CalSTRS has decided to suspend new mortgage originations through its Home Loan Program because current market conditions do not favor more competitive products beyond what is already available to our members on the open market. Our easy application can be completed in under 10 minutes.

Any home owner can apply for a home equity loan.

Calpers home loan program 2019. The CalPERS Home Loan Program was discontinued in December 2010 due to several external factors including changing market conditions. Qualifying for loans with the California Employee Loan program works the same way as getting qualified for any conventional or government loan program. This type of loan is available to anyone who owns their property.

That means all hours access to the people handling your loan in-house underwriting and all the information you need right at your fingertips in addition to our no cost loan. Calpers Member Home Loan Program It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. Calpers Member Home Loan Program Applying for a home equity.

How Does a Home Equity Loan Work. 100 financing 60 Day mortgage rate lockand the CalPERS mortgage rate roll-down benefit. CalPATH is not a CalPERS home loan program.

Answer Home Loans has no affiliation to CalPERS. CalSTRS remains committed to the Home Loan Program however current conditions make its re-launch impractical. As of June 30 2019.

May 14 2021. As a leader in home lending we offer a streamlined mortgage refinance and purchase application process to save you time and money. Employer contributions arent refundable.

Our Board of Administration suspended the program. 9 The CalPERS Member Home Loan Program was launched in 1982 and offered a unique mortgage benefit for members including reduced lender fees through preferred mortgage lenders lower closing costs through participating partners and a down payment assistance program that allowed members to borrow against their CalPERS retirement for up to 100 of their required down payment. No you cant borrow from your CalPERS retirement account to buy a house.

CalSTRS had offered a loan program to help teachers purchase or. Call Matt your CalPERS Home Purchase and Mortgage Refinance Program specialist. Reduced Lender Fees.

The home you are purchasing or refinancing must be in the state of California. Since this can impact your future retirement. Home Purchase Cash Out or Rate.

CalPERS home loans assist members of CalPERS LRS JRSwith buying a home or a mortgage refinance at competitive mortgage rates preferred loan terms and discounted loan fees. Getting started with a loan approval is easy you can have a loan decision usually in 24 hours. CalSTRS is striving to offer our members unique financial products while maintaining the Home Loan Program.

Visit the CalPERS Twitter page. CalPERS launched its Member Home Loan Program in 1982 and offered benefits for members that included reduced lender fees lower closing costs and down payment assistance. Borrowers with conforming CalSTRS 8017 or 955 mortgages may be eligible to refinance using the Home Affordable Refinancing Program HARP part of the federal governments Making Homes Affordable MHA initiative.

CalPATH Home Loan Benefits. Calpers Home Loan Program Suspended It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. CalSTRS Home Loan for Teachers in California.

The CalPERS Member Home Loan Program was launched twenty-nine years ago and offered a unique mortgage benefit for members including reduced lender fees through Preferred Mortgage Lenders lower closing costs through participating partners and a down payment assistance program that allowed members to borrow against their CalPERS retirement system for up to 100 of the down payment. This type of loan is available to anyone who owns their property. Lender paid Mortgage Insurance No PMI options available with as little as a 3 down payment.

Any home owner can apply for a home equity loan. CalPERS income over the last 20 years demonstrates that every dollar spent on public employee pensions comes from the following sources. CalPERS home loans offer many advantages to CalPERS members such as.

Calpers Home Loan Program Look For Calpers Home Loan Program Fha Home Loan Rates 10 Year Home Equity Loan Calculator 20000 Dollar Home Equity Loan 10 Lakh Home Loan Emi Sbi 20 Year Mortgage Rates Virginia 100k Mortgage Over 25 Years 2000 Deposit Home Loans 0 Interest Home Loans India 2 Million Dollar Home Loan 2 1 Buydown Mortgage. Can I Borrow from CalPERS to Buy a House. Mortgage rates change daily based on the market.

We work to make sure you get the right loan at the right rate every time. - a nationwide mortgage lender. If youre leaving CalPERS employment you can elect to take a refund of your contributions plus interest.

This means you lose the right to receive a service or disability retirement benefit. Visit the CalPERS Facebook page. Were a specialized division of Summit Funding Inc.

Matt the Mortgage Guy is proud to offer the new CalPATH home loan to replace the CalSTRS and CalPERS home loan programs. This program applies to qualifying first mortgages only not second liens. However taking a refund ends your CalPERS membership.

Calpers Home Loan Program Suspended Applying for a home equity. Cost of Living. The previously offered non-conforming mortgages under the 8017 or 955 program are not eligible.

You can find the press release on the. Httpwwwifundit CalPERS loans are no longer available since CalPERS has decided to suspend the 29 year old program. Summit Funding is the best in the business at handling your home loan you might call it our specialty and has the full resources of a large mortgage bank - but our small team works only for you.

How Does a Home Equity Loan Work. At Answer Home Loans we are a direct lender committed to providing low down payment and other government assistance loan programs such as CalPATH FHA VA USDA and other community lending programs. Pre-Qualification can take as little as 15 minutes and the service is free.

This can be done online or we can set an appointment for you to meet with one of our loan. The new CalPATH home loan program with Mountain West Financial have the same guidelines and can be completed very quickly.

![]() What Happened To The Calpers Member Home Loan Program Calpers Perspective

What Happened To The Calpers Member Home Loan Program Calpers Perspective

Calpath Home Loan Program For California Public Employees

Calpath Home Loan Program For California Public Employees

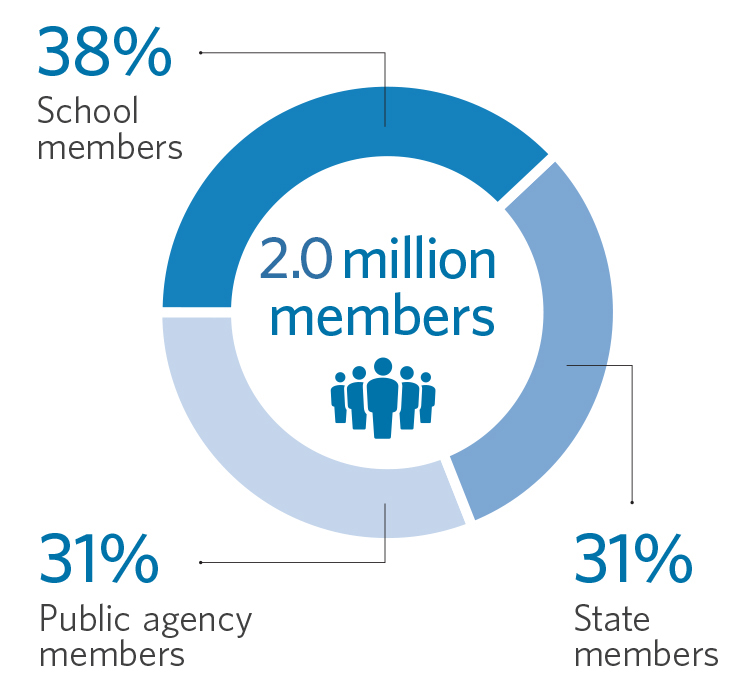

California Public Employees Retirement System Calpers

California Public Employees Retirement System Calpers

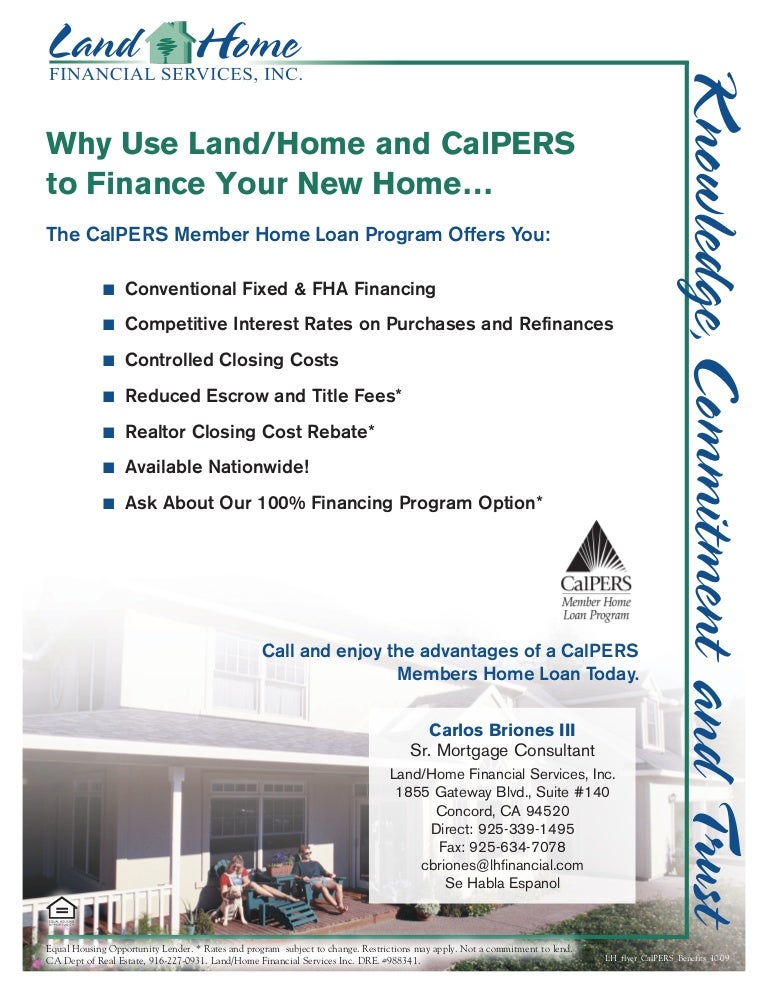

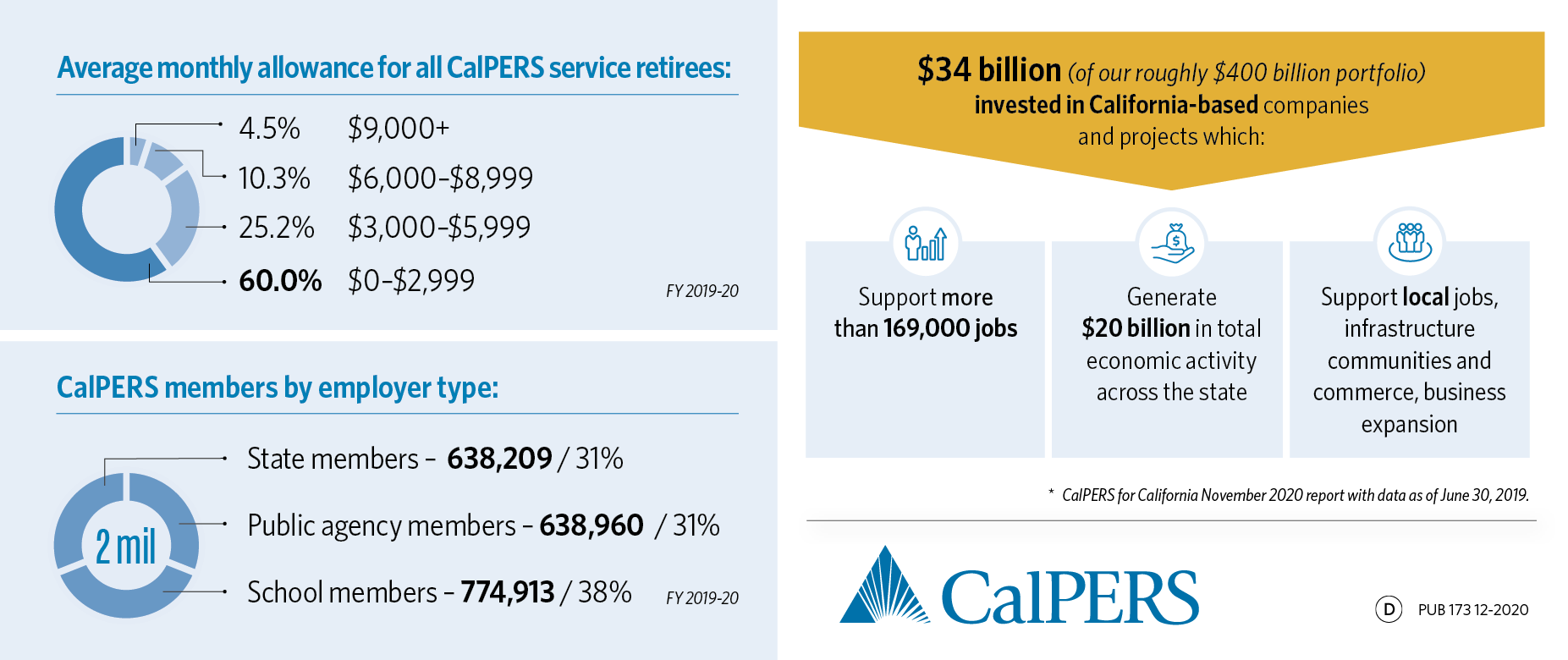

Calpers Flyer Benefits Carlos Briones

Calpers Flyer Benefits Carlos Briones

Calpers 2009 Annual Investment Report Calpers On Line

Calpers 2009 Annual Investment Report Calpers On Line

Calpers Calstrs Home Mortgage Loans Purchase Refinancing Debt Consolidation Investment Properties

Calpers Calstrs Home Mortgage Loans Purchase Refinancing Debt Consolidation Investment Properties

Pdf Convergence By Design The Case Of Calpers In Japan

Pdf Convergence By Design The Case Of Calpers In Japan

What Happened To The Calpers Member Home Loan Program Calpers Perspective

What Happened To The Calpers Member Home Loan Program Calpers Perspective

Who Pays For Calpers Pensions Calpers

Who Pays For Calpers Pensions Calpers

Calpers Members Home Mortgage Loans In California Youtube

Calpers Members Home Mortgage Loans In California Youtube

What Happened To The Calpers Member Home Loan Program Calpers Perspective

What Happened To The Calpers Member Home Loan Program Calpers Perspective

Calpath Home Loan In California Assisting Calpers Calstrs Members Youtube

Calpath Home Loan In California Assisting Calpers Calstrs Members Youtube

Calpath California Public Employee Teacher Home Loan Program Youtube

Calpath California Public Employee Teacher Home Loan Program Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.