5 Medicare Part A is perhaps the most well-known part of the Medicare program. Hospice care coinsurance or copayment.

Understanding Medicare Part A - YouTube.

Understanding medicare part a. Medicare Part A is the oldest product in the Medicare program and is a benefit every US. Medicare Part A benefits begin the first day of the month you turn 65. Medicare Part A is also known as hospital insurance because it is the part of Medicare that covers inpatient hospital stays.

You begin paying a larger share in the form of a daily hospital copay. In 2021 the Medicare Part A deductible is 1484 per benefit period. Learn about the parts of Medicare and how Original Medicare Medicare Advantage and Medicare drug coverage Part D works.

Your share of that cost is a hospital deductible which will be 1484 in 2021. It covers hospital stays hospice care and some skilled nursing care that you may need after being hospitalized for a stroke a broken hip or other episodes that require rehabilitation in a nursing home or other facility so you can get back on your feet. Part A Hospital Coverage.

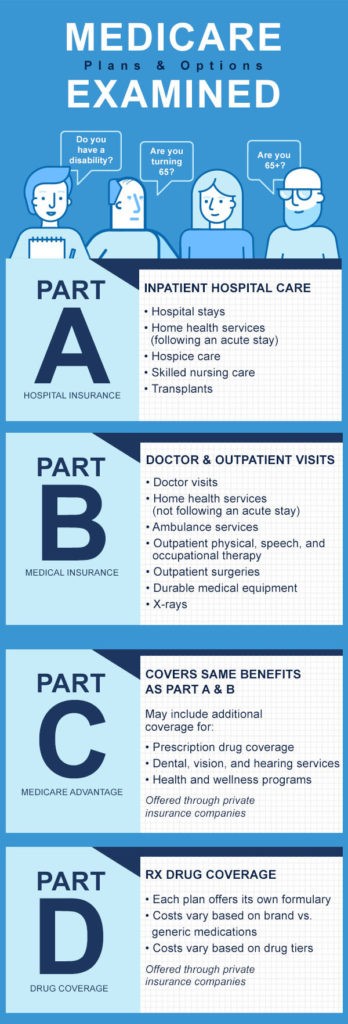

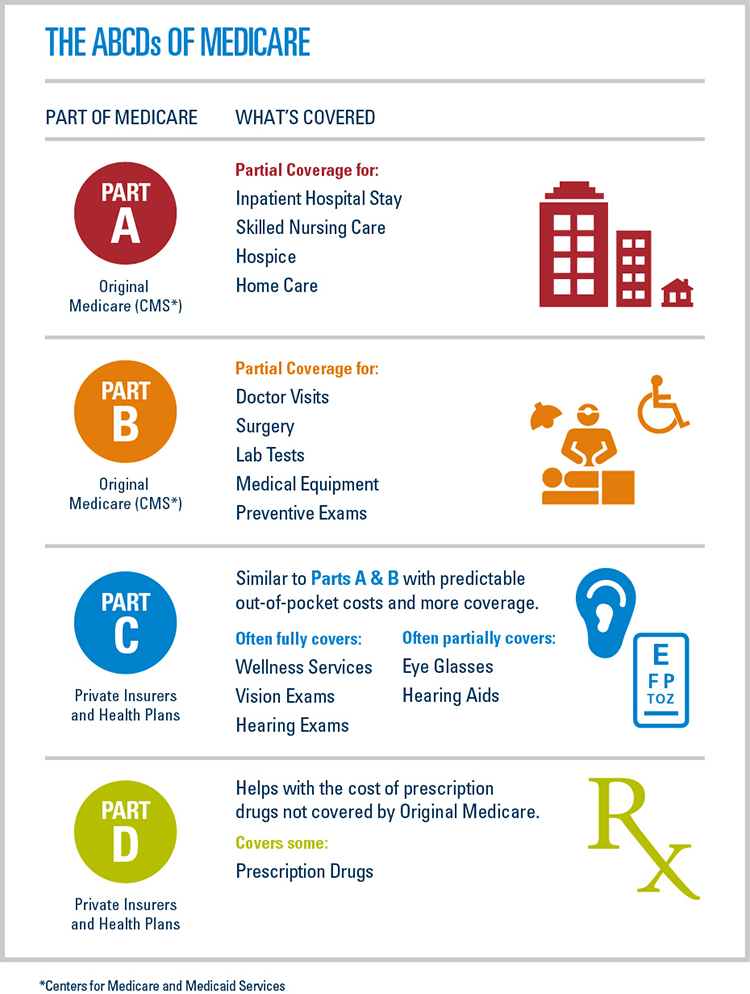

Part A Hospital Insurance Part B Doctor and Medical Insurance Part C Medicare Advantage. Medicare Part A is hospital insurance and its coverage which is provided by the US fed. Part A pays for your first 60 days in the hospital.

What do you qualify for. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. Medicare Part A is designed as a federally-funded healthcare program.

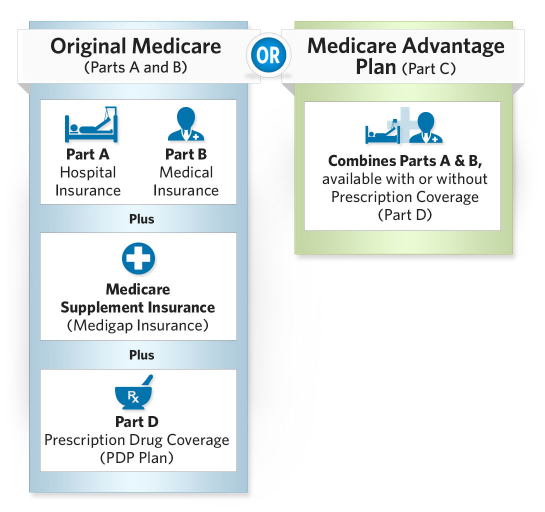

After 60 days consecutive days in the hospital Medicare pays a diminishing share of your benefits. Copayments coinsurance and deductibles may apply for each service. Your Medicare coverage choices Learn and compare the 2 main ways to get your Medicare coverageOriginal Medicare Part A and Part B and Medicare Advantage.

Part B also covers durable medical equipment home health care and. Part B Doctor and Outpatient Services. This video will explain Medicare Part A benefits such as inpatient hospital stay skilled nursing facility care.

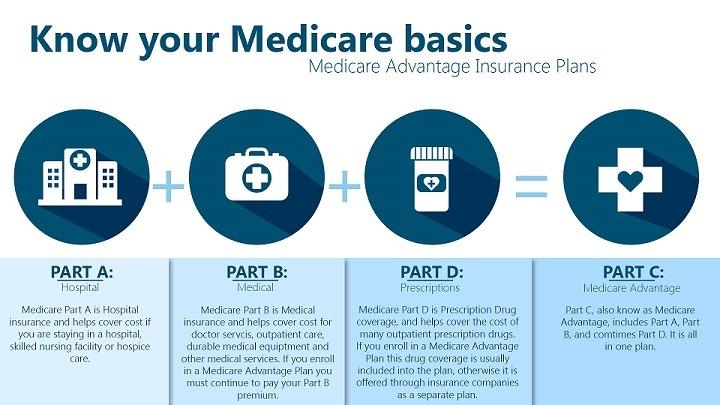

Medicare Part A covers inpatient hospital care skilled nursing facility hospice lab tests surgery home health care. You can use any doctor or hospital that takes Medicare anywhere in the US. An important step in understanding Medicare is learning about its four parts each of which covers a different area of health care costs and is designated by a letter A through D.

Medicare Has Four Parts. Medicare Part A is known as hospital insurance as it covers hospital expenses such as inpatient hospital stays skilled nursing facility care hospice care and some home health care. Enrollment is simple and easy as most participants are automatically eligible for the Medicare Part A healthcare program because they have reached the age of 65-years old and are receiving retirement benefits from Social Security or the Railroad Retirement Board.

When you apply for Medicare you will automatically be enrolled in Part A. Medicare Part B covers doctor and other health care providers services and outpatient care. Part A helps cover most inpatient hospital needs skilled nursing home care and home health and hospice care.

This includes some services provided in skilled nursing facilities hospice and certain home health care services. Medicare Part A comes without a monthly premium if you paid Medicare taxes for 10 years 40 quarters while working. Medicare Part A covers inpatient hospital skilled nursing facility and some home health care services.

Part A Part B. Medicare Part A also has several out-of-pocket costs which include. To make it easier let us break it down into individual parts.

Medicare coverage will pay for semi-private rooms general nursing care meals medications while in the hospital and all other services and care during an inpatient hospital visit. Medicare Part A also referred to as Medicare hospital insurance helps cover inpatient care for Medicare recipients. Medicare Part A - Hospital Insurance Helps cover inpatient care in a hospital or skilled nursing facility following a hospital stay home health care services and hospice care services.

Your Medicare Part A deductible is how much you must pay before Medicare will begin paying its share. And your loved one. If you want drug coverage you can join a separate Medicare drug plan Part D.

1 In addition Part A covers services including lab tests and surgeries. To help pay your out-of-pocket costs in Original Medicare like your 20 coinsurance you can also shop for and buy supplemental coverage. Part A Hospital Insurance and Part B Medical Insurance.

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. Other individuals become eligible for Medicare Part A if. Part B Understand the difference in coverage from Part A to Part B.

Citizen or permanent legal resident residing for at least five continuous years is entitled to if they meet Medicare Eligibility requirements.

Understanding Medicare Part A Part B Part C And Part D

Understanding Medicare Part A Part B Part C And Part D

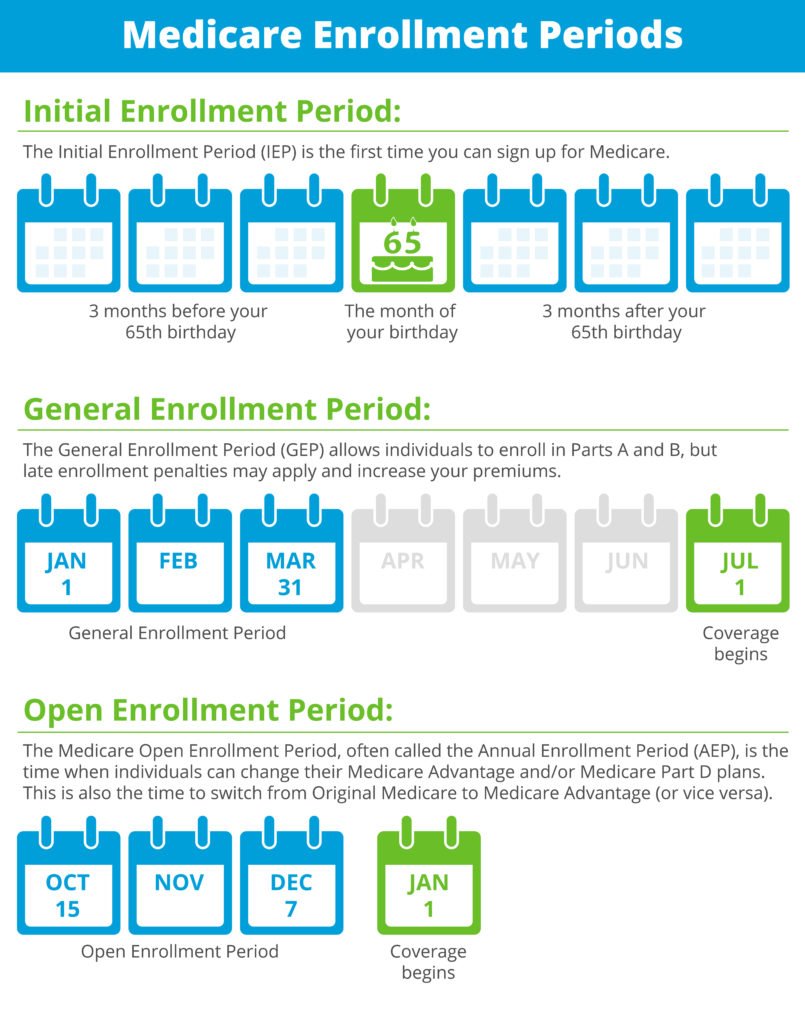

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

Graphic Medicare Guide Learn About The Medicare Types A B C D

Graphic Medicare Guide Learn About The Medicare Types A B C D

Medicare Parts Learn The Parts Of Medicare Medicare Parts A B C D

Medicare Parts Learn The Parts Of Medicare Medicare Parts A B C D

Understanding Medicare Parts A B C And D How Medicare Advantage Plans Work What Each Covers Senior Resource Hub

Understanding Medicare Parts A B C And D How Medicare Advantage Plans Work What Each Covers Senior Resource Hub

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

Medicare Part A B C And D What You Need To Know Healthmarkets

Medicare Part A B C And D What You Need To Know Healthmarkets

Your Guide To Understanding Medicare Parts A D Medicare Medicare Advantage Info Help And Enrollment

Your Guide To Understanding Medicare Parts A D Medicare Medicare Advantage Info Help And Enrollment

Understanding The Parts Of Medicare Healthtn

Understanding The Parts Of Medicare Healthtn

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

What Are The Parts Of Medicare The Abcd S Explained

What Are The Parts Of Medicare The Abcd S Explained

Understanding Medicare In Nc Medicare Parts And Plans

Understanding Medicare In Nc Medicare Parts And Plans

Understanding Medicare Before You Age In Blue Cross Mn

Understanding Medicare Before You Age In Blue Cross Mn

Medicare 101 Novel Insurance And Wealth Management

Medicare 101 Novel Insurance And Wealth Management

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.