their income is below the threshold.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Statements of pension distribution from any government or private source.

Covered california tax return. The premium tax credit was available immediately when you enrolled in a plan through the Marketplace. They can only see your tax return if you send it to them as a document to verify your income. Use the California Franchise Tax Board forms finder to view this form.

If you make over that amount but less than 400 of the federal poverty level based on your household income and number of dependents then you may be eligible for an up-front subsidy also referred to as a tax credit 1. To report an income change you can call Covered CA or your insurance agent for assistance or log in to your Covered CA account online to report the change yourself. Get an exemption from the requirement to have coverage.

Federal Tax Form 1040 with any appropriate Schedules. So the important thing to keep in mind is that you want to report. Make sure you have your spouse sign and date the letter as well as listing the Covered California.

After logging in youll be on the Consumer Home Screen. It worked like a discount so you could get help paying for coverage throughout the year rather than having to wait until you filed your 2017 taxes. 46 Zeilen Do I need to add my dependents income to my Modified Adjusted.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. In other words the amount of assistance you received is going to be compared to the income that you actually made in that benefit year and depending on whether your income matches up to what you reported on your Covered California application you may either owe money back to the IRS or receive a refund. This fact sheet explains how the IRS will figure out if you got the right amount of premium tax credits and what you need to do to.

If you are required to file state or federal taxes you may self-attest your coverage as well. When it is time to file your tax returns the federal government needs to know if you got the right amount of premium tax credits. You can quickly delegate us as the agent and we can then go through.

What exactly does this mean. For divorce or separation documents dated after Dec. Members who did not file their 2015 Federal Tax Return with form 8962 are at risk of losing their tax credits.

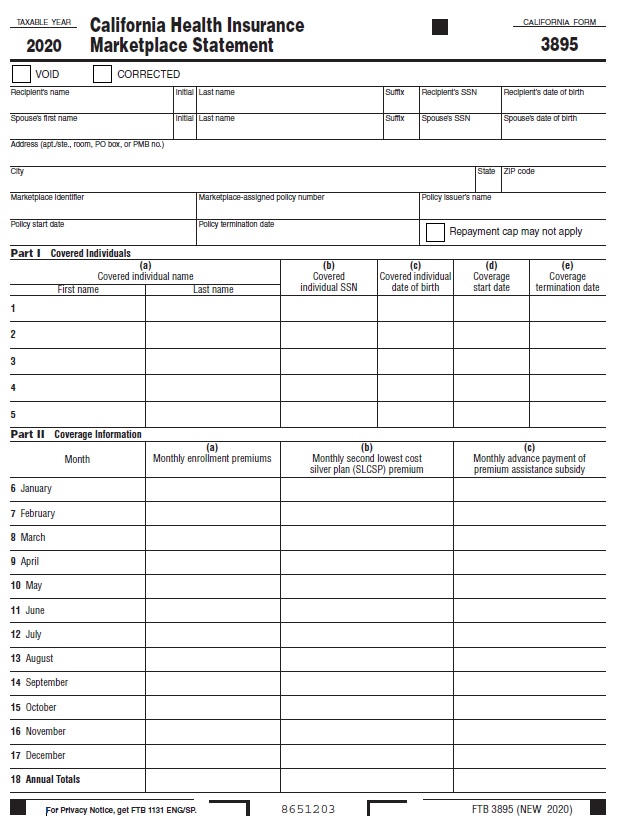

Your Form 1095-B shows your Medi-Cal coverage and can be used to verify that you had MEC during the previous calendar year. Covered Ca throws around Household a lot in the discussion. The California Form FTB 3895 California Health Insurance Marketplace Statement.

This new tax credit works differently than most. From Covered California with the help of premium tax credits. It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return.

Covered California is asking for proof of income for my spouse who does not have income. Please write a letter stating that your spouse does not have any source of income at this time. You can use this information to complete your state andor federal income tax returns.

These forms are used when you file your federal and state tax. The federal IRS Form 1095-A Health Insurance Marketplace Statement. One notewhen enrolling in Covered California you essentially confirm that you will file taxes as required by law and on time if you are required to.

If you dont have a login and password call 800-300-1506. Again as certified Covered California agents there is no cost for our services. The easiest answer is that their definition of household is everyone that files together on one 1040 tax form.

We have many enrollees that claim grandmothers grandson you name it. Average tax credit of 302. Remember that a tax return for the prior year is a useful proof of income only if it reflects your income for the current year.

Look for the list of links in the bottom-center of the page. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040. No one at Covered California looks at anyones tax.

Prizes settlements and awards including alimony received and court-ordered awards letters. During tax season Covered California sends two forms to members. Then add or subtract any income.

Add any foreign income Social Security benefits and interest that are tax-exempt. IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members. The web address for the Covered California Account Login is.

If you make less than 138 of the Federal Poverty Level in California you qualify for Medi-Cal otherwise known as Medicaid. Based on the 1000s of successfully enrolled Covered Ca members a quick snapshot. What do I do.

Starting in 2020 California residents must either. 51 of Enrollees qualify for Enhanced Silver Plans. One notemarried couples must file Jointly to get the tax credit.

88 of Californians qualify for a tax credit. During the next open enrollment period if a tax payer has failed to file a tax return for the previous benefit year in which they received the premium tax credits Covered California wont allow the tax credits for the next year. Put simply the Tax Credit means 1000year in savings.

Covered California does not get a copy of any consumers tax return. Again this is all checked electronically. Click on Eligibility Results.

Dates covered and the net income from profitloss.