You may be worried about a health insurance gap between jobs. Its available if youre already enrolled in an employer-sponsored medical dental or vision plan and your company has 20 or more employees.

Cobra Is Free For Six Months Under The Covid Relief Bill Do You Qualify The Virginian Pilot

Cobra Is Free For Six Months Under The Covid Relief Bill Do You Qualify The Virginian Pilot

In Nevada there are two types of COBRA healthcare continuation coverage.

Cobra health insurance between jobs. Fortunately under the Consolidated Omnibus Budget Reconciliation Act COBRA individuals who work for certain private-sector or government employers with 20 or more employees have the ability to continue using their current employers group health insurance plan after a qualifying event that separates them from their employer. The Consolidated Omnibus Budget Reconciliation Act COBRA is a law that helps employees maintain their job-based health insurance for a limited time if they are experiencing qualifying circumstances such as a job loss furlough. The way it works is through the federally administered program known as COBRA.

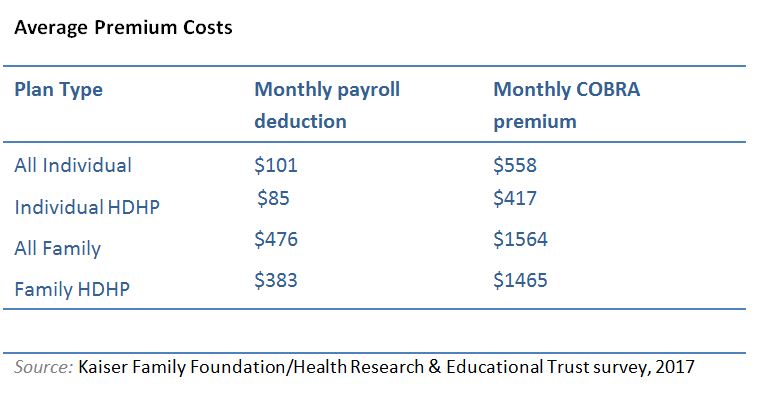

Your employer contributed 400 per month toward your health insurance premiums so the total cost of your job-based health plan was 650 per month. 3 days ago COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs. HIPAA the Health Insurance Portability and Accountability Act simplifies the task of.

The way it works is through the federally administered program known as COBRA. Under COBRA the Consolidated Omnibus Budget Reconciliation Act most employers have to offer terminated employees similar coverage to the health insurance provided while they were employed. More than 2 million people could benefit according to the Congressional Budget Office.

Its available if youre already enrolled in an employer-sponsored medical dental or vision plan and your company has 20 or more employees. Your spousepartner and dependents can also be included on your COBRA coverage. COBRA is a federal law that may let you pay to stay on your employee health insurance for a limited time after your job ends usually 18 months.

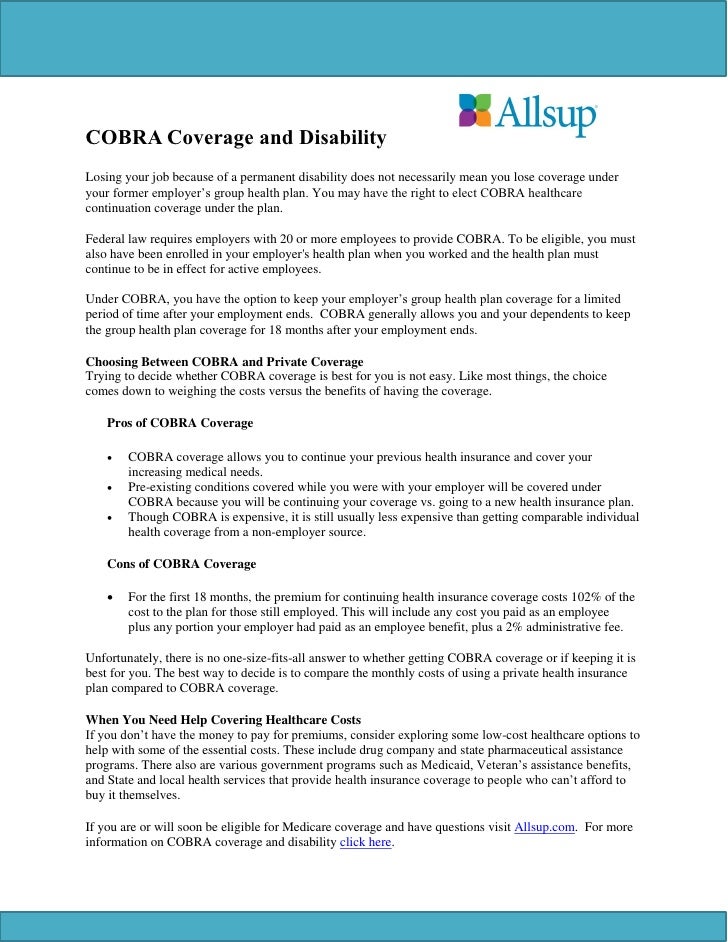

You pay the full premium yourself plus a small administrative fee. COBRA is a federal law that allows workers who leave a job for any reason or have a qualifying family event happen like divorce or death the right to remain on the same health insurance plan they previously had. Sadly not every employer must offer COBRA coverage.

Had benefits at a job you are now leaving. However due to the Affordable care Act new options are available through the Health Insurance. The problem is COBRA is usually offered at full price plus a two percent administrative fee.

One option for health insurance coverage is through the Consolidated Omnibus Budget Reconciliation Act COBRA which allows former employees and their dependents to keep their existing group health insurance coverage under the companys group rate. Under both of these options employees and dependents who lose their coverage due to what is considered a qualifying event may be able to temporarily extend their group health insurance plan while they are between jobs. This law applies only to companys with 20 or more employees.

HIPAA and COBRA are acronyms for two laws regarding health insurance for employees who lose their jobs. If you work at a company with. 9 days ago The Consolidated Omnibus Budget Reconciliation Act COBRA gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss reduction in the hours worked transition between jobs.

COBRA Cost Calculation Example Lets say you used to have 125 taken from each paycheck for health insurance. Your spousepartner and dependents can also be included on your COBRA coverage. A COBRA plan allows you to extend the health care plan from your previous employer for up to 18 months after you leave a job.

But remember that you have the option of COBRA health insurance. To learn about your COBRA options contact your employer. You got paid twice per month so your portion of the monthly premiums was 250.

Federal COBRA and Nevada COBRA insurance. The disadvantage to this is COBRA is expensive and you have to pay for it yourself. COBRA health insurance allows you to continue the health insurance you had from your employer for up to 18 months.

COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs. If you become eligible for COBRA health insurance you should get a letter from your health insurance provider or your employer explaining the benefits how they work and how to sign up. Employees can use COBRA the Consolidated Omnibus Budget Reconciliation Act to continue participating in their employers group health coverage after losing their jobs.

In some cases you may be able to continue coverage through COBRA for. More than 2 million people could benefit according to the Congressional Budget Office. This basically means once youre unemployed your monthly premium is going to be pretty expensive.

Get coverage through COBRA The Consolidated Omnibus Budget Reconciliation Act of 1996 known as COBRA lets you buy coverage under your former employers group health plan generally for up to 18. If you work at a company with. You can buy a plan yourself through the Health Insurance Marketplace.

Short Term Health Insurance Plans Vs Cobra

Short Term Health Insurance Plans Vs Cobra

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

How To Get Cobra Health Insurance If You Lose Your Job Or Retire Early Business Insider

Is Cobra Insurance The Best Option For People Between Jobs

Is Cobra Insurance The Best Option For People Between Jobs

How To Manage Health Insurance Between Jobs

How To Manage Health Insurance Between Jobs

Short Term Health Insurance Plans Vs Cobra

Short Term Health Insurance Plans Vs Cobra

How Much Does Cobra Insurance Cost Top Class Actions

How Much Does Cobra Insurance Cost Top Class Actions

Insurance Coverage After Job Loss The Importance Of The Aca During The Covid Associated Recession Nejm

Insurance Coverage After Job Loss The Importance Of The Aca During The Covid Associated Recession Nejm

What Are Your Health Insurance Options If You Re Unemployed Due To Coronavirus Ramseysolutions Com

What Are Your Health Insurance Options If You Re Unemployed Due To Coronavirus Ramseysolutions Com

Laid Off And Looking For Health Insurance Beware Of Cobra Shots Health News Npr

Laid Off And Looking For Health Insurance Beware Of Cobra Shots Health News Npr

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

What To Do If You Have A Lapse In Health Insurance Between Jobs Vera Health

What To Do If You Have A Lapse In Health Insurance Between Jobs Vera Health

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.