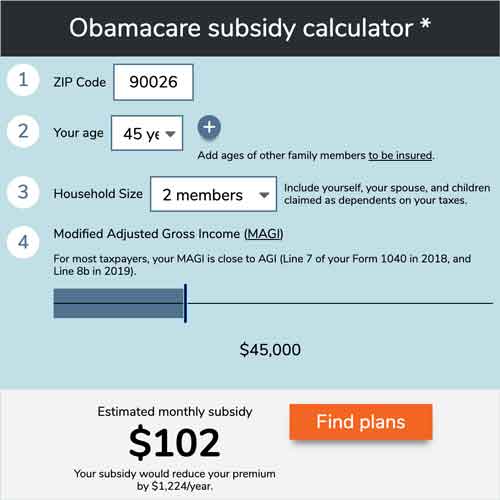

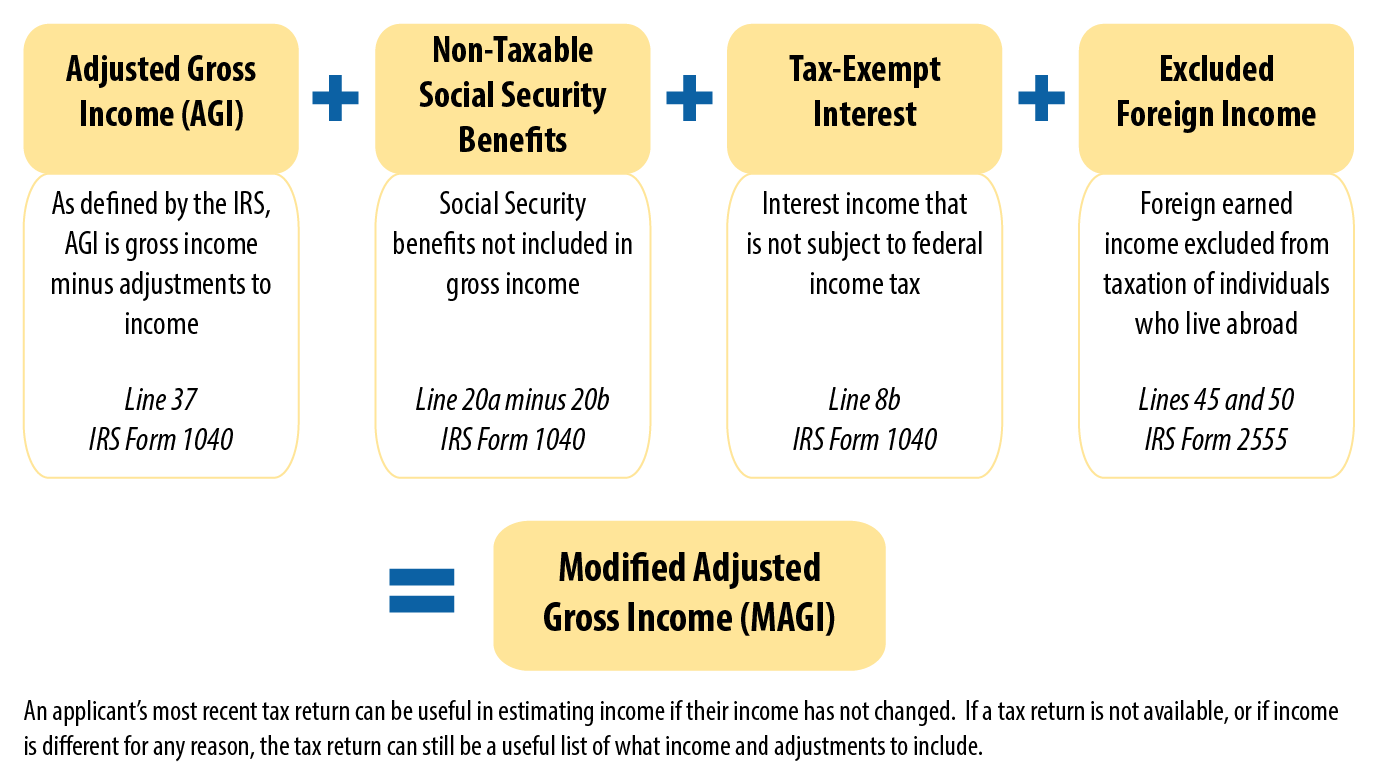

About the 2020 2021 Obamacare Subsidy Calculator. The ACA uses the term modified adjusted gross income MAGI to describe the way income would be calculated for premium subsidy eligibility and thats accurate terminologythe calculation is a modification of adjusted gross income.

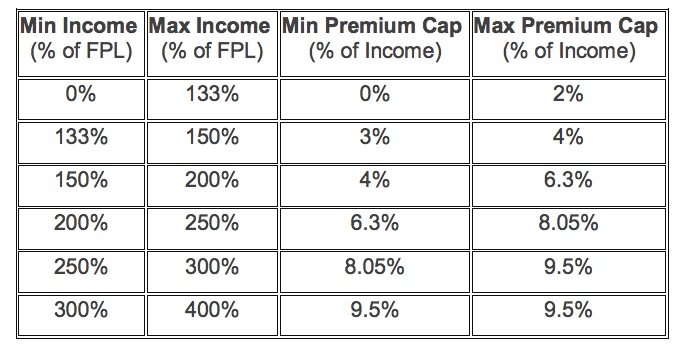

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

See another way to estimate your income.

Affordable care act income calculation. The types of assistance offered under the Affordable Care Act are. Formula W-2 wages calendar months offered coverage months of employment 20000 58 12500 The W-2 wages used in the affordability calculation are adjusted to 12500 for the 5 months Joe is offered coverage. Under the Affordable Care Act eligibility for income-based Medicaid1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI.

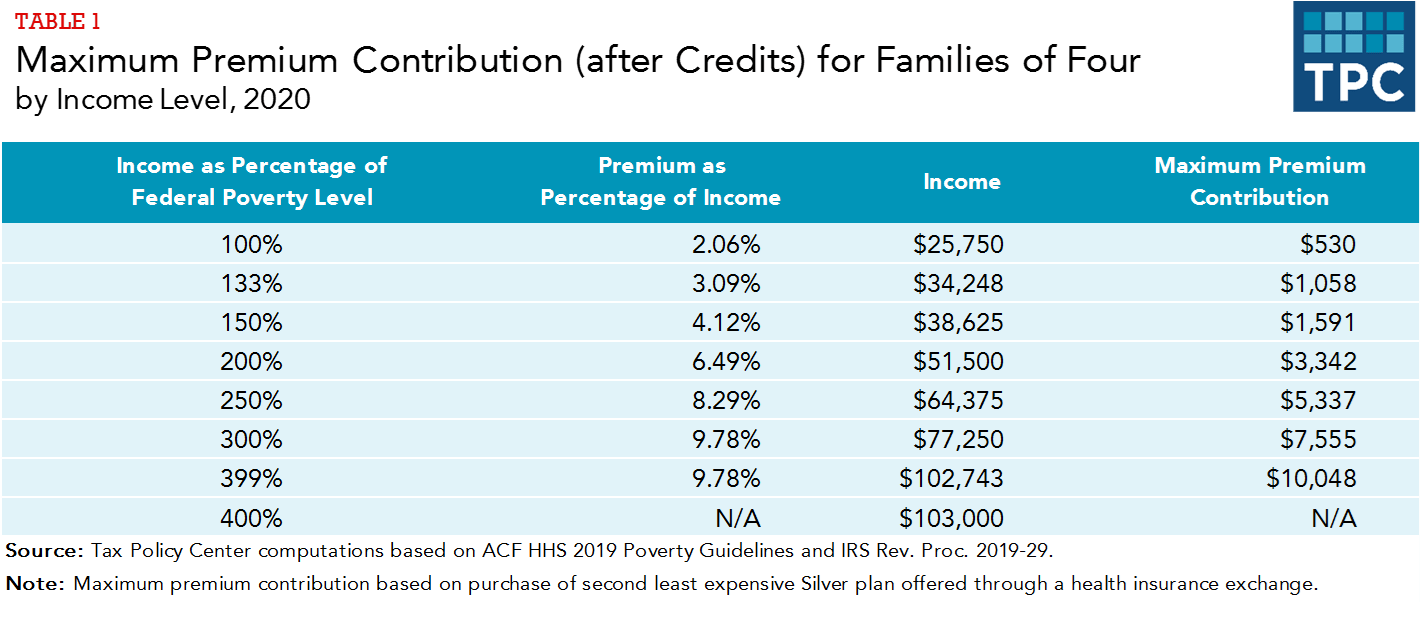

To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. However if you are a victim of domestic violence or spousal abandonment you may.

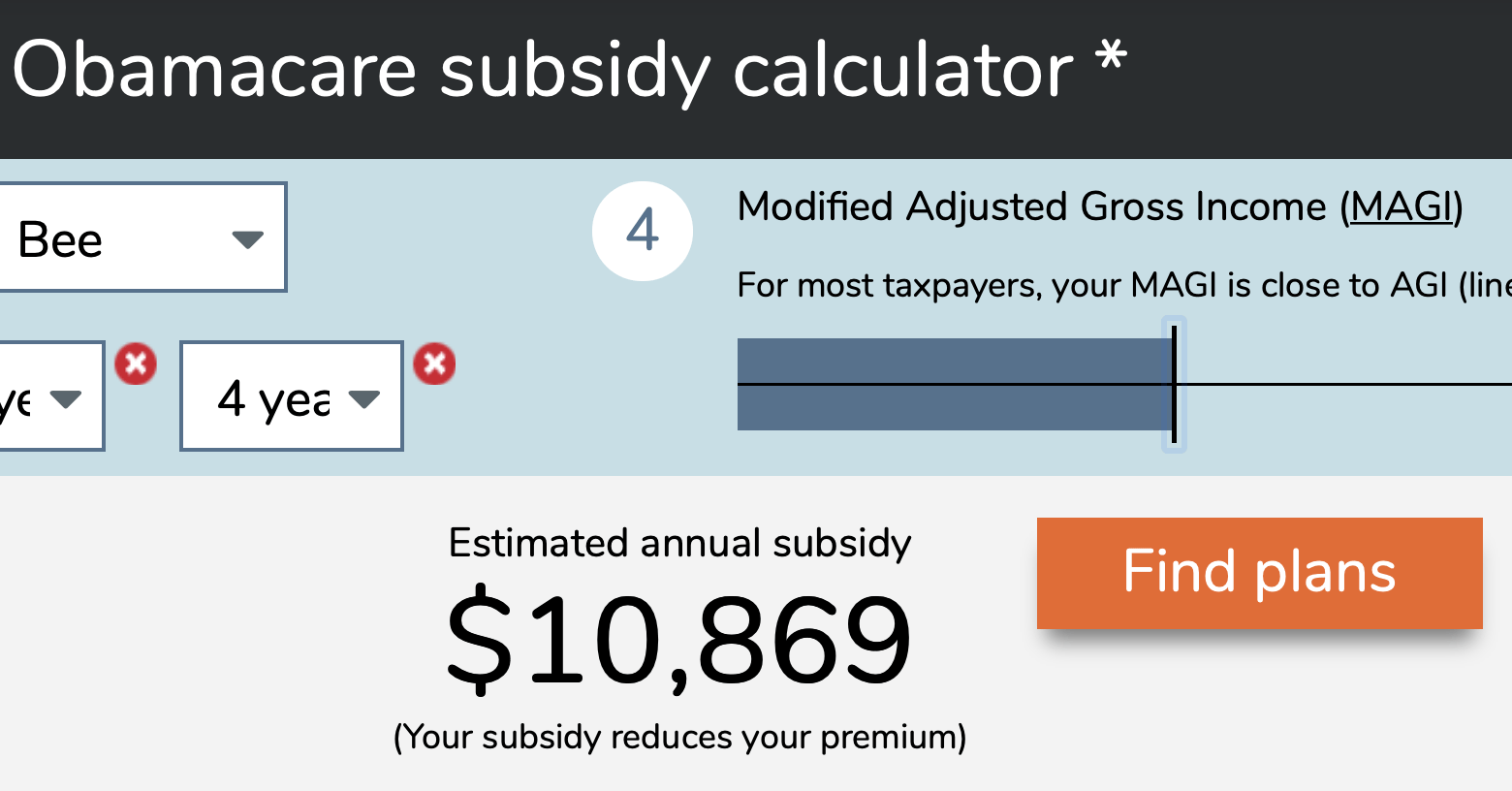

Calculation 30000 x 978 12 For employees hired at a later time during the year affordability is based on their annual wages and how many months of coverage you offered them for the year. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

Say you are a single person and you earn 47520 nearly 400 of the poverty level. How to make an estimate of your expected income. Youll find your AGI on line 7 of IRS Form 1040.

Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income. Instead of an income cap the new rules allow for premium subsidies if the cost of the benchmark plan would otherwise exceed 85 of their ACA-specific modified adjusted gross income. This gives the maximum amount you can charge that employee this year for qualifying coverage.

As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions. Premiums displayed in the calculators results are based on actual exchange premiums in 2018 dollars. The Affordable Care Act definition of MAGI under the Internal Revenue Code 2 and federal Medicaid regulations 3 is shown below.

And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff. Add the following kinds of income if you have any to your AGI. The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health and Human Services HHS and the.

So if the plan is 5000 your subsidy is 35244. Dont have recent AGI. Find out how to estimate your expected income Healthcaregov.

Under the Affordable Care Act eligibility for income-based Medicaid 1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI. The Affordable Care Act definition of MAGI under the Internal Revenue Code2 and federal Medicaid regulations3 is shown below. Your subsidy is the cost of the plan minus 464746.

Coverage is affordable if the employee does not pay more than 24450 per month for the lowest-priced self-only plan. Start with your households adjusted gross income AGI from your most recent federal income tax return. 20 rows You will be asked about your current monthly income and then about your yearly.

On the lower end subsidies are available in most states if your income is at least 139 of the poverty level with Medicaid available below that. Your household income is at least 100 and no more than 400 of the federal poverty line for your family size If you are married you file a joint return with your spouse. For most individuals who apply for health.

Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan. To calculate ACA affordability based on employee compensation multiply an employees monthly salary by 978. The Health Insurance Marketplace Calculator is based on the Affordable Care Act ACA as signed into law in 2010 and subsequent regulations issued by Health and Human Services HHS and the Internal Revenue Service IRS.

Our calculation is based upon the federal poverty level data provided by the. For hourly employees assuming 130 work hours in.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

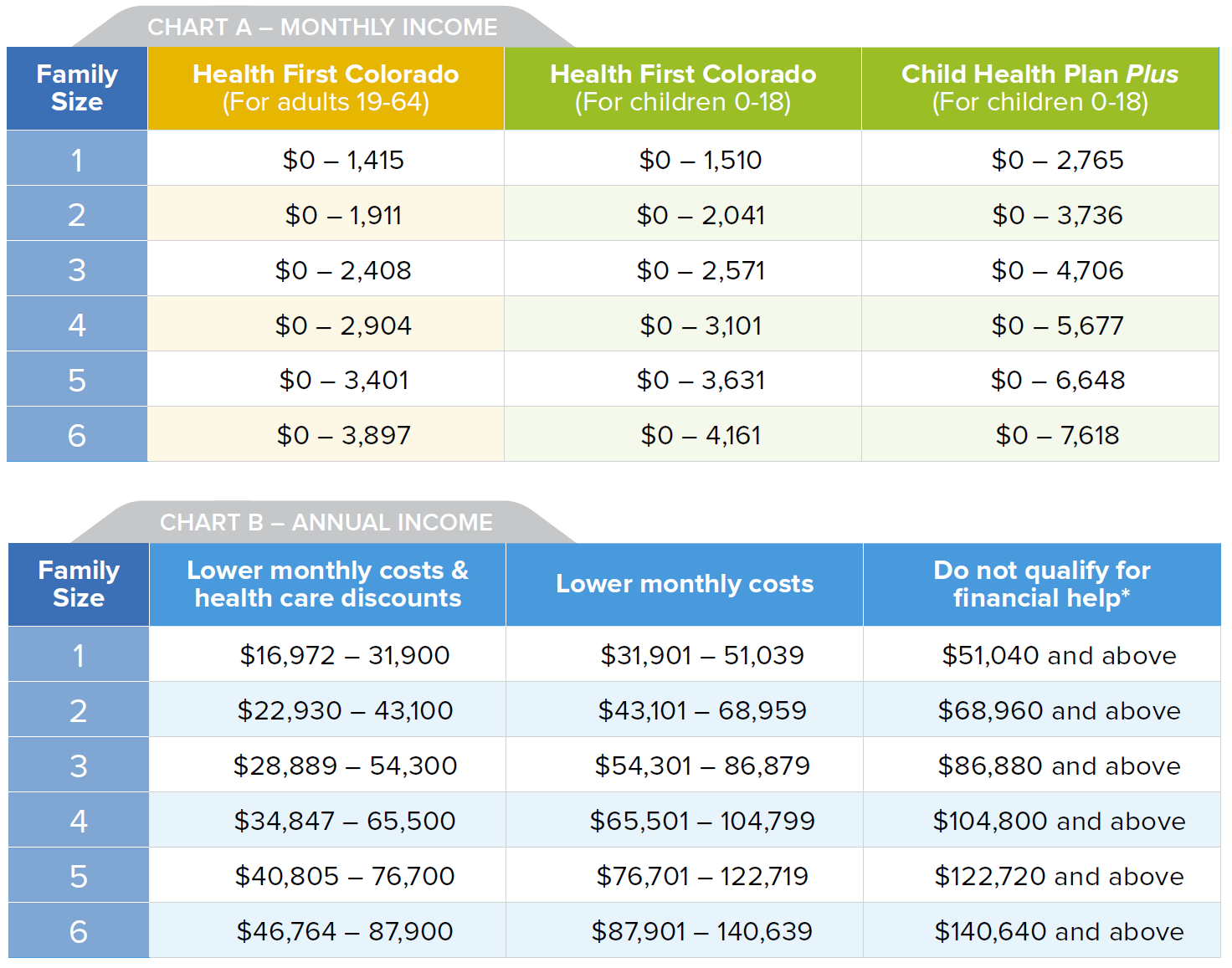

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Modified Adjusted Gross Income Magi

Modified Adjusted Gross Income Magi

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Household Income Subsidy Eligibility Under Obamacare

Household Income Subsidy Eligibility Under Obamacare

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.