Bronze plans cover about 60 percent Silver plans cover about 70 percent unless youre eligible for cost sharing reduction. Several Gold and Platinum plans in Sacramento County are less expensive than some Silver plans through Covered California.

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

Silver is the better choice than Bronze if you can afford it because of its lower deductible more benefits before hitting the deductible and the only plan that is eligible for cost-sharing subsidies.

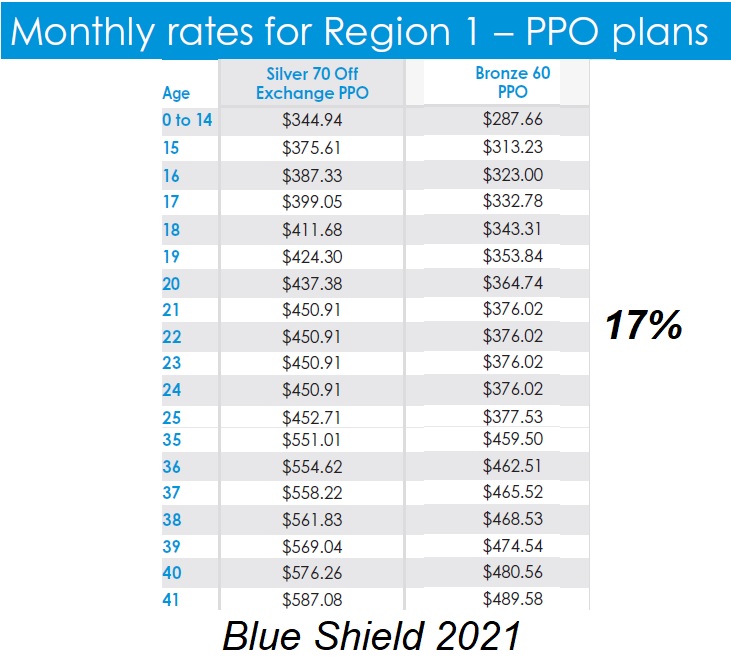

Covered california bronze vs silver. A lower co-pay plan eg. A Bronze plan could work for you but be prepared to possibly spend more than 8000 when you access care. Bronze 60 plans are generally 15 to 17 less than the Silver 70 off-exchange plans.

Any care in a facility setting hospital surgicenter etc can easily cost 1000s if not 10s of 1000s. The most popular plans people choose on Covered California are the silver level plans. Gold plans cover 80 percent while you pay 20 percent.

Both the Bronze and the Silver have a 6350 max so they treat the big bill or many medium size bills the same way. Doesnt the tax benefit of an HSA and the lower OOP costs of Bronze always mean a lower maximum after tax health care spend. We dont qualify for subsidy in Covered California.

Plans in higher metal categories have higher monthly premiums but when you need medical care you pay. MetalTier Monthly Premium PrimaryCare DoctorVisit NonPreferred BrandDrug SpecialistVisit Bronze 321 75. See 10 CCR 6460 for further detail on what costs enrollees must pay for specific services.

Your income was in that range in 2016 but apparently it is now between 151 and 200 FPl making you eligible for enhanced Silver 87 plans. Under what circumstances does it make sense to. Be sure to read through all.

Covered California Silver Plans are a popular choice for many people. More often than not they provide the best bang for your buck The affordable monthly premiums mid-size deductibles and discounted fees for commonly-needed medical services make Silver Plans an attractive option for those who are trying to balance cost with benefits. Several Gold and Platinum plans in Santa Clara County are less expensive than some Silver plans through Covered California.

Silver plans are different than bronze plans in that they may apply cost-sharing reductions sometimes called extra savings. The Bronze 60 plans are the same rates regardless of whether they are purchased through Covered California or direct from the carrier off-exchange. The max is the same for the Bronze Silver and Gold.

Choosing the Right Metal Plan Checklist. You will probably find that your income has been increased. Silver plans cover 70 percent while you pay 30 percent.

But with a 6300 deductible for most services it might not be the best plan if you often go in for doctor visits. Interested in a plan that offers free services and protection in case something goes wrong. We explain what this is below.

And Bronze plans cover 60 percent while you pay 40 percent. The deductible or lack there of really drives the cost. Weve broken up the Covered Ca plan details in more detail but the quick bullet points.

On average Platinum-level plans cover 90 percent of health care costs and you pay 10 percent. Households with income 139 to 150 of the Federal Poverty Level FPL are eligible for enhanced Silver 94 Plans. In the long run it may be more cost-effective to sign up for a Silver 70 Plan.

Many people are unaware that all bronze-level plans sold through Covered California must allow for three outpatient visits a year. The Bronze Plan has the lowest premium of all the metal plans with the exception of the Minimum Coverage Plan. Can you help us understand why one shouldnt always go Bronze with HSA vs.

Covered California Silver Plans. This plan is still competitively-priced. Click here to compare the Bronze Plan Silver Plan Gold Plan and Platinum Plan side-by-side.

The reasonable premiums lower deductibles and additional support from Covered California for day-to-day medical services is what usually makes the silver. They are most often the middle-ground plan that provides the most coverage for the least amount of money. Have a look at the income section of your Covered California account.

Bronze Plan vs Silver 70 Plan. The price is right. It can be confusing to compare health plans on your own.

Anyone choosing Bronze however should be prepared for the high deductible if services are needed. Youll have a lower out-of-pocket maximum and lower prices for basic medical treatments. The Affordable Care Act requires each metal tier to cover a certain percentage of your health care costs.

Copays start with the Silver plan and. This is the key point. If you have not yet received a quote click.

Note that currently only Silver and Bronze plans have deductibles and Silver plans cover more services before the deductible is paid.

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

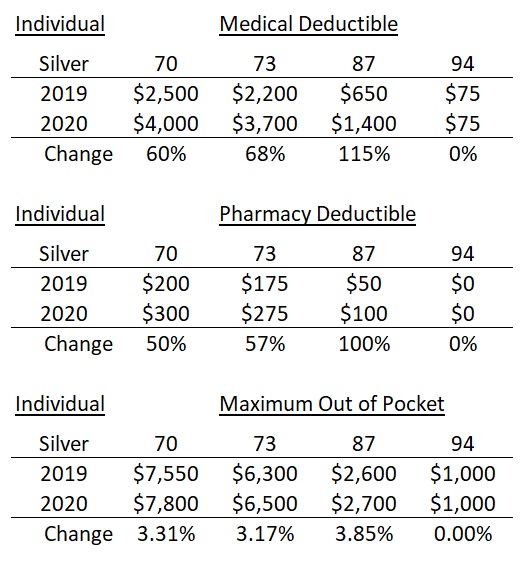

Covered California Keeps Rates Low By Increasing Silver Plan Deductibles

Covered California Keeps Rates Low By Increasing Silver Plan Deductibles

Covered California Vs Medi Cal Vs Obamacare Health For California

Covered California Vs Medi Cal Vs Obamacare Health For California

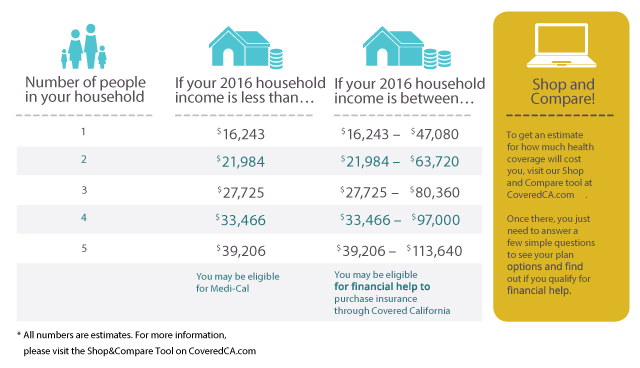

Covered California Open Enrollment For 2016 Begins Nov 1 Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Open Enrollment For 2016 Begins Nov 1 Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

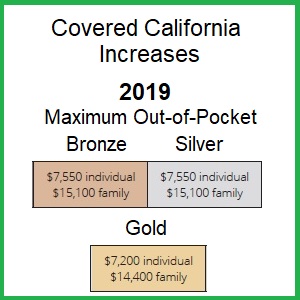

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans

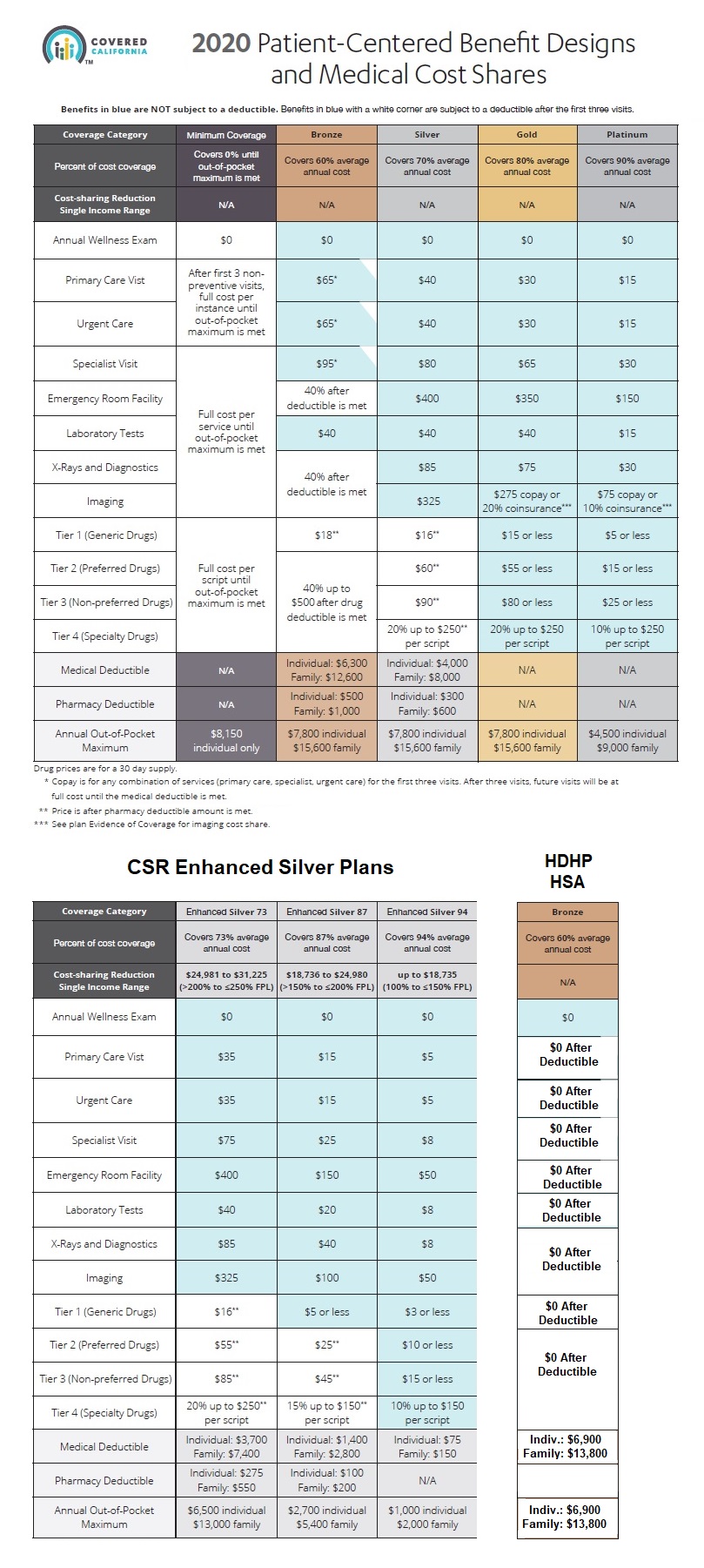

Covered California Plan Summaries Imk

Covered California Plan Summaries Imk

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

10 Tips To Succeed At Comparing Covered California Plans

10 Tips To Succeed At Comparing Covered California Plans

Covered California Releases 2019 Individual Market Rates Average Rate Change Will Be 8 7 Percent With Federal Policies Raising Costs

Covered California Releases 2019 Individual Market Rates Average Rate Change Will Be 8 7 Percent With Federal Policies Raising Costs

Metal Tier Levels Ehealth4california

Metal Tier Levels Ehealth4california

Metal Levels Bronze Silver Enhanced Gold Platinum Health Insurance

Metal Levels Bronze Silver Enhanced Gold Platinum Health Insurance

Covered California Reveals 2014 Standard Benefit Plan Designs Quotebroker Insurance Services

Covered California Reveals 2014 Standard Benefit Plan Designs Quotebroker Insurance Services

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

Bronze 60 Vs Silver 70 Which Covered California Plan To Select

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.