The 2021 weighted average premium for this Part D plan. Because of this however the monthly premium amount is likely to vary by plan insurance company and location.

Where Can I Find The Size Of The Medicare Part D Prescription Drug Plan Formularies

Where Can I Find The Size Of The Medicare Part D Prescription Drug Plan Formularies

Select your State and enter at least the first three letters of your drug name or.

Compare medicare part d prescription plans. The tier your medication lands on gives you an idea what it will cost. Medicare Part D coverage varies according to your plan. Learn about the types of costs youll pay in a Medicare drug plan.

They designate which drugs are included in the formularies as. Medicare Part D is an optional prescription drug plan PDP that helps people pay for both brand name and generic drugs that their doctor prescribes. Learn about formularies tiers of coverage name brand and generic drug coverage.

Some drug plans offer mail-order pharmacies which is a great way to save. Youll want to check plan formularies to see where you can. Overview of what Medicare drug plans cover.

The plan with the lowest monthly premium is 730 and the highest monthly premium is 10470. Keep in mind that the premium for your Medicare Part D. There are 28 Medicare Part-D Plans available in Minnesota from 10 different health insurance providers.

What Medicare Part D drug plans cover. A plans formulary may change at any time. Select the starting letter for the drug you wish to find.

Anthem Blue Cross Anthem Medicare Part D plans can offer copays as low as 0 and some plans can feature 0 deductibles. What Drugs Are Covered by Medicare Part D. Because Medicare plans set their own monthly premiums and other out-of-pocket expenses your Medicare Part D costs may differ by plan insurance company and location.

When comparing your Part D plan options look carefully at the drug formulary. Select your State and enter your drugs 11-digit National Drug Code NDC or. The Anthem network features over 68000 pharmacies nationwide.

Generally youll pay this penalty for as long as you have Medicare Part-D coverage. Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans. Medicare Part D prescription drug costs.

Medicare Part D plans must meet minimum coverage standards set by Medicare. While Cignas Part D Plan premiums can be a bit on the costly side 288 for the Essentials plan from between 360 and 460 for the Secure plan and from between 550 and 600 for the Extra. Aetna Medicare Part D plans.

In addition to the formulary most Medicare PDPs use a tier system to help manage drug costs. In general each Medicare Prescription Drug Plan and Medicare Advantage Prescription Drug plan requires a monthly premium. Some Medicare Part D Plans require you to use network providers when you fill your prescriptions.

When you compare Medicare Part D plans be sure the formularies include any medications you take on a regular basis. Learn about Medicare drug plans Part D Medicare Advantage Plans more. According to KFF more than 940 PDPs will be.

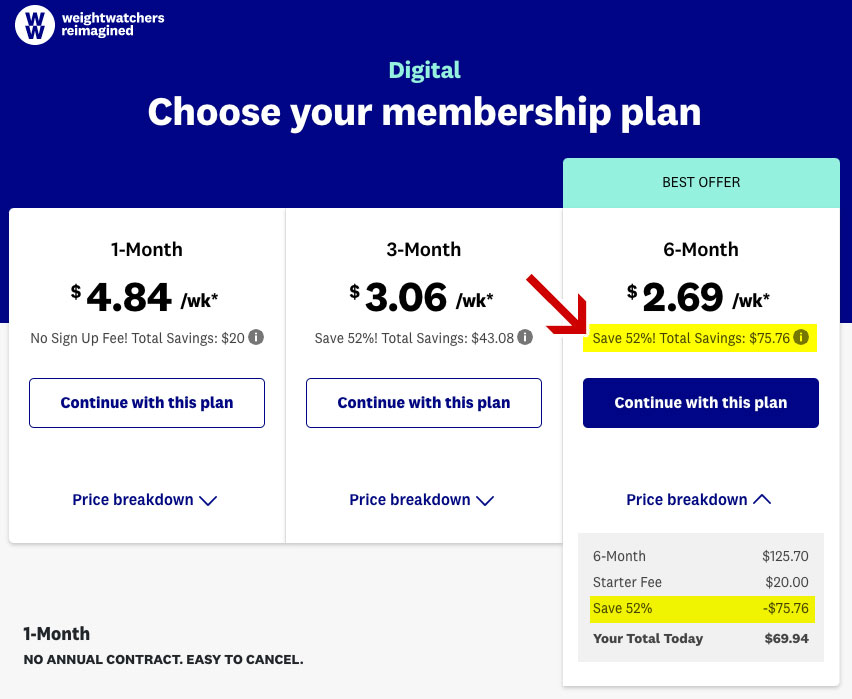

If you chose Medicare Part D Plan Juliet you could pay 294 more a year in premiums 53040 compared to 23640. Compare Medicare Part D Plans 2020 Costs. You will receive notice from your plan when necessary.

Get the right Medicare drug plan for you. Search for Your Prescription Drug Across All Medicare Part D or Medicare Advantage Plans There are three ways to find your medication. Aetna offers Medicare Part D plans including the SilverScript Choice Part D plan which is available nationwide.

2021 Medicare Plans Offering Prescription Part D Coverage. A Best Insurance Company for Part D Prescription Drug plans is defined as a company whose 2021 plans were all rated as at least three out of five stars by CMS and whose plans have an average. Comparing Prescription Drug Plans Part D During the Medicare Annual Enrollment Period AEP Whether you have a Medicare Prescription Drug Plan Part D or have prescription coverage through a Medicare Advantage Plan its extremely beneficial to review your plan each year to ensure it still includes the benefits you need at a price you can afford.

However Medicare Part D plans dont need to cover every medication that Medicare approves. This is the list of prescription medications covered by the plan. Medicare Part-D drug coverage helps pay for the prescription medications you need.

You will be taken to a page showing all Medicare Part D. If you want to continue to use the pharmacy you currently use be sure it participates with your plans network or you could pay more out-of-pocket for your medications. Most Part D plans.

When youre ready to compare Medicare Part D plans there are several things you should keep in mind. The drugs each plan covers are listed on its formulary. All Medicare Part D plans must meet specific requirements set in place by Medicare.

Even if you dont take prescription drugs now in 2021 you should consider getting Medicare drug coverage or other creditable prescription drug coverage because youll likely pay a late enrollment penalty if you join a plan later. You can choose from 4 prescription drug plans offering additional gap coverage. Costs for Medicare drug coverage.

However if you take a prescription drug on tier 1 and a prescription drug on tier 2 you could save 21 a month on copayments with Medicare Part D Plan Juliet. Comparing Medicare Part D costs and benefits Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans are available through private insurance companies approved by Medicare. Start by making a list of any medications you take every day.

Thats why its essential to compare Medicare Part D plans and choose one that covers your prescribed medications.