The Consumer Directed HealthSelect SM plan is a high-deductible health plan HDHP with a health savings account HSA and PPO network. HMOs generally have less options because less providers are part of the HMO but the discounts are deeper.

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

With a PPO plan members still have access to a local network of doctors and hospitals.

What does ppo and hmo mean. But they also have the flexibility to see any other provider anywhere in America. In this video I explain the differences between the different types of networks that you see on health insurance plansWhat does HMO mean. HMO stands for Health Maintenance Organization.

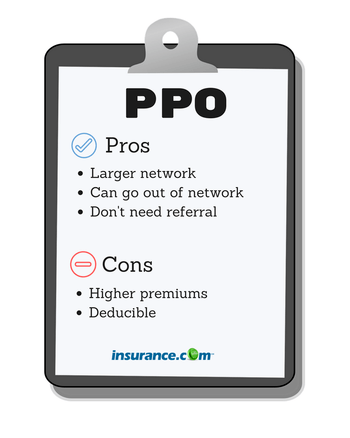

However PPOs generally offer greater flexibility in seeing specialists have larger networks than HMOs and offer some out-of. What does PPO mean in dental insurance. PPO stands for Preferred Provider Organization.

You will have to pay more if you choose out-of-network physicians hospitals and providers. Compared to PPOs HMOs cost less. HSA-qualified plans must meet specific plan design requirements laid out by the IRS but they are not restricted in terms of the type of managed care they use.

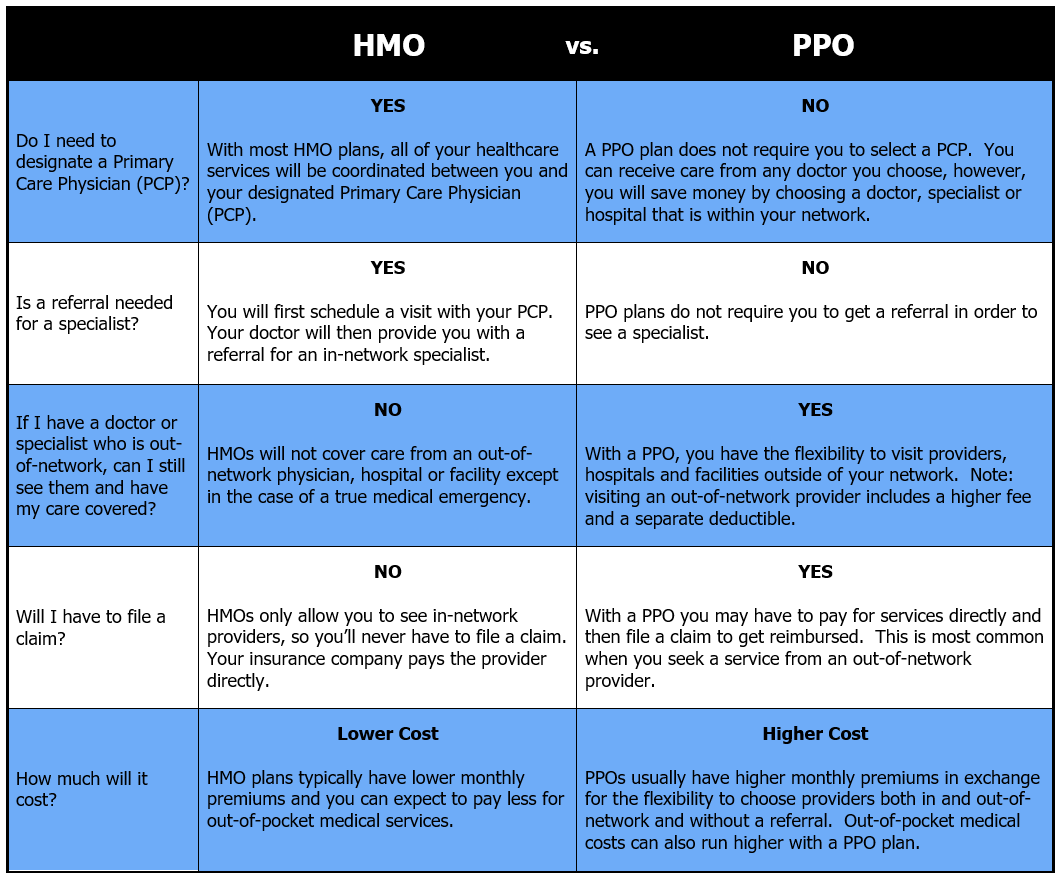

As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. PPO stands for Preferred Provider Organization. You pay a contracted rate less than full price to see network providers.

HMO stands for health maintenance organization. An HMO requires that patients see only doctors or hospitals on their list of providers. This plan is available to people not enrolled in Medicare.

To start HMO stands for Health Maintenance Organization and the coverage restricts patients to a particular group of physicians called a network. HMODMO providers can be expected to perform services for a deeply discounted rate. A PPO is a type of insurance plan that uses a defined network of medical providers to meet your health care needs.

PPO Preferred Provider Organization Plan. All these plans use a network of doctors and hospitals. What is the difference between a PPO and HMODMO insurance.

PPO Preferred Provider Organization is a form of managed care under which health care providers contract to provide medical services at pre-negotiated rates. Larger networks typically have smaller discounts while small networks can offer deeper discounts. The difference between them is the way you interact with those networks.

PFFS stands for Private Fee For Service. PPO stands for preferred provider organization. This is the primary difference between a PPO Preferred Provider Organization and a HMO Health Maintenance Organization.

HMO Health Maintenance Organization Plan. If PPO plan members do choose to go out of the PPO. What about a PPOI.

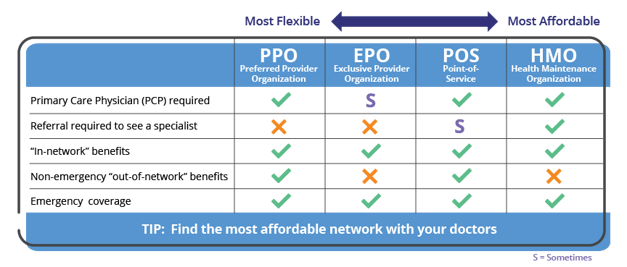

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. In a PPO plan you pay less if you choose physicians hospitals and other health care providers from the plan network. POS stands for point of service.

PPO is short for Preferred Provider Organization and allows patients to choose any physician they wish either inside or outside of their network. In most HMO plans you may only be seen by network. On the other hand the EPO plans have lower monthly premium than the PPO but higher than the HMO plans.

HSA stands for health savings account and HSA-qualified plans can be HMOs PPOs EPOs or POS plans. HMO stands for Health Maintenance Organization while PPO stands for Preferred Provider Organization. PPOs generally have more.

You might also see these written as DHMO and DPPO to specify that theyre dental policies rather than medical policies. HMO stands for health maintenance organization. The difference is how big those networks are and how you use them.

Thats as long as the doctor participates in Medicare and accepts the members health plan. PPO stands for Preferred Provider Organization. PPO stands for preferred provider organization.

IPO Independent Provider Organization operates by having an HMO contract directly with independent physicians to provides services to HMO members. POS stands for Point of Service. With an EPO you typically dont.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Lets start by going over what a PPO dental plan typically features. A health maintenance organization HMO and a preferred provider organization PPO have several differences such as which doctors patients can see how much services cost and how medical records are kept.

On the other hand PPO dentists only receive money from the insurance company if services are rendered. Difference between PPO HMO and EPO COST OF COVERAGE In terms of cost the PPO plans are offered at highest premium and also have higher deductibles. However unlike an HMO with a PPO you can use doctors clinics and hospitals outside the network at a higher cost.

While HMO and PPO plans are the 2 most common plans especially when it comes to employer-provided health insurance there are other plan types you should know about including EPO and POS plans.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

What Is An Hmo About Hmo Health Insurance Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Understanding The Difference Between In Network And Out Of Network Provider Coverage

Understanding The Difference Between In Network And Out Of Network Provider Coverage

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

What Is A Ppo About Ppo Health Insurance Medical Mutual

What Is A Ppo About Ppo Health Insurance Medical Mutual

Terms Defined Hmos Vs Ppos Empower Health Insurance

Terms Defined Hmos Vs Ppos Empower Health Insurance

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.