Plan F is offering coverage for Medicare Part Bs annual deductible of 198. If your 65th birthday came before January 1 2020 or if you qualified due to a disability before January 1 2020 then you can purchase a Medigap Plan F policy.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

If your plan G premium is 203 less than F it makes sense to go to G.

Medicare supplement part f vs part g. Medigap plans can be Part F or Part G. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183. Medigap plan G saw a 28 increase in number of enrollment in 2015 the most recent data while Plan F increased by only 8.

Most striking is one company in North Carolina that offers a Plan F with an annual premium of 3556. Medicare Supplement Plan G. With Plan G you will need to pay your Medicare Part B deductible.

If you are looking for a comprehensive supplement plan G is a perfect option. After you pay your deductible you have no other out-of-pocket costs just like the Plan F. This is not the case for Plan F.

In Washington a Plan Fs premium is 2568 and the Plan G1896 a difference of 672. The savings will make up for the extra cost you have in the Part B deductible. Neither Medigap Plan covers prescriptions.

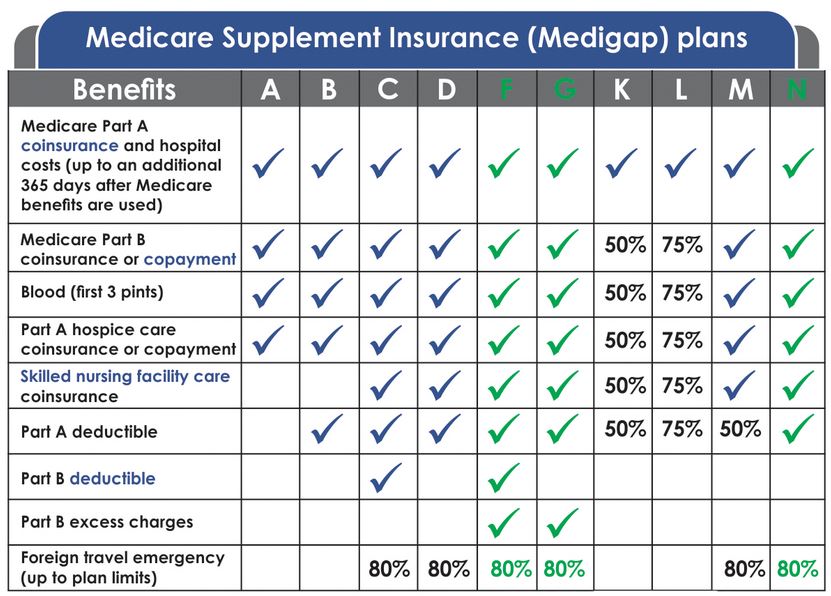

Enrolling in order to compare medicare supplement plans f and g Knowing enrolling stipulations is important to compare Medicare supplement plans f and g because anyone new to Medicare can enroll in Plan G. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible. Medicare Advantage plans.

This means that you will have to pay 183 annually before Plan G begins to cover anything. Out of network doctors and hospitals when allowed have significantly higher maximum copays. 16 Zeilen Medicare Supplement Plans F and J also have a high deductible option.

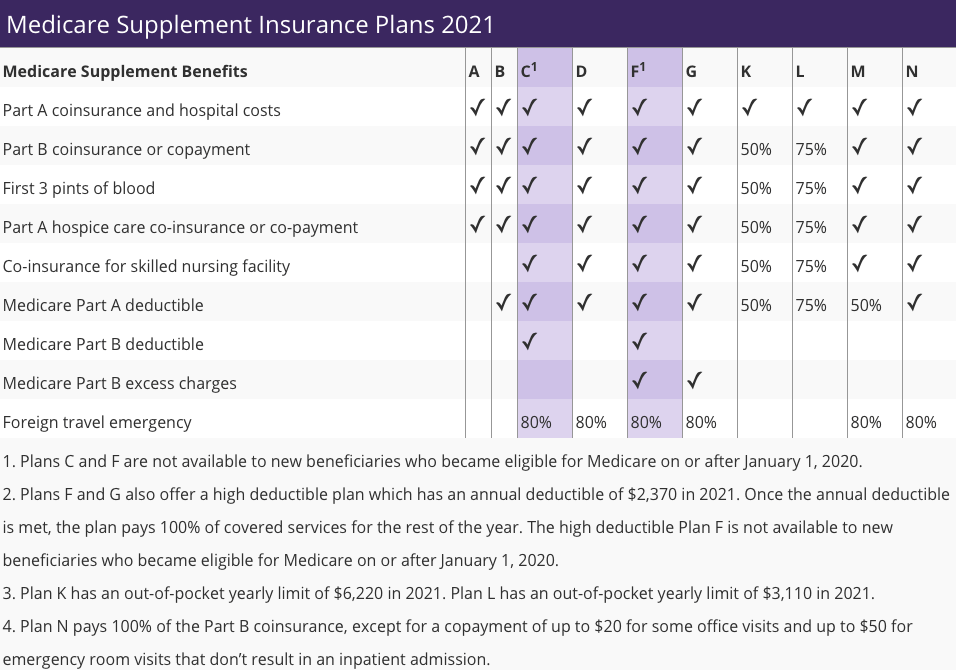

The Part B deductible for 2021 is 203. Private insurance companies offer them. If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself.

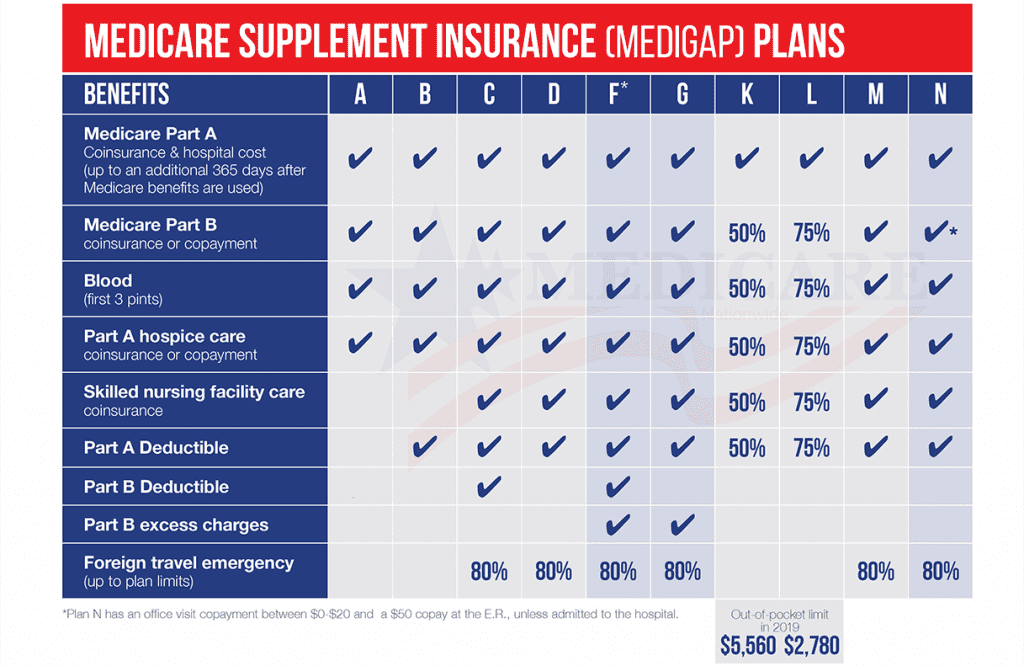

When it comes to coverage Plan F will give you the most coverage since its a first-dollar coverage plan and leaves you with zero out of pocket costs. Only people who are covered and new entrants to Medicare before January 1 st 2020 can enroll. Medicare Supplement Plans F and G are identical with the exception of one thing.

Medigap plans F and G are supplemental health insurance plans that work in conjunction with original Medicare. Maximum total out-of-pocket costs for the year. If a Plan F option includes premiums that cost more in a year than the price of a Plan G policy plus the Medicare B deductible 203 in 2021 then a beneficiary would save money by.

Plan F is the only supplement that offers more benefits than Medicare Plan G but the plan F is not available for people entering Medicare as of 01012020 making the Medicare part G the most comprehensive plan on the market. Then your Medicare Supplement plan would cover the 20 coinsurance. Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible.

You are responsible for your Part B deductible with Plan G plans. Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible which is 203 in 2021. However when it comes to the monthly premium if you think lower is better then Plan G may be better for you.

Both plans require you to first have Original Medicare but the enrollment guidelines for Plan F changed at the beginning of 2020. Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Thats not a substantial medical benefit by any means but it is one that none of the other Supplement plans are offering.

We at Medicare Nationwide normally see Plan G rates about 240-480 per year cheaper than that of Plan F. Medicare Part G or Plan G does not cover that for you but it. Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception.

Part F Medicare Supplement Plan F is only available to people who became eligible for Medicare before January 1 2020. However once the Part B deductible for Plan G is paid for you essentially have Plan F. Even though Plan G doesnt cover the Part B deductible some Plan F options could have high enough premiums that the cost difference between Plan F vs.

Medigap Plan G is now the most popular plan among beneficiaries new to Medicare The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. So the answer to the question depends on you. Plan G would be higher than the Part B deductible itself.

If you have Medicare Plan G youll need to pay the 203 Medicare Part B deductible first. Maximum total out-of-pocket costs with copays for the year typically in the range of 4000-6700year. Plans F and G.

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N How To Compare Medicarefaq Medicare Preventive Care How To Plan

Medicare Plan F Vs Plan G Vs Plan N How To Compare Medicarefaq Medicare Preventive Care How To Plan

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medigap Plan F Vs Plan G Helpadvisor Com

Medigap Plan F Vs Plan G Helpadvisor Com

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plans Seniorquote Insurance Services

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.