Individual andor Family Plan Type. These companies are Independent Licensees of the Blue Cross and Blue Shield Association.

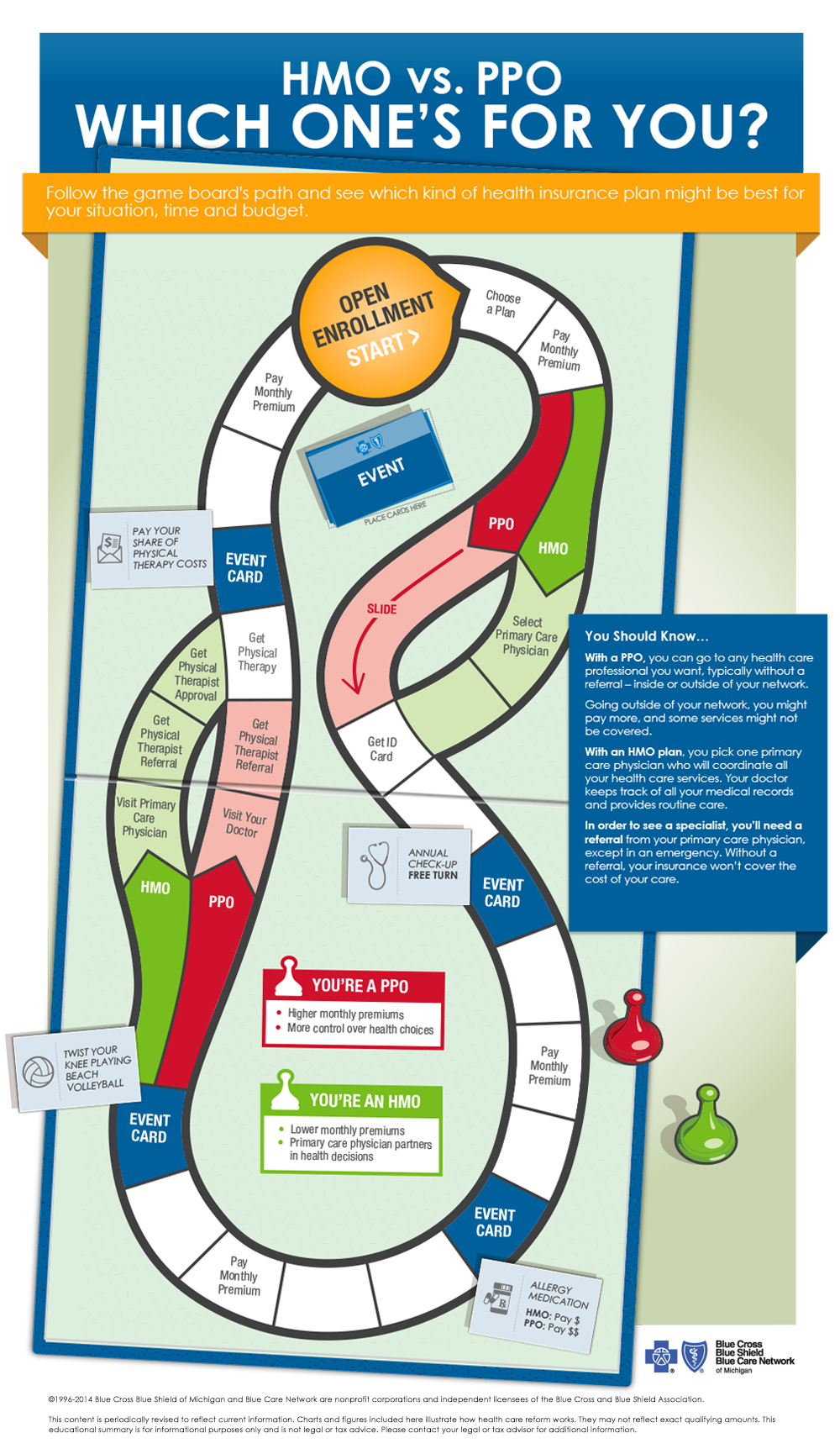

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

It is an HMO plan that does not require a referral if you visit a doctor within the Advocate BlueCare Direct Network.

Blue care hmo. How to get care when traveling within Michigan and the US. Call 911 or go to the nearest hospital or emergency care center. We have made no changes to this formulary since December 1 2020.

There are 3 Blue FocusCare Plans. For more recent information or other questions please contact BlueCare Plus Member Service at. Out-of-network care is only covered for emergency or urgent care.

Your PCP becomes your home for. Richter Jessica R DO Gender. Just make sure you have your Blue Care Network.

BlueCare Direct HMO KIT3-OOC-PPO 1209 Anthem Blue Cross and Blue Shield is the trade name for Anthem Health Plans Inc. Emergency care is always covered within the US. For emergency care or accidental injuries.

Unlike traditional HMOs with Duke Select Duke Basic and Blue Care you do not. A Health Maintenance Organization is a network of doctors hospitals and other health care providers who agree to provide care at a reduced rate. MyBlue myBlue is a new type of HMO plan that includes a narrow network of primary care physicians.

HMO The Summary of Benefits and Coverage SBC document will help you choose a health plan. Information about the cost of this plan called the premium will be provided. Florida Blue Care HMOs are available in all of the metal levels and this includes Gold Silver Bronze and.

These are some features of the Florida Blue Care Select HMO plan. BlueCare Plus HMO SNPSM 2020 Formulary List of Covered Drugs BlueCare Plus HMO SNP SM. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association.

If you arent clear about any of the underlined terms used in this form see the. ANTHEM is a registered trademark. Blue Care Network HMO.

Blue-Care KS Johnson KS Johnson Johnson Family Practice Ackerman Jill M Allen Jacquelyn L Argubright Marisa Baird Aimee Baker Sarah M Beck Calvin Brack Julie D Brown Jennifer L Bruce Rebecca L Brunner Jane P Buss Matthew S Cahill Alisa B Cameron Kathryn E Campbell Mary Ann Campbell Virginia A Chambon Gregory E Cho Young J Christiansen Edward B. BlueCare Plus Choice HMO SNP SM. Information about the cost of this plan called the premium will be provided separately.

As an HMO member there are limits to the type of care you get thats covered when you travel outside your plans network and around the US. You can also find out more about Blue Care Network in the About Us section. To keep costs low HMOs may require you to select a primary care physician sometimes called a primary care provider or PCP who can refer you to specialists when needed.

Blue-Care KS Johnson KS Johnson Johnson Family Practice 10100 W 119TH ST STE 150 OVERLAND PARK KS 66213 913 754-0061 The following doctors practice at the address shown above. All Coverage Tiers Plan Type. Independent licensee of the Blue Cross and Blue Shield Association.

Blue Care Blue Cross NC - available only to employees living in North Carolina. However members are not required to receive services from their assigned primary care physician and referrals are not required for specialist visits. Our traditional HMO plan BlueCare requires members to be assigned to a primary care physician.

March 31 you can call us. What this Plan Covers What it Costs Coverage for. Primary Care Provider is required Referrals are needed to see specialists Auto-enrolled into a Health Reimbursement Arrangement HRA with Blue Cross contributions with option of enrolling into a Health Care FSA FSA andor Dependent Care FSA.

You cannot be denied because of pre-existing conditions and the plan provides mandated essential health benefits. The BlueCare HMO Network The BlueCare HMO network is group of doctors hospitals and other health care providers that have agreed to. Heres a Quick Overview of Our HMO Plan.

Blue-Care HMO Plan Coverage for. HMO coverage is offered by Health Options Inc DBA Florida Blue HMO. You can find information about how an HMO works and the quality health care benefits we provide in the articles below.

HMO The Summary of Benefits and Coverage SBC document will help you choose a health plan. At Blue Care Network we provide coverage that helps you easily find health care when youre sick or injured. Summary of Benefits and Coverage.

All Coverage Tiers Plan Type. Participants must use a statewide network of providers. Overland Park Regional Medical Center 10600 MASTIN ST STE A OVERLAND PARK KS 66212 913 469-6447.

Beginning on or after 01012019 -Care HMO Basic Plan Coverage for. Health insurance is offered by Blue Cross and Blue Shield of Florida Inc DBA Florida Blue. The SBC shows you how you and the plan would share the cost for covered health care services.

In these HMOs you may but are not required to select a primary care physician PCP from a plans list of network providers. Handle prior authorizations and file claims for you Offer a lower member price Your Primary Care Physician Choose a Primary Care Physician PCP for each person on your plan. The SBC shows you how you and the plan would share the cost for covered health care services.

Blue FocusCare Gold HMO 211 750 individual deductible and 30 coinsurance 20 PCP40 specialist copays Blue FocusCare Silver HMO 210 4150 individual deductible and 30 coinsurance 30 PCP60 specialist copays. A visit with a heart doctor within 24 hours after you call Advocate Health Care BlueCare Direct is an innovative new plan designed to offer individuals a new choice in your path to becoming a healthier you with lower costs. Dental Life and Disability are offered by Florida Combined Life Insurance Company Inc DBA Florida Combined Life.

/Understanding-acupuncture-for-depression-4770157-V2-fab0986399b746d6b0e856a88e357468.gif)