Received a Form 1095-A Health Insurance Marketplace Statement showing you received the benefit of advance payments of the premium tax credit. If there are errors contact.

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

The information shown on Form 1095-A helps you complete your federal individual income tax return.

Health insurance marketplace tax form. Here is what you need to know. Form 1095-A Health Insurance Marketplace Statement will include the information you need to report on your federal tax return in order to prove you have health insurance. If youre claiming a net Premium Tax Credit for 2020 including if you got an increase in premium tax credits when you reconciled and filed you still need to include Form 8962.

Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. But the IRS might change that for 2020 in the case of people who arent owed additional premium tax.

If anyone in your household had a Marketplace plan in 2020 you should have received Form 1095-A Health Insurance Marketplace Statement by mail from the Marketplace not the IRS. If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. To see the subsidy you qualify for based on your actual income find Form 8962 in the forms.

Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace. The Form 1095-A is used to reconcile Advance Premium Tax Credits APTC and to claim Premium Tax Credits PTC on your federal tax returns. Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file.

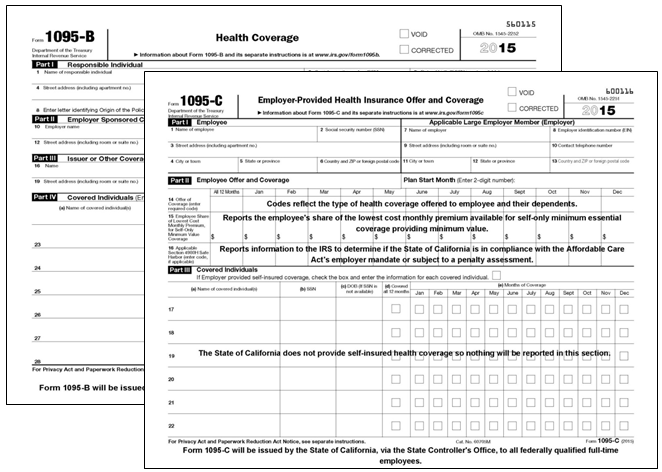

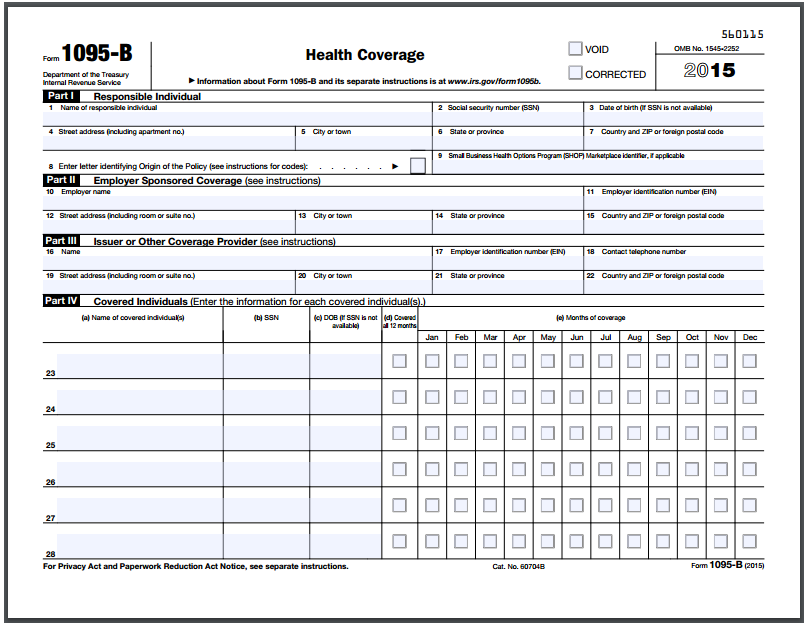

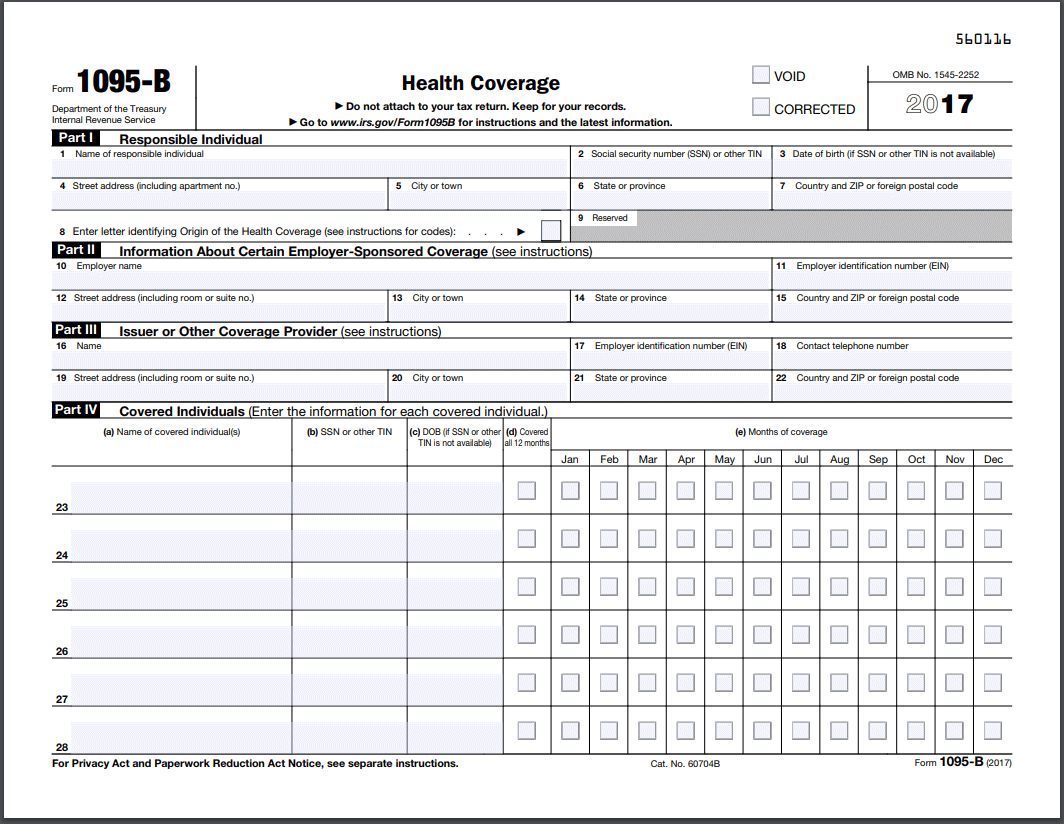

The individual forms are Form 1095-A A Health Insurance Marketplace Statement Form 1095-B Health Coverage and Form 1095-C Employer-Provided Health Insurance Offer and Coverage. Tax Forms and Filing During tax season Covered California sends two forms to members. If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return.

This computation lets taxpayers know whether they must increase their tax liability by all or a. The federal IRS Form 1095-A Health Insurance Marketplace Statement. Individuals can also use the health insurance information contained in the formforms to help them fill out their tax returns.

Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. Anyone who was enrolled in a Marketplace health insurance plan in 2020 will need to use Form 1095-A when filing their taxes. After confirming that its accurate be sure to store it with important tax information like W-2 forms and other records so that you can easily find it.

Form 8962 Premium Tax Credit. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family members purchased health insurance through the Marketplace for some or all of the year. If you purchased health care insurance through the Marketplace you should receive a Form 1095-A Health Insurance Marketplace Statement at the beginning of the tax filing season.

The eFile tax app will automatically. Form 1095-A will also include information you need for the premium tax credit a tax benefit to help pay for marketplace insurance. If your form is accurate youll use it to reconcile your premium tax credit.

You must have your 1095-A before you file. It may be available in your HealthCaregov account as soon as mid-January. You dont need to file an amended return or do anything else if you already filed your 2020 taxes and reported excess APTC or made an excess APTC repayment.

If she got a Form 1095-A that shows a premium tax credit was paid on her behalf the normal rules say that she has to file Form 8962 to reconcile that tax credit. Dont file your taxes until you have an accurate 1095-A. How to get a 1095-A form You should have received Form 1095-A also called a Health Insurance Marketplace Statement by mail from the Marketplace.

Health Insurance Marketplaces furnish Form 1095-A to. For 2020 however nobody has to repay excess premium subsidies. The California Form FTB 3895 California Health Insurance Marketplace Statement.

It shows we are getting a 2633 tax deduction for health insurance. For Forms 1095-A with APTC read the cover letter sent with these forms. Must file a tax return and reconcile the advance payments with the amount of the premium tax credit allowed on your return.

The resources on this page provide information about your Form 1095-A from NY State of Health. But the IRS is still sorting out the details on this so were not yet sure how theyll handle it. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace.

If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. Premium tax credits are sometimes known as. Among other things Form 1095-A.

If Form 1095-A shows coverage for you and everyone in your family for the entire year check the full-year coverage box on your tax return. Its tax season.

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Corrected Tax Form 1095 A Katz Insurance Group

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Tax Filing With The Affordable Care Act Katz Insurance Group

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.