Before the American Rescue Plan was enacted a single individual in the continental US. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff.

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies.

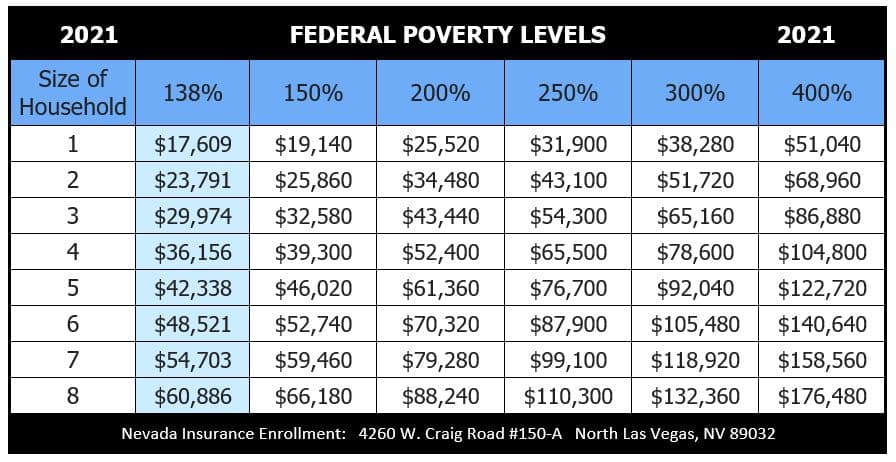

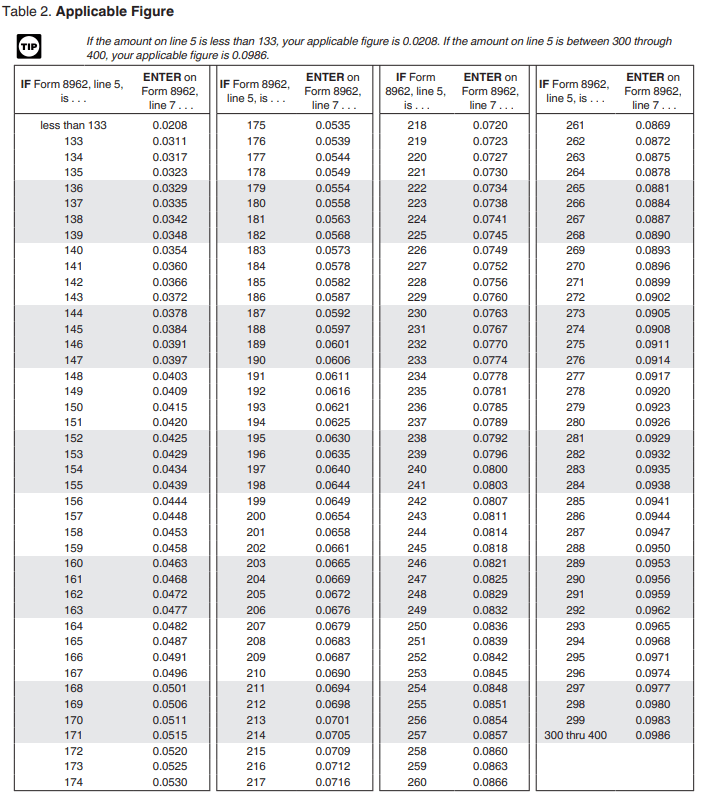

Obamacare income limits for 2020. In 2021 However your liability is capped between 100 and 400 of the FPL. Select your income range. 3 Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans.

Estimating your expected household income for 2021. So based on 2020 poverty thresholds if you had claimed upfront health subsidies but went on to earn more than 51040 as a single earner or 104800 for a family of four even if you earned. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

If you are a single person making more than 400 of that amount 51040 you will likely not qualify for subsidies. Fortunately subsidy clawback limits apply in 2022 if you got extra subsidies. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

For a family of four the income limit was 104800. If you fall within this income range and you cant get Medicaid from your state heres what happens. Specifics may differ by state.

Dont include qualified distributions from a designated Roth account as income. What is the maximum income for ObamaCare. Retirement or pension Income.

Your income is no more than 400 of the federal poverty level According to the Federal Register the 2020 poverty level for an individual is 12760. But for 2021 and 2022 this limit does not apply. Previous 2021 Total Household Income for Maximum ACA Subsidy.

Here are the limits for 2018 plans for individuals and families. The basic math is 4X the Federal Poverty Level FPL as determined by the government. This cap ranges from 650 to 2700 based on income.

For single filers the threshold is just 200000. For instance people who make up to 150 of the federal poverty level or 19320 for an individual and 39750 for a family of four will no longer be required to pay anything toward their. Another example of the marriage penalty at work in our tax code.

If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. I Make Less Than 16753 or 34638 for a Family of Four - If your income is 138 or less of the federal poverty level you qualify for expanded Medicaid. For a family of four that number equaled 104800 a year.

But do not include Supplemental Security Income SSI. Was ineligible for subsidies in 2021 if their income exceeded 51040. Include most IRA and 401k withdrawals.

See details on retirement income in the instructions for IRS publication 1040. But many states state didnt expand Medicaid. 6 That means Obamacare costs you zero.

39300 for a family of four enrollees under the old law were. Each year the ACA sets new limits for out-of-pocket maximums and deductibles. 1 For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies.

At 150 of the 2020 poverty level used for 2021 plans 19140 for a single person. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. So you should still be well within the subsidy-eligible range even if you end up getting extra unemployment benefits.

See Stay Off the ACA Premium Subsidy Cliff. In 2020 for example thats a family of four with an income between 26200 and 104800 a year. Out-of-Pocket Maximums and Deductible Limits For 2020.

You may qualify for free or low-cost care for Medicaid based on income and family size if you make 138 of the poverty level or for example 17609 individual or 36156 for a family of four in 2020. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. You can probably start with your households adjusted gross income and update it for expected changes.

For 2021 those making between 12760-51040 as an individual or 26200-104800. Premium subsidies are available for a family of five in 2020 with a total annual income up to nearly 121000 and with an income of nearly 123000 in 2021. How the Obamacare Medicare Tax works There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross income AGI.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.