Abnehmen mit WW Weight Watchers WW Deutschland. Digital Subscriptions for 150 Per Week at Weight Watchers.

Weight Watchers Coupon Online Free Trial By Coupondeals Com Au In May 2021

Weight Watchers Coupon Online Free Trial By Coupondeals Com Au In May 2021

55 off Select myWW Membership Plans Free Best of WW Cookbook.

Weight watchers joining deals. Join Now Pay Later. Join WW Canada Unlimited Workshops Digital Plans starting at 615Week. You might also be able to use Weight Watchers coupons if youve had a Weight Watchers account before but its been a.

For 150 Per Week Find Digital Plans at Weight Watchers. Join WW Today for Just 10Month. Join WW and youll get access to lots of exciting features including exclusive mindset content through Headspace and incredible products and experiences through our rewards program WellnessWins.

How much does it cost to join Weight Watchers 2020. Join for Free Save 33 on 3 months of Meetings with OnlinePlus. Get 58 Off Plus Free Kitchen Essentials Kit with Select Plan Purchase.

First Months Membership is Free at Weight Watchers - Save 40. Verified 17 hours ago Used 29 Times in the Last Week Last Day. Combine effective in-person meetings with 247 access to online tools and apps with a membership to WW Canada Unlimited Workshops.

A waived registration fee. Currently it is Free to Join WW Free Month a Free Kickstart Kit. Join today and save on select purchases of auto-renew myWW plans formerly Weight Watchers.

WW Gutschein bis 100. When you sign up for the plan you get. See how the 1 weight loss program can help you lose weight and create healthy habits.

Get a Free Cookbook on Orders Over 50 with Weight Watchers Promo Code. Get Your 1ST 3 Months Free At Weight Watchers. Virtual Workshops Starting at Less than 10Week at Weight Watchers.

Start a virtual workshop TODAY for as low as 692week. When you first join Weight Watchers you might be able to get a good Weight Watchers coupon for your very first time signing up. With purchase of select plans in participating areas only.

Digital Membership for 1495 Per Month at Weight Watchers. Join WW Weight Watchers today. Verified 2 days ago Used 20 Times in the Last Month.

Try The New WW FreeStyle Program With 200 ZeroPoint Foods. However these promotions tend to change every Tuesday. WW Shop-Gutschein bis 100 sichern.

Weekly guidance and motivation from trained coaches. Simply use our calculator. 2095 for every month after.

Find out more about our weight loss plans. Looking to join Weight Watchers this Summer. While this isnt the official Weight Watchers calculator its so close you shouldnt.

Every Membership Helps You Build 39 Used And Maintain Healthy Habits At Weight Watchers. Up to 30 Discount on Monthly Plans at Weight Watchers. First Month is Free at Weight Watchers.

Weight Watchers is reimagined. That might include special starter kits a reduced price for joining and even better pricing when you buy more time at once. The plan will auto-renew at the end of the applicable pay period.

Start your wellness journey today. Free first month after joining. They arent sponsored by Weight Watchers and might be slightly off but these are extremely close to their program and should work almost the same.

Whether youd prefer meetings or an online journey find a plan that fits your life. Up to 30 Off Selected Monthly Plans at Weight Watchers. Enjoy Snack Bars Starting at 8.

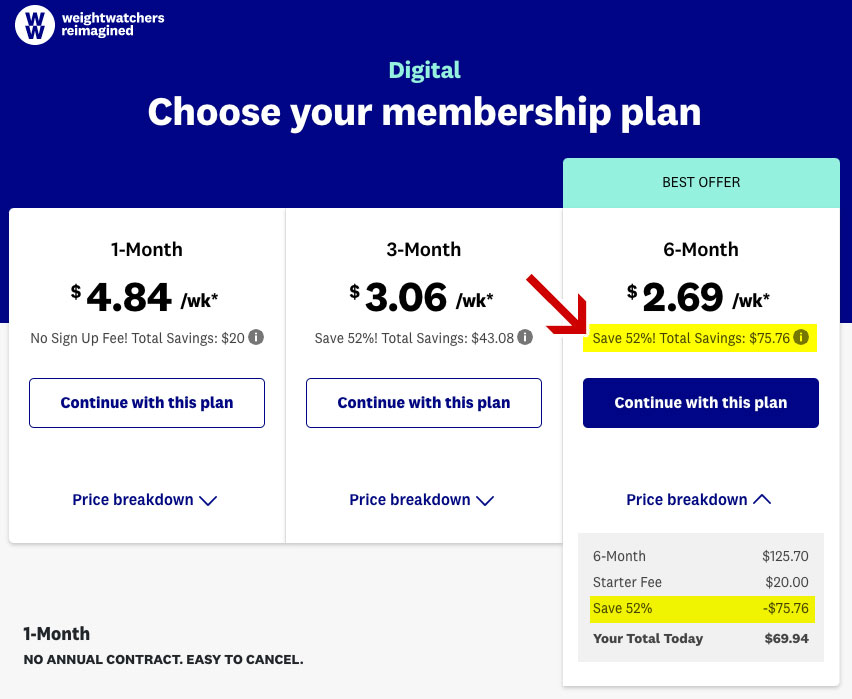

Grab a Spring Saving at Weight Watchers. New members enjoy 55 off with the purchase one of Weight Watchers membership plans Choose from 3 different membership plans ranging from 3 6 or 12-month with Weight Watchers for 55 off. This offer is ending next week so dont miss out.

Take 70 Off the WW Digital Plan. Following the Weight Watchers program without actually joining is easier than you think. Digital Membership for 1495 Per Month at Weight Watchers.

Free Shipping Sitewide With Weight Watchers Discount Now. One of the best Weight Watchers deals is the Triple Play plan. Workshops Digital formerly Monthly Pass for 3822.

Blue Cross Blue Shield of Michigan or BCN members are eligible for. Join For Free On Selected Plans At Weight Watchers NZ.