An HSA doesnt have copays on doctors visits or prescription drugs before the deductible. An HSA-qualified plan can have out-of-pocket maximums below these statutory maximum figures.

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

Covered charges are paid after the deductible is met.

Hsa qualified plan. Maximum out-of-pocket cost for the annual deductible and expenses such as copays cant exceed 6650 for. HSA funds can be used at any time tax-free to cover qualified medical expenses. You can still be HSA-eligible if your spouse is enrolled in one of.

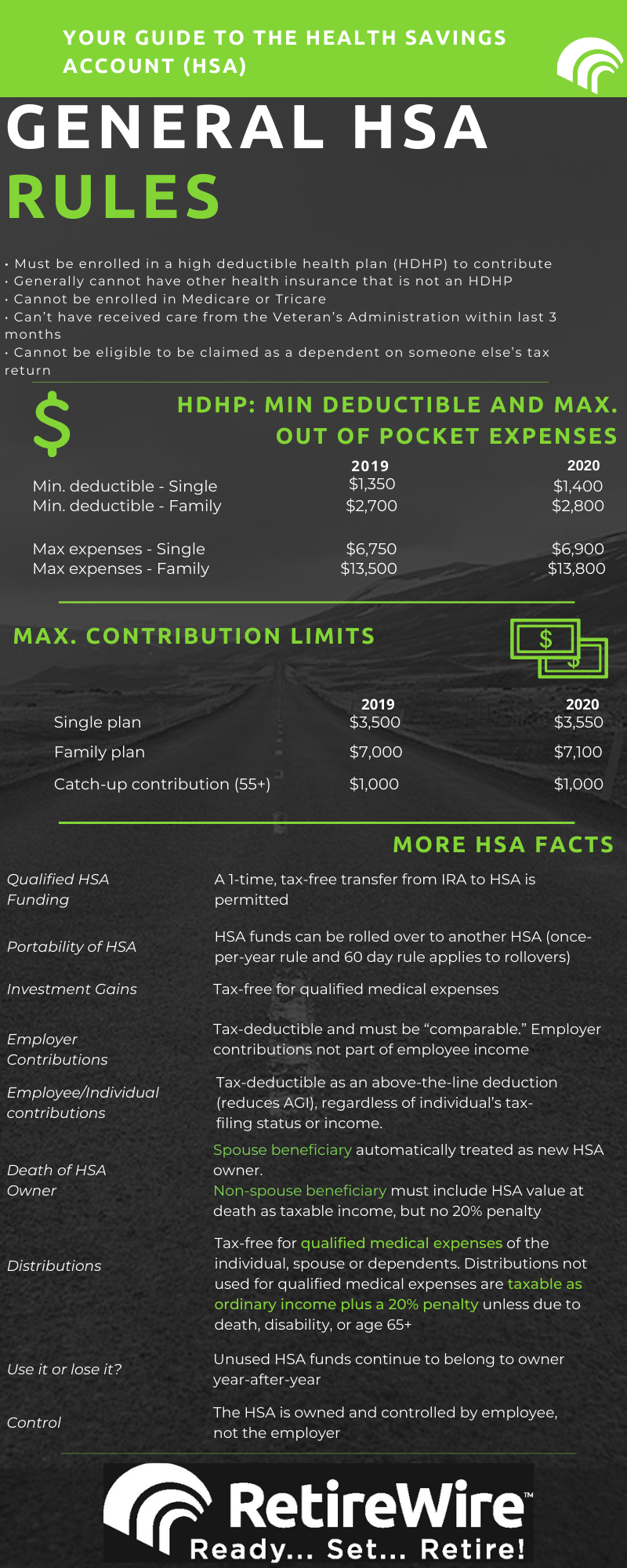

In order to qualify for one you must be enrolled in a. At the same time a tool that could soften the blowthe Health Savings Account HSA which allows people to pay many of their health care costs with tax-deductible dollarsis not available to most Americans with high-deductible plans. Being enrolled in Medicare Medicaid or Tricare.

You can only open and contribute to a HSA if you have a qualifying high-deductible health plan. Another health plan that isnt HSA-qualified including a spouses health plan or a supplemental health plan. First lets review what an HSA is and how it helps you save money.

This list includes products like allergy medication pain relievers prenatal vitamins and tampons. An HSA qualified plan is an inexpensive high deductible health insurance plan. Your plan counts as an HDHP only.

You must be an eligible individual to qualify for an HSA. How to find an HSA-eligible HDHP When you compare plans on HealthCaregov HSA-eligible HDHPs are identified on plan cards by an HSA-eligible flag in. HDHP premiums are usually among the lower-cost plans but theyre typically not the least expensive.

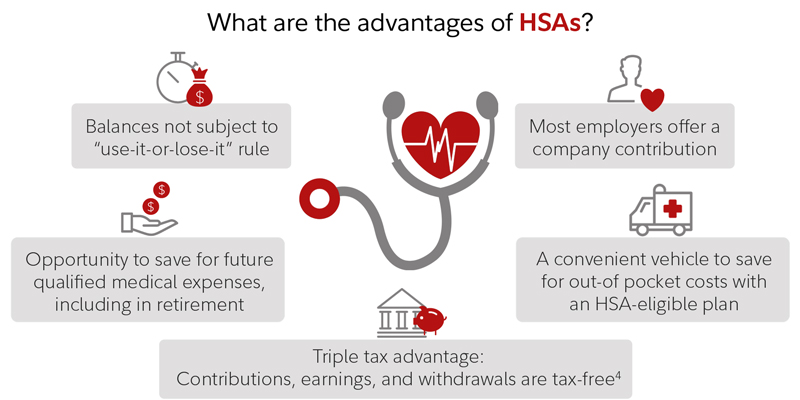

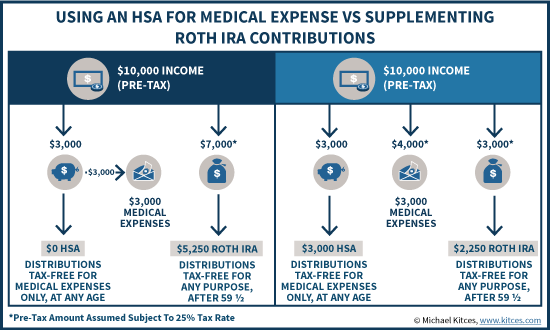

As I mentioned it comes with tax advantages specifically three benefits. Many employers offer such plans as well as HSAs to. As part of the 2020 CARES Act over-the-counter medications and menstrual care products are now eligible for purchase with health savings accounts HSAs flexible spending accounts FSAs and health reimbursement arrangements HRAs.

Your HSA contributions are never taxed. No permission or authorization from the IRS is necessary to establish an HSA. What is a high-deductible health plan.

Please purchase a membership to view this content. In 2016 3365 of the 4058 plans 83 on the federal exchange had deductibles greater than 1300. In a recent Money Girl article and podcast called How to Save Money on Healthcare With an HSA I discussed the rules and benefits of using a tax-advantaged HSA to pay for medical expenses.

An HSA-qualified plan must cap total out-of-pocket expenses for covered services at an amount not to exceed the statutory maximum out-of-pocket expenses set by the IRS. Thats a powerful incentive for everyone to have an HSA to help save for the inevitable medical expenses we all have whether its routine care with your doctor the cost of prescription drugs or for a major accident or sickness. What Is an HSA.

Preventive services are paid 100 with no cost sharing. An HSA can help pay for qualified medical expenses such as copays deductibles coinsurance and dental and vision costs. A Health Savings Account HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur.

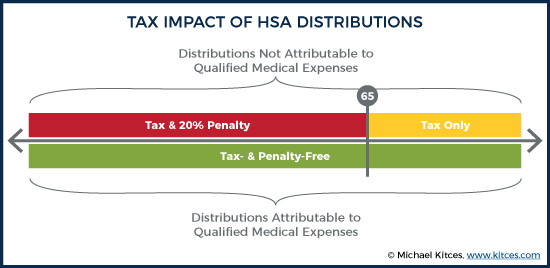

Being covered by a. After age 65 they can be withdrawn without a penalty for non-medical expenses but income tax would apply in that case. The minimum deductible must be no less than 1350 for individual plans and 2700 for families.

Basically an HSA is meant for those whose health insurance doesnt kick in until theyve already borne a substantial part of the upfront cost. Once you meet your deductible your HDHP starts to cover your medical expenses as outlined in your plan. For a health plan to be HSA-qualified it must meet the following criteria for 2018.

An HSA is funded with pre. For 2020 the maximum contribution amounts are 3550 for individuals and 7100 for family coverage. To qualify for an HSA you must have a high deductible health plan with a deductible over 1400 for an individual or 2800 for a family.

Money that is spent from your HSA on qualified medical expenses also is tax free. You can continue to use your HSA funds to cover copays and coinsurance. You set up an HSA with a trustee.

If your health plan qualifies for an HSA its one of my favorite ways to cut medical costs and save more money. While you can use the funds in an HSA at any time to pay for qualified medical expenses you may contribute to an HSA only if you have a High Deductible Health Plan HDHP generally a health plan including a Marketplace plan that only covers preventive services before the deductible. You can also filter to see only HSA-eligible plans by using the Filter.

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How To Tell If Your High Deductible Health Plan Is Hsa Qualified

How To Tell If Your High Deductible Health Plan Is Hsa Qualified

Is Your High Deductible Health Plan Hdhp Hsa Qualified

Is Your High Deductible Health Plan Hdhp Hsa Qualified

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

Can A Healthshare Plan Be Hsa Qualified Hsa For America

Can A Healthshare Plan Be Hsa Qualified Hsa For America

Retirement Health Savings Account And Medicare

Retirement Health Savings Account And Medicare

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

The Amazing Tax Benefits Of An Hsa Plan Hsa For America

The Amazing Tax Benefits Of An Hsa Plan Hsa For America

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.