This combination gives you more control over your money and rewards you for making healthy cost-conscious choices. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs.

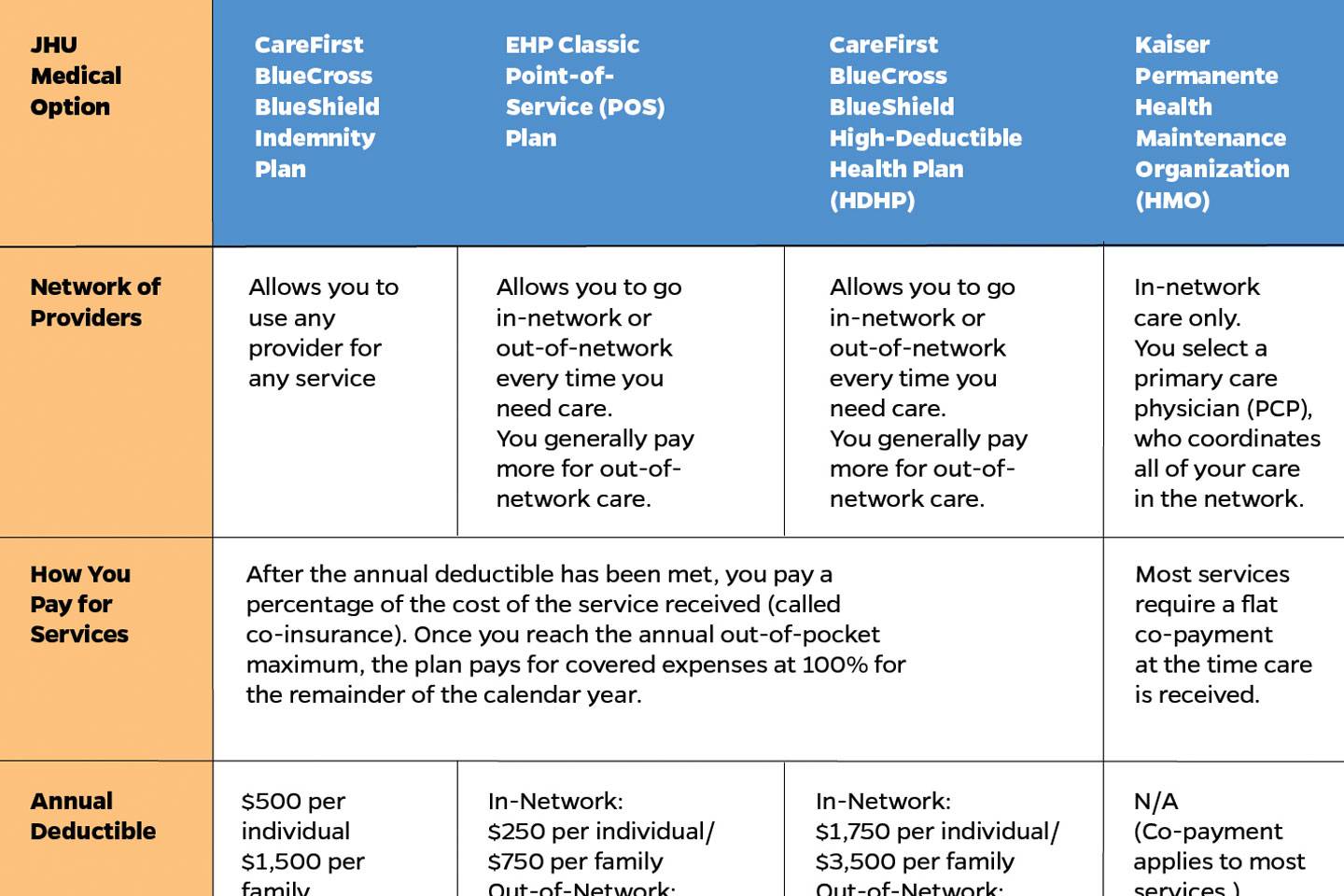

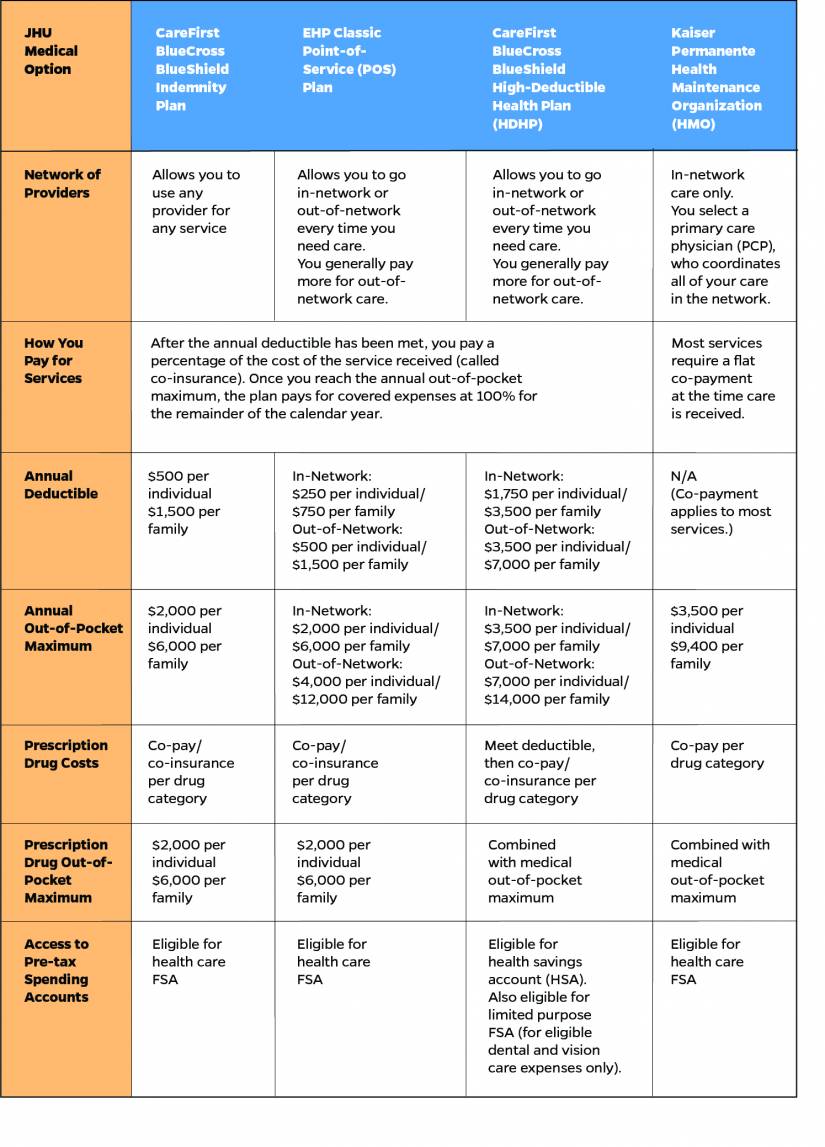

Understanding Your Medical Plan Options For 2020 Hub

Understanding Your Medical Plan Options For 2020 Hub

01012021 12312021 Summary of Benefits and Coverage.

Blue cross high deductible plan. Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. If this is the first time logging in you will need to register first. The Blue Advantage PPO is BCBSNCs traditional co-pay-based health plan for individuals.

Blue Options HSA is paired with a Health Savings Account which customers use to pay their out of pocket expenses. With an HDHP you pay the full cost for services until your annual deductible is met for services other than in-network preventive care services which are covered 100. When youve paid 5000 out of your pocket toward your medical costs your plan covers 100 of your costs until your plan year renews.

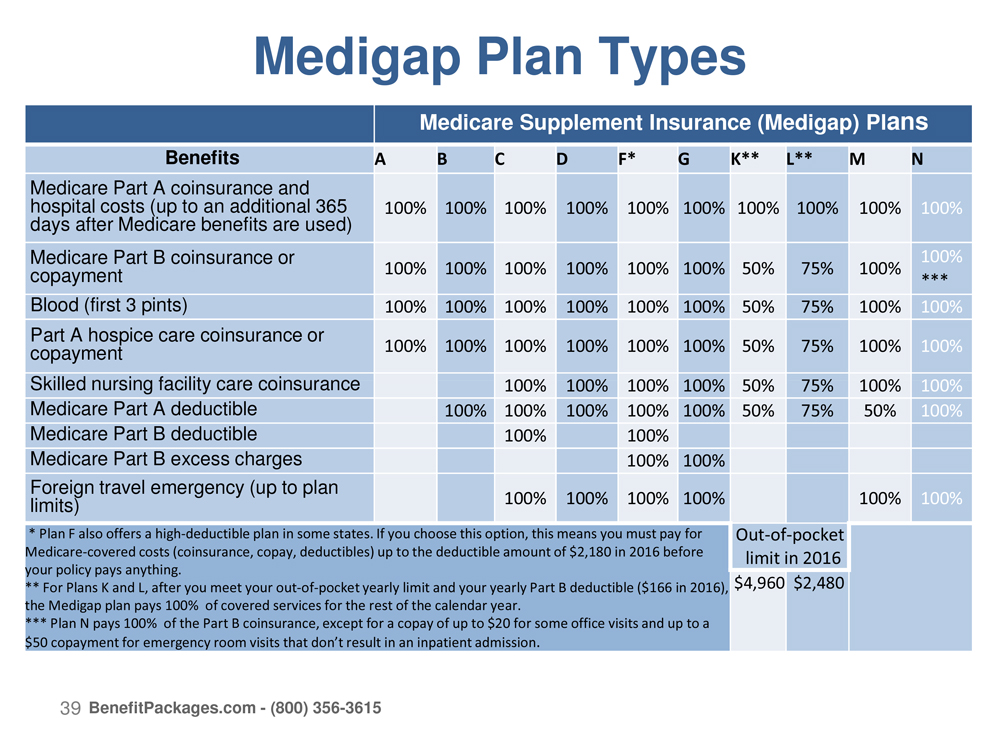

This high-deductible plan pays the same or offers the same benefits as Plan F after one has paid a calendar year 2370 deductible. PPO Group Number 007000285-0014 0015 5 of 8. Medicare Supplement Insurance High Deductible.

Benefits from high-deductible Plan F will not begin until out-of-pocket expenses are 2370. HRAs and HSAs may be paired with these plans to help offset the costs of the high deductible. Plan G after one has paid a calendar year 2370 deductible.

What this Plan Covers What it Costs Coverage for. Keep in mind that to qualify for an HSA you must first choose a high-deductible plan Premera has two types. For all other charges after satisfying the annual deductible the Plan pays a percentage of the covered charge coinsurance.

Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy. Preferred Silver 3000 HSA and Preferred Bronze 5250 HSA. With Medicare Supplement Insurance Plan F from Blue Cross Blue Shield of Oklahoma you can expect to pay a monthly premium all hospitalization costs beyond the additional 365 days after the Lifetime Reserve are used up all costs after 101 days of skilled nursing care an annual 250 deductible for foreign emergency care and 20 percent of costs within the first 50000.

Devereux Blue Cross High Deductible Health Plan Coverage Period. Your Part B coinsurance and the cost of the first three pints of blood. These expenses include the Medicare deductibles for Part A.

Benefits from high deductible Plan G will not begin until out-of-pocket expenses exceed 2370. The High Deductible Health Plan HDHP costs less out of your paycheck than the Direct Access plan but you must meet your deductible before the plan begins covering services. A health plan that has a high minimum deductible that a member must reach before the health plan begins to pay for covered services.

Your Part A deductible and coinsurance. If there is only one person. Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy.

These plans typically offer a lower monthly premium and give members more control over their health care dollars. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. Blue Options HSA and Blue Saver are high-deductible plans that offer customers lower monthly premiums and more streamlined benefits.

High Deductible Plan F covers 100 of the remaining charges after the 2240 deductible is met including. These expenses include the Medicare deductibles for Part A and Part B but do not include the plans separate foreign. Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage.

What this Plan Covers What You Pay For Covered Services Coverage for. High Deductible Plan F. Im healthy and dont anticipate high medical expenses With a high-deductible plan youre responsible for all of your medical expenses until you meet your deductible.

This Plan pays 100 for in-network adult or child wellness charges. Closed Panel PPO Questions. Preventive services such as wellness exams prenatal care and cancer screenings are covered at 100 in-network whether you have met your deductible or not.

The Premera Blue Cross HDHP pairs low premium high-deductible coverage with a tax-free Health Savings Account HSA that helps you save money and plan ahead for future medical expenses. HDHPs offer a lower premium with a higher annual deductible. If this is the first time logging in you will need to register.

IndividualFamily Plan Type. 9 Zeilen 1 The deductible on the family plan is non-embedded. Each plan is a little different so youll want to be familiar with the terms of your plan.

Higher level of benefits applies when in-network provider is used. Use your social security number as your member ID. Benefits from High Deductible Plan F will not begin until your out-of-pocket expenses total 2240.

IndividualEmployee ChildEmployee SpouseFamily Plan Type. Each time medical care is needed patient decides which physician to use. After you meet your deductible you may only be responsible for a small percentage of the costs called a co-insurance.

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Https Www Hca Wa Gov Assets Pebb Sebb Premera High Ppo Sbc 2021 Pdf

Https Www Cmich Edu Fas Hr Documents 2020 202021 20hsa Advantage 20hdhp 20sbc Pdf

Understanding Your Medical Plan Options For 2020 Hub

Understanding Your Medical Plan Options For 2020 Hub

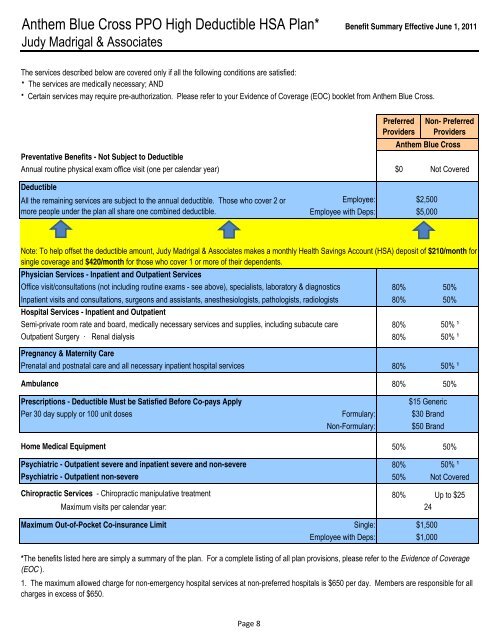

Anthem Blue Cross Ppo High Deductible Hsa Plan Judy Madrigal

Anthem Blue Cross Ppo High Deductible Hsa Plan Judy Madrigal

Health Savings Accounts Blue Cross Blue Shield Seneca

Health Savings Accounts Blue Cross Blue Shield Seneca

Https Www Bcbsm Com Content Dam Microsites Som State Health Plan Hdhp Booklet Pdf

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Covering The Costs Of A High Deductible Health Plan

Covering The Costs Of A High Deductible Health Plan

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

Health Plans From Florida Blue Florida Health Connector

What You Need To Know About Hsas Hras And Fsas

What You Need To Know About Hsas Hras And Fsas

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.