You will only get a Form 1095-A showing the months you had health insurance coverage through the Health Connector. View or download each Form 1095-A.

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Use the secure online form at askDFAS.

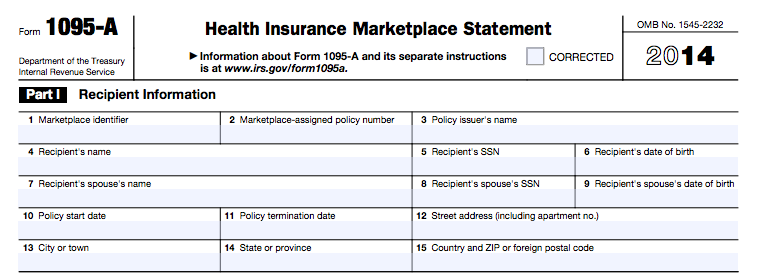

Request 1095 a. The California Form FTB 3895 California Health Insurance Marketplace Statement. The federal IRS Form 1095-A Health Insurance Marketplace Statement. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family members purchased health insurance through the Marketplace for some or all of the year.

1095 Requests Your form will be sent within 30 days of the date your request is received. The form 1095-A is used to report health insurance purchased through Healthcargov or your states Health Insurance agency The form 1095-A is mailed to taxpayers on January 31 of the year. Call the main number on the back of your insurance card.

You do not need Form 1095A in order to file your taxes unless you purchased your health insurance through the marketplace. If you have questions please call SHIP at 212-228-9060. Use the California Franchise Tax Board forms finder to view this form.

Select your 2014 application be sure youre not choosing your 2015 coverage application Select Tax forms from the menu on the left. You wont need information about your dental coverage when you file your taxes. This information is only for the state of Massachusetts.

If you dont have your user name and password. Log in to Marketplace account. The eFile tax app will automatically select the.

Heres how to find IRS Form 1095-A on the Massachusetts Health Connector website. During tax season Covered California sends two forms to members. You may retrieve a copy of Form 1095-B on your myPay account or if you would like to request a copy of your Form 1095-B please submit your request to askDFAS or the address below and allow 30 days to process your request.

Find your Form 1095-A online. If you need another copy of your 1095-A without any changes to it you can ask for a new copy online at. Request for 1095-A Correction BY MAIL 1095-A Processing Unit 1225 Eye St NW Suite 400 Washington DC 20005 IRS Form 1095-A Correction Request.

Other states that use healthcaregov will find their 1095-A. 1095A REQUEST FORM FREE Service. Call the Health Connector at 1-877-623-6765.

Complete our form below and youll have your 1095A in no time. Customer Care Center 325 Brooks Road Rome NY 13441. You can also find the information on your 1095 yourself or request another copy from the Marketplace.

You just need to answer yes to the question Did you all have health insurance coverage in 2018. Download all 1095-As shown on the screen. Under Your Existing Applications select your 2020 application not your 2021 application.

You may call your Health Insurance Marketplace to avail a copy or visit the website. Select Tax Forms from the menu on the left. We Email or Fax it within 1 to 24 hours tops.

1Fill 1095-A Request FormOpen the email and click the1095-A Request Form button to get started. If you cant find your insurance card use a search engine to reach your insurance company. If you have questions about Form 1095-A Minimum Essential Coverage PTC or the SLCSP table call Community Health Advocates Helpline at 1-888-614-5400.

Cant wait 30 - 45 days to have your 1095-A mailed out to you. First you must be able to log into your Mass Health Connector online account. The Form 1095-A is used to reconcile Advance Premium Tax Credits APTC and to claim Premium Tax Credits PTC on your federal tax returns.

Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. 2Complete DocuSign via emailNext youll receive a Docusign requesting an AOR to give us authorization to access your Marketplace account and retrieve your 1095-A form3Receive your 1095-A FormWe will deliver 1095-A to your email inbox. You can get all your MA Form 1095-As going back all years.

Please view the TurboTax FAQ below for more information. How to find your 1095-A online Log in to your HealthCaregov account. Even if youre no longer enrolled your insurance provider still has to promptly mail your Form 1095 if you request it.

Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an accurate tax return.

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Corrected Tax Form 1095 A Katz Insurance Group

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.