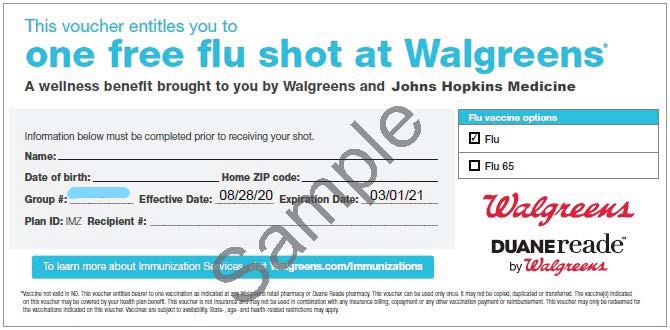

Score Walgreens offers free flu shots through most health insurance policies as well. At Walgreens the flut shot costs 30 to 55 depending on the form of vaccine.

Youll even get a coupon for 5 off a 25 purchase when you get the flu shot in most states according to the rep.

Walgreens flu shot insurance. Give a Shot. Whether youre insured or not there are ways to make your vaccines affordable. And if you dont have health insurance or any government coverage you can pay out of pocket for the flu.

Flu shots can range from 0 yes free to 50 or more depending on where you get your shot and what kind of vaccine you receive. This is particularly important during the pandemic in anticipation of heightened consumer awareness and desire to be protected this flu. Expect to pay 4099 at CVS and CVS Pharmacy locations inside Target and Walgreens.

To date the Walgreens Get a Shot. Your flu shot is covered at 0 out-of-pocket 1. Getting a flu shot is a simple way you can help yourself and others be healthier this flu season.

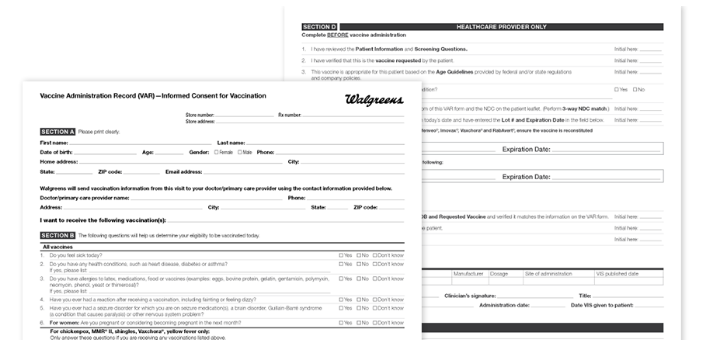

Without insurance or outside your insurance network youll probably pay the list price. You can get a flu shot. The CDC recommends everyone over the age of 6 months receives a flu shotWalgreens pharmacies can provide flu immunizations for anyone over the age of 4 and age restrictions vary based on state.

You can get vaccinated during pharmacy and clinic hours every day without an. Program has helped provide 50 million lifesaving vaccines to children around the world. If your UnitedHealthcare health plan is provided through your employer.

Coronavirus Information and Support. Get your flu shot today. At CVS and Walgreens for example the cost of the flu shot is about 40 for people.

Walgreens and CVS announced they will have the vaccine at their pharmacies starting this week and the CDC has ordered an extra 93 million doses to distribute to uninsured adults this year. The CDC recommends everyone over the age of 6 months receives a flu shotWalgreens pharmacies can provide flu immunizations for anyone over the age of 4 and age restrictions. Your school your employer and your GP will likely also have a serious flu-shot.

Flu shots. Find Care near you. If you still need convincing.

At Walgreens the cost for a flu shot at for people without insurance is 2999 and the price of FluMist Intranasal Spray is 3490. Will cover shots for members nationwide. Who can get a flu shot.

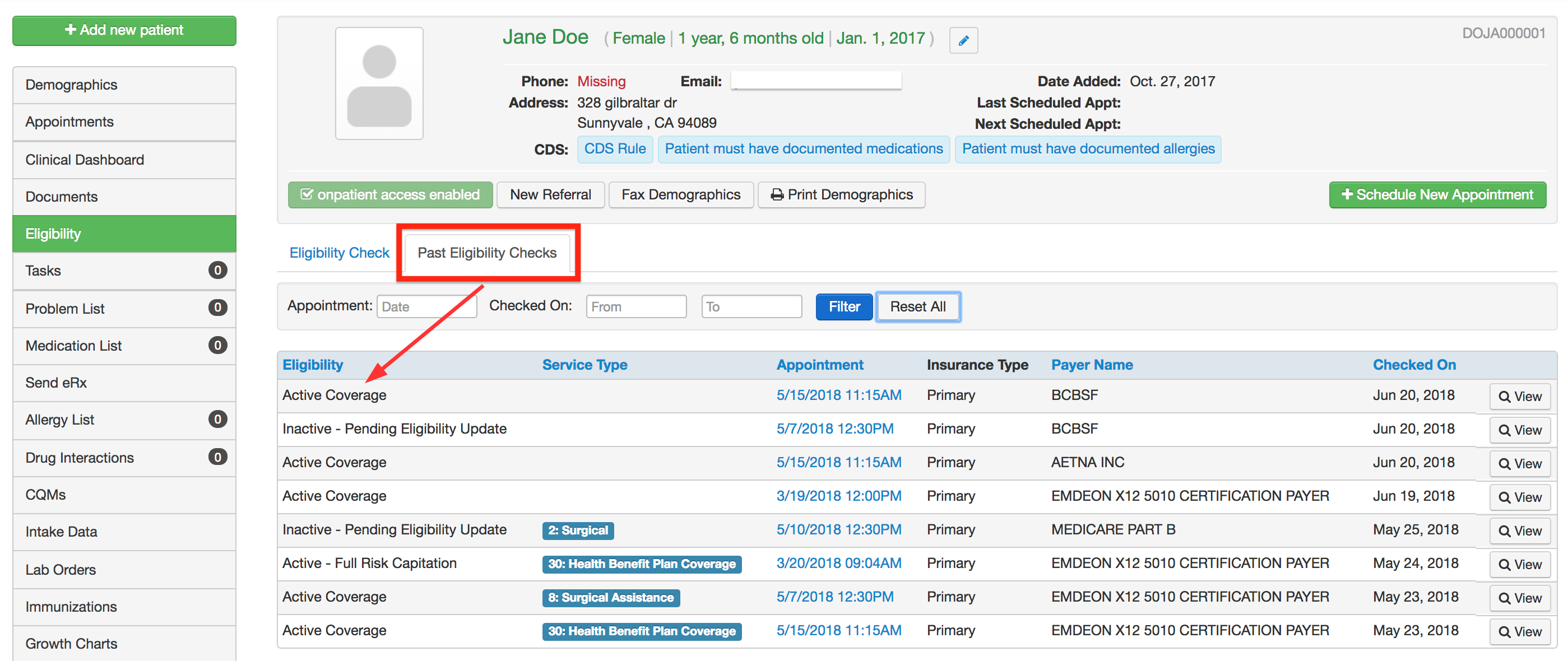

Medicare Part B covers the flu shots and Walgreen announced that health insurers UnitedHealth Group Inc. The flu shot is available for free with most insurance as well as with Medicare Part B and Medicaid in certain states. For every flu shot or other vaccination administered Walgreens will make a donation to the UN Foundation up to 26 million.

You can also get a walk-in flu shot at Walgreens and have it covered by your insurance. Program to provide lifesaving vaccines to children around the world. Walgreens has a long history of stepping up to support our communities and providing flu shots is another way were providing accessible care for our patients and protecting communities from vaccine-preventable diseases.

Flu shots at Walgreens - Schedule a flu shot or walk in today Walgreens. Walgreens doesnt offer discounts but they do have the Give-a-Shot Get-a-Shot program where your vaccine purchase helps fund vaccinations for. The price will vary based on which provider you choose.

Although a shot in the arm is the most common you have options including a nasal spray. You can pay out-of-pocket for a flu shot at loads of big-box pharmacies that probably have a location near you. If youre on private insurance through your family employer or school the CDC says that most plans provide a flu vaccine without a co-pay even if you havent reached your deductible.

Publix offers a 10 gift card with your flu shot. Here are some things to know to make sure you dont overpay.