Switching from Plan F to Plan G. Is Plan F vs Plan G better.

Medicare Plan F And G Which Is Best In 2020 Senior Healthcare Direct

Medicare Plan F And G Which Is Best In 2020 Senior Healthcare Direct

A person with such a plan.

Medicare plan f vs plan g 2020. Annons Find affordable quality Medicare insurance plans that meet your needs. Anyone with a current Plan C or F can keep it indefinitely Medicare Plan G with the standard low deductible has a 203 Medicare Part B deductible in 2021. First Plan G has lower premiums than Plan F.

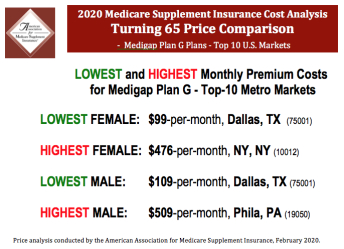

Find your best rate from over 4700 Medicare plans nationwide. Cost in the medigap plan f vs g comparison In the medicare plan g vs f evaluation cost is offered by private insurers who have the liberty of fixing their own costs. For example the average 2020 premium ranges from 160 to 210 for Plan G and 185 to 250 for Plan F for a 65-year-old Florida woman who does not use tobacco.

The better option depends on the monthly premium difference between Plan G and Plan F in your area. There is only one difference between the Plan F and Plan G. Another thing to consider is that in 2020 Plan F will be going away however those who already have Plan F can be grandfathered in to keep it.

Why do I think this. Medicare Supplement Plans C F are no longer offered to new enrollees turning 65 as of 2020. When you compare the lower premium benefit of Plan G you can save 500 or more.

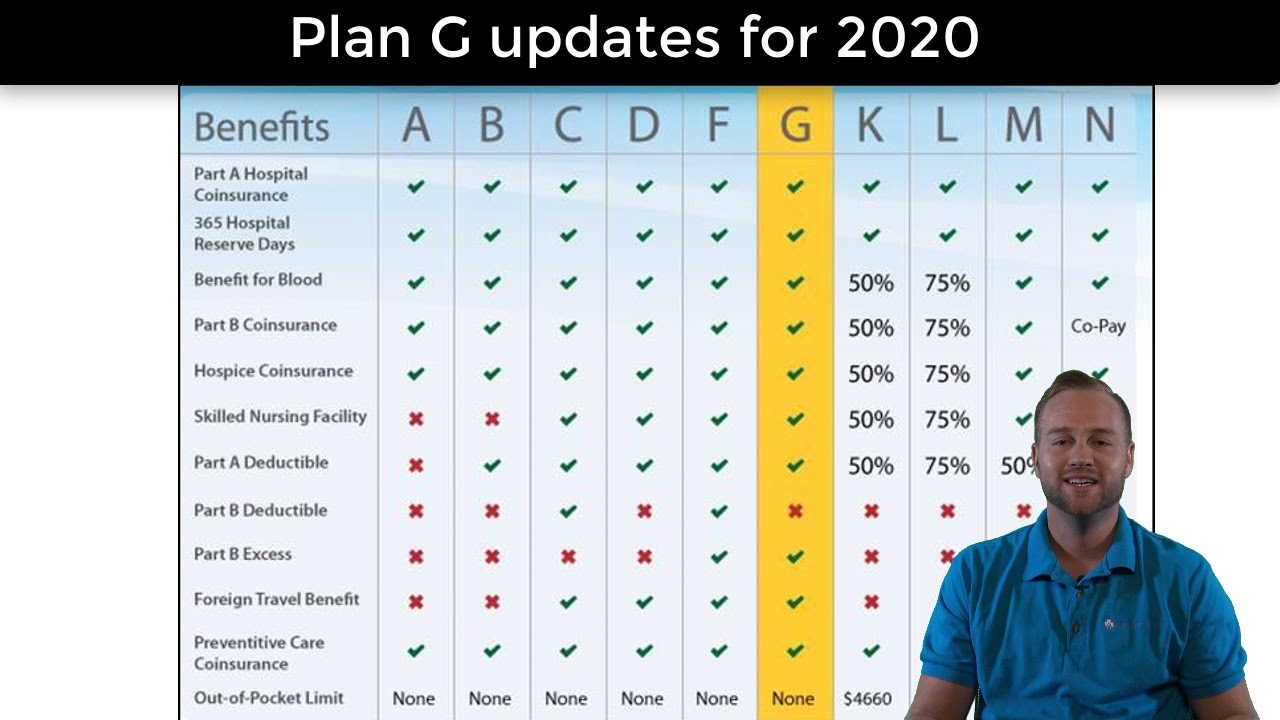

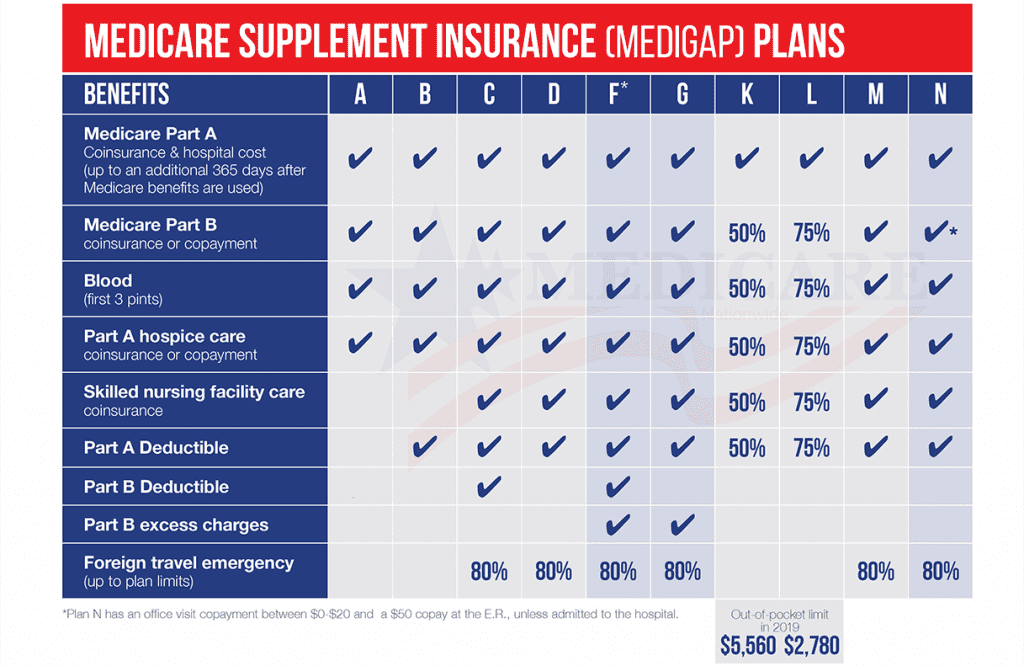

However Plan G does not cover the Medicare Part B deductible. Medicare Supplement Plan G also known as Medigap Plan G is VERY SIMILAR to Plan F with one exception it does not cover the annual Medicare Part B Deductible. You may want to make the change to reduce the price of your health insurance.

Annons Find affordable quality Medicare insurance plans that meet your needs. If youre looking for another similar option consider High-Deductible Plan F. The only difference between Plan F Plan G is the Part B deductible which will be 198 in 2020.

In some states both plans offer a high deductible version. However if you were Medicare-eligible before 2020 you can keep or pick up Medigap Plan F. If you enrolled in Plan F before 2020 you can continue your plan or switch to another Medigap plan such as Plan G if you prefer.

Part B of Medicare is the part that is paid to physicians and outpatient services for your care. That difference is that the Plan G does not cover the annual Part B deductible see the Medicare supplement plan chart on our comparison page. For 2019 the deductible is 185 but this deductible is subject to change annually.

Plan G costs approximately 25-40 less per month. If the financial difference is small only you can answer that. As mentioned earlier in the medicare plan g vs f comparison Medigap Plan F provides coverage for Medicare Part B deductible 198 as of 2020 while Medigap Plan G does not.

The least expensive Plan F premium as of 111820 in that area was 187 per month and the least expensive Plan G premium was 155 per month. Medigap plans F and G offer similar coverage. However every state has different rules worth considering before making the switch.

Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible. What Benefits Does Medicare Supplement Plan G Cover. However if the premium for Plan F is minimal compared to Plan G it may be the better option.

Example if the Plan F premium in your area is 140 but the Plan G premium is 100 you end up spending 480 more over a 12-month period in premiums with Plan F just. Plan G offers the same coverage as Plan F except for a single difference. It does not cover the Medicare Part B deductible.

Well the average age of the plan F membership will increase with time due to the lack of inflow of new younger and healthier members. Find your best rate from over 4700 Medicare plans nationwide. There are two big differences between Medicare Plan F and Plan G.

Plan G is a popular Medicare Supplement plan that is expected to increase in popularity after 2020 changes to Plan F If you were enrolled in Medicare before January 1 2020 you may still choose. Although Plan G does not cover the Part B deductible 198 in 2020 the premium savings could offset the cost of the yearly deductible. Plan F will no longer be available for those new to Medicare after 2020.

Second you will pay a 203 Part B deductible in 2021. Just like all Medigap plans Plan G is standardized and its benefits are the same for all. Medicare Plan G offers excellent coverage.

As mentioned above these are your medical insurance costs which can be some of the more expensive hospital services. So the question is whether the 181 per year is worth making the change. I am wondering if I should switch to Plan G while I can in the next few months.

If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself.