Federal Tax ID for a Business. The Employer Identification Number EIN is a unique nine-digit number assigned by the Internal Revenue Service IRS to business entities operating in.

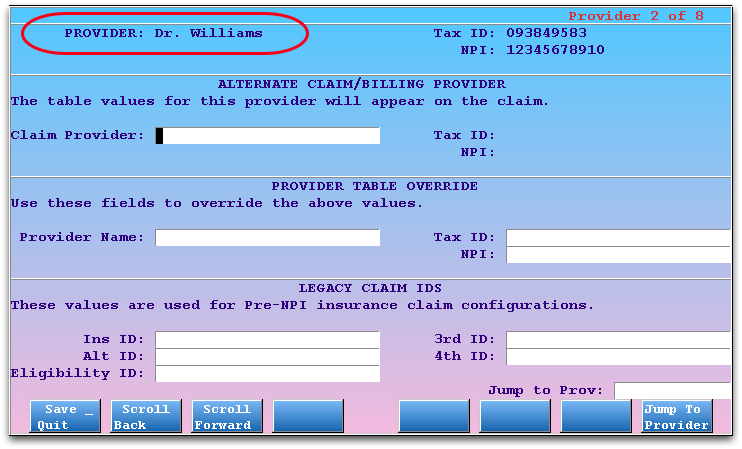

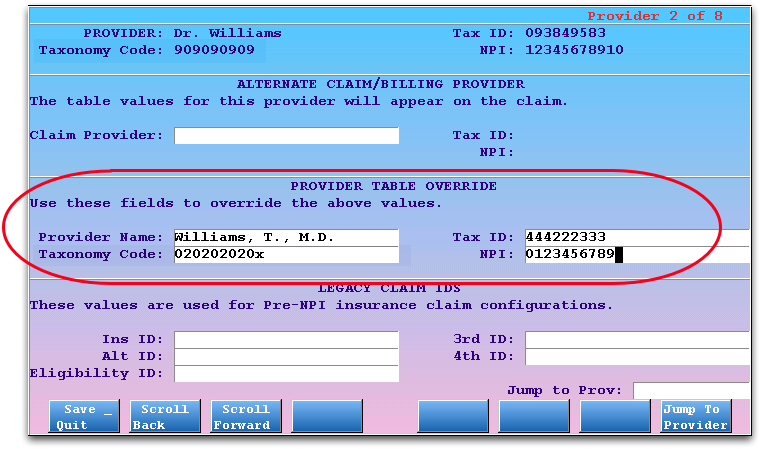

Override Provider Identifiers For An Entire Insurance Batch Pcc Learn

Override Provider Identifiers For An Entire Insurance Batch Pcc Learn

To verify an Employer Identification Number the IRS recommends calling their Business and Specialty Tax Line at 800-829-4933.

Dr tax id number. A federal tax ID lookup is a method of searching for a businesss information using their tax identification number FTIN or employer identification number EIN. Obtain a new EIN If you have obtained an EIN Tax ID Number from the IRS in the past but do not remember it you can call the IRS EIN Department directly at 1-800-829-4933 to speak with an IRS EIN representative. Legal Info Disclaimer.

The NPI has replaced the UPIN Unique Provider Identification Number as the required. If you are in a practice group and have multiple tax IDs and billing NPI numbers to bill from you will have to set up an office attaching the numbers you would like to use typically this will be an organizational NPI number. Tax est une suite de logiciel destinée à létablissement des déclarations dimpôt décomptes de TVA planifications fiscales et de prévoyance ainsi que des applications de formulaire.

2 Enter your Criteria. Your Employer Identification Number EIN is your federal tax ID. You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits.

Understanding the Tax Identification Number TIN A tax identification number is a unique set of numbers that identifies individuals corporations and other entities such as nonprofit. Please use the following article to see where to enter in this information. Every person who is registered in Germany or is liable to pay taxes here automatically receives an 11-digit tax ID which is used for all tax purposes and never changes not even when you move or get married.

It is a 9-digit number beginning with the number 9 formatted like an SSN NNN-NN-NNNN. How to Find a Doctors Federal Tax ID Number Ask the Doctors Office. Employer ID Numbers EINTax ID are located on the tax return forms you file every year.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Adding an NPI and Tax ID to an office location. Tax est destiné aux conseillers fiscaux particuliers et les administrations.

Its free to apply for an EIN and you should do it right after you register your business. Generally businesses need an EIN. An employer can accept an ITIN from an individual for tax purposes for filling out a W-4 form at hiring time for example.

Employees and former employees need the TIN also referred to as the Employer Identification Number. 5 Click on the provider name for additional information. You may apply for an EIN in various ways and now you may apply online.

The NPI Final Rule issued in Jan 2004 has adopted the NPI number as that standard for healthcare provider identification. NPI Lookup - Search the NPI Registry. The SSA will issue social security numbers SSN and the IRS is responsible for issuing all other taxpayer identification numbers.

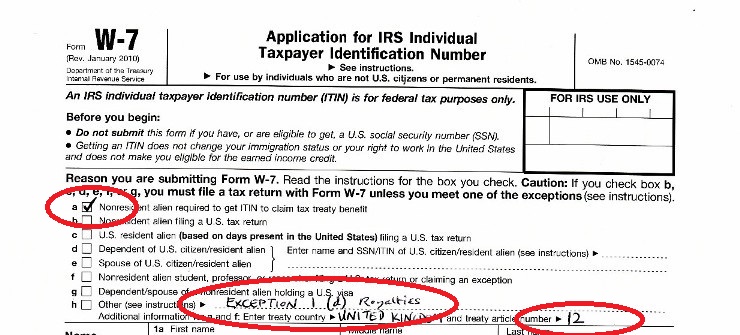

Network Status Provider NameTIN Search. Individual Taxpayer ID Number ITIN An ITIN is for people who arent eligible to receive a Social Security Number or Employer ID Number. 1 Choose a Search Type.

An ITIN or Individual Taxpayer Identification Number is a tax processing number only available for certain nonresident and resident aliens their spouses and dependents who cannot get a Social Security Number SSN. Since 1996 HIPAA requires the adoption of a standard unique number for healthcare providers. There is no reason a doctor would withhold TIN information if there is a viable business need.

In either case youre looking for a nine-digit number with a dash after the second digit. If you need to find the federal tax ID number for your employer also called their Employer Identification Number or EIN check your W-2 form under section b If you havent. Govt Assist LLC only works on behalf of its clients and is in no way affiliated with any governmental or regulatory agency including the IRS.

3 Select the State in which you would like to search. A Free Guide coming soon that will help you get a Tax Id Number in any US City County or State is written by an attorney who has helped thousands of small business owners to set up their businesses. Look at Past.

When you are filing your tax return or filling out a personal information form for a new job you should always have your tax ID number Steuer-ID on hand. Your taxpayer identification number will either have been issued by the Social Security Administration SSA or by the IRS this depends on what kind of TIN is required for your tax return see above. Govt Assist LLC acts as a Third Party Designee as described in the instructions to Form SS-4 to help clients obtain Federal Tax ID Numbers from the Internal Revenue Service the IRS in a timely manner.

Tax identification numbers are issued to businesses by.

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Override Provider Identifiers For An Entire Insurance Batch Pcc Learn

Override Provider Identifiers For An Entire Insurance Batch Pcc Learn

How To Get A Tax Id Number Stumpblog

How To Get A Tax Id Number Stumpblog

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

Fillable Online Tax Id Number For Dr David Langer Form Fax Email Print Pdffiller

Fillable Online Tax Id Number For Dr David Langer Form Fax Email Print Pdffiller

Sales Tax Worksheet Sumnermuseumdc Org

Sales Tax Worksheet Sumnermuseumdc Org

Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

How I Got My Itin Us Individual Taxpayer Identification Number Nail Your Novel

How I Got My Itin Us Individual Taxpayer Identification Number Nail Your Novel

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.