The average effective after exemptions property tax rate in California is 079 compared with a national average of 119. Under this circumstance you will receive a negative supplemental tax bill and a regular supplemental tax bill.

Understanding California S Property Taxes

Understanding California S Property Taxes

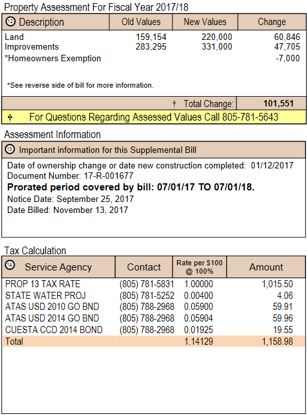

A change in ownership or a completion of new construction that occurs between January 1 and May 31.

California supplemental tax. Please refer to page 13 for additional information on PIT withholding or refer to the PIT withholding schedules available on page 17. A decrease in value will result in a negative supplemental tax. 2 If the bill is mailed within the months of November through June the first installment shall become delinquent on.

In California you supplemental tax bill only comes into play when the property changes ownership or there is an addition or large remodel that adds value and square footagespecial features to the home. Article XIIIA requires the reassessment of property for tax purposes whenever a change of ownership or completion of construction occurs. Member companies of the California Land Title Association are dedicated to facilitating the transfer of real property throughout California.

California State law requires the reassessment of property as of the first day of the month following an ownership change or the completion of new construction. The obligation for this tax is entirely that of the property ---The Title Consumer is published by the California Land Title Association. How does SB 95s offset work.

Supplemental assessments are determined in accordance with Article XIIIA of the California Constitution. You could start with the. Tax to be withheld from the supplemental wages or Withhold at a fat rate without allowing for any withholding exemptions claimed on the employees withholding allowance certifcate.

For other types of supplemental. If you have any concerns about local taxes I would recommend contacting a local tax authority. On July 1 1983 California State law was changed to require the reassessment of property following a change of ownership or the completion of new construction.

California Personal Income Tax PIT Withholding California PIT withholding is based on the amount of wages paid the number of withholding allowances claimed by the employee and the payroll period. Watch our supplemental tax bill video above for an example. SB 95 does not require employers to pay more than 511 per day and 5110 total per covered employee for COVID-19 supplemental paid sick leave.

Those identified as secured are liens on real property those identified as unsecured are billed to the named assessee and if unpaid will result in the recordation of a personal tax lien. Due dates for supplemental tax bills depend on when the bill is mailed. For stock options and bonuses that were paid on or after November 1 2009 the fat rate is 1023 percent.

No unlike your ordinary annual taxes the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the tax year on June 30. Supplemental Property Bill - Supplemental Property Bill to the Annual Secured Property Tax Bill and both must be paid by the date shown on the bill. Exempt employees must be paid the same rate as the employer pays for other forms of paid leave.

To calculate your supplemental tax bill subtract your homes old value from the new market value based on the reassessment. The SUPPLEMENTAL tax bill is IN ADDITION to the regular property tax bill and any other property taxes due on the property. Property taxes are collected by the County but governed by California state law.

Finally the 1 tax rate is applied to that amount to get your supplemental tax total. Reassessments downward due to a change in ownership or completion of construction result in a negative supplemental assessment. All supplemental tax bills are in addition to the annual tax bill.

31 Zeilen Employers may optionally use a federal flat rate of income tax federal withholding of 22. You are taxed on that difference. Simply type in the propertys zip code and select the assessed home value.

Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. Supplemental tax bills are identified as either secured or unsecured. The California Property Tax Calculator provides a free online calculation of ones property tax.

California doubles all bracket widths for married couples filing jointly except the 1000000 bracket. Your first supplemental assessment will result in a negative assessed value of 10000 and the tax refund would be 412ths of a 100 or. If you dont pay.

The first supplemental tax bill will be for the difference between your purchase price of 240000 and the previous owners September 2007 purchase price of 250000. This reassessment may result in one or more supplemental tax bills being mailed to the assessed owner in addition to the annual property tax bill. Next we prorate what you owe based on the number of months left in the fiscal year.

Understanding Supplemental Property Taxes in California 1 If the bill is mailed within the months of July through October the first installment shall become delinquent on. Revenue and Taxation Code Section 18663. The supplemental withholding rates continue at 66 and 1023 for stock options and bonus payments.

2021 Publication DE 44 California Employers Guide New California employees are required to use state Form DE 4 in addition to federal Form W-4.

Https Www Sdttc Com Content Dam Ttc Docs New Homeowners Property Tax Guide Pdf

![]() Ca Supplemental Tax Bill The Ugly Truth Video

Ca Supplemental Tax Bill The Ugly Truth Video

Spt Notice Of Your Supplemental Property Tax Bill C A R Business Products

Spt Notice Of Your Supplemental Property Tax Bill C A R Business Products

San Diego Property And Supplemental Taxes What You Sh

San Diego Property And Supplemental Taxes What You Sh

Do I Have To Pay Supplemental Property Tax Every Year Property Walls

Ventura County Assessor Supplemental Assessments

Ventura County Assessor Supplemental Assessments

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Placer County Ca

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.