Learn about open enrollment and choosing a health plan. It generally wont cover out-of-network care except in urgent or emergency situations.

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

The group or employer is the plan sponsor of the managed care plan.

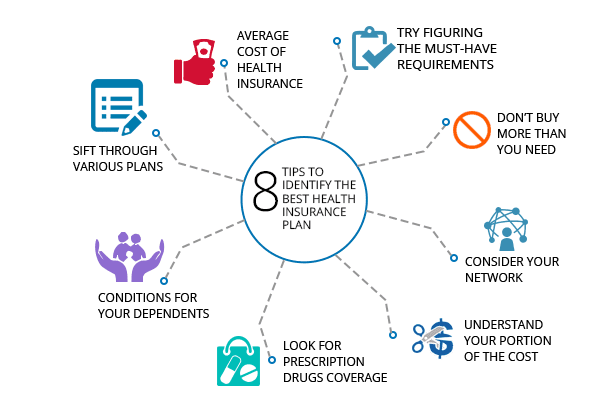

Understanding health insurance plans. Make sure your plan information is available and easily searchable on your companys internal site. A little self-reflection and careful reading of your plan documents can help you avoid unnecessary expenses and difficulties later. Preferred Provider Organization PPO.

The SBC was designed to make apples-to-apples comparisons of plans quick and easy. Understanding Premiums Deductibles and Out-of-Pocket Costs. The doctor bills your insurance company.

And since insurance companies arent supposed to be able to have rates that are unaffordable you should be able to find a health insurance plan that you can easily afford. Exclusive Provider Organizations EPOs. Now that Open Enrollment is winding down take some time to understand your health insurance plan how to get the most out of your coverage.

Managed Healthcare Plans are types of health insurance plans that emerged in the latter part of the 20th century. An employee should find what they need by doing a keyword search. Understanding key health insurance terms.

You can plan on paying anywhere from 200-400 monthly for a single insurance plan and closer to 1000 or more for a family insurance plan. A 2018 regulation by the Trump Administration broadened the scope of small employers and self-employed individuals that are allowed to participate in AHPs. Marketplace coverage includes preventive health services like immunizations for children and adults annual doctor visits for women and seniors screening and.

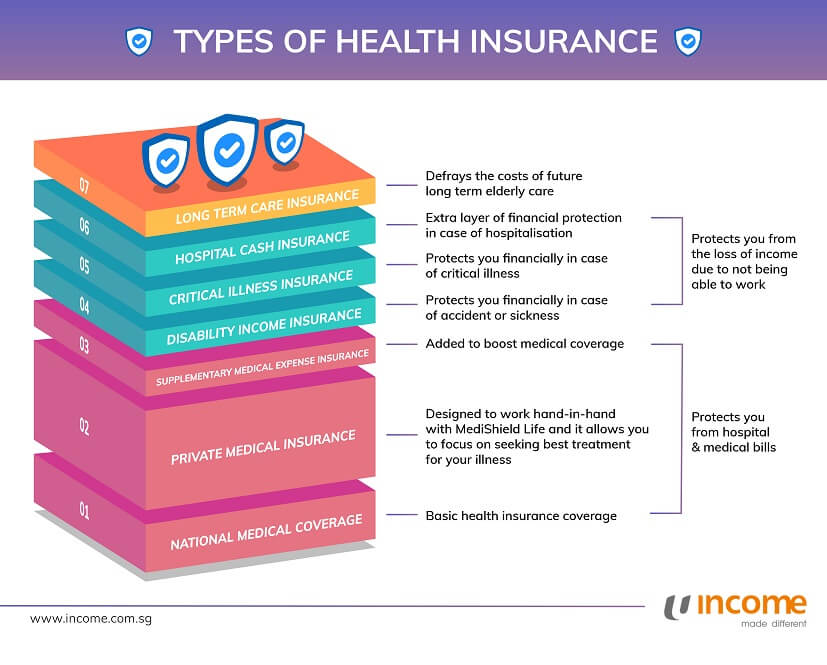

Types of Health Insurance Plans Health Maintenance Organizations HMOs. HMOs require a Primary Care Provider PCP who provides integrated care and focuses on prevention and wellness. The ACA requires that health insurance plans provide you with a Summary of Benefits which is an easy-to-understand summary of benefits and coverage.

A type of health insurance plan that usually limits coverage to care from providers who contract with the HMO. Insurance plans can differ in which providers you can see and how much you have to pay. Finally your insurance starts paying 100 of your health bills until the plan year ends or you change insurance plans.

These plans offer a network of health care providers and low monthly premiums. Health insurance is an insurance policy you pay into that later helps you cover a portion of your medical expenses. Indemnity plans often called 8020 plans These plans typically have a deductible the amount the patient pays before the insurance company begins paying benefits.

People generally buy a plan without copays because they are generally less expensive. Important key words explained. This is a good choice if youre relatively healthy and dont need to visit the doctor a lot.

It will also include a Uniform Glossary of terms used in health coverage and medical care. This period usually happens once a year and the timing will depend on the type of plan. Understanding health insurance is critical to understanding medical management as well as how healthcare is changing under reform.

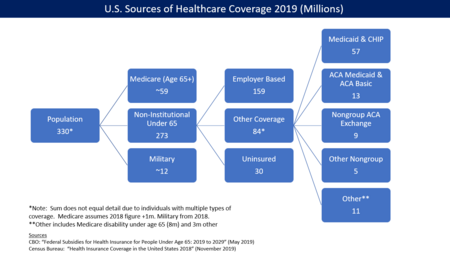

When you purchase a plan you become a member of that plan whether thats a Medicare plan Medicaid plan a plan through your employer or an individual policy like an Affordable Care Act ACA plan. Understanding your health coverage. Health insurance is a contract between you and your insurance companyinsurer.

Its also important when youre not sick. Its important to understand your costs and key health insurance terms so youll know what services your plan will pay for and how much each visit or medicine will cost. Health coverage pays for provider services medications hospital care and special equipment when youre sick.

But before you start shopping around for a dental plan. Dental insurance typically covers. The insurance company then pays the claim.

Most health insurance plans have a special period of time called open enrollment when you get to start stop or change your health plan. Managed health care plans provide a health insurance policy to individual members of a group or employer. Association Health Plans AHPs are health insurance plans run by small employers that band together as an association.

If understanding health insurance means reading through a 50-page booklet your employees just arent going to do it. You typically pay a periodic premium and then you or your care provider will remit a claim to the insurance company for care received. These are plans that offer networks of providers and low monthly premiums.

Preventive treatments such as routine checkups and cleanings Basic procedures such as fillings extractions and root canals Major procedures such as crowns or bridges Though about 6667 of Americans get dental insurance as a benefit through their jobs you can still get an affordable dental insurance plan if youre unemployed in between jobs or your employer doesnt offer it.

Understanding Health Insurance Jargon Ldi

Understanding Health Insurance Jargon Ldi

Health Insurance Plans Policies In India

Health Insurance Plans Policies In India

Understanding Health Insurance Kff

Understanding Health Insurance Kff

Here S How You Compare Health Insurance Plans Sick Chirpse

Here S How You Compare Health Insurance Plans Sick Chirpse

Understanding The Different Types Of Health Insurance Plans Alliance Health

Understanding The Different Types Of Health Insurance Plans Alliance Health

7 Types Of Health Insurance Ntuc Income

7 Types Of Health Insurance Ntuc Income

Tips To Find Best Health Insurance Plans Truecoverage

Tips To Find Best Health Insurance Plans Truecoverage

What Is Private Health Insurance

What Is Private Health Insurance

Health Insurance Coverage In The United States Wikipedia

Health Insurance Coverage In The United States Wikipedia

Should You Get Health Insurance Online

Should You Get Health Insurance Online

![]() Do You Need Help Understanding Health Insurance Terms The Florida Bar Member Benefits Insurance Retirement Programs

Do You Need Help Understanding Health Insurance Terms The Florida Bar Member Benefits Insurance Retirement Programs

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Types Of Health Insurance Plans Health Insurance Plans Compare Health Insurance Types Of Health Insurance

Types Of Health Insurance Plans Health Insurance Plans Compare Health Insurance Types Of Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.