Help Protect You Your Family When Moving Abroad. Get a Personalised Quote.

Private Health Insurance The Avenue Dental

Private Health Insurance The Avenue Dental

Access High Levels of Medical Cover in the UK Abroad.

What are some private health insurance companies. - Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. A diversified health and well-being company UnitedHealth Groups core capabilities are clinical. The reason is that Blue Cross can keep its premiums down for healthy enrollees who dont plan to go to the hospital by allowing the cost of out-of-network services to be imposed on sick people.

Advertentie Private International Health Cover. Private health insurance cover is generally divided into hospital cover general treatment cover also known as ancillary or extras cover and ambulance cover. Help Protect You Your Family When Moving Abroad.

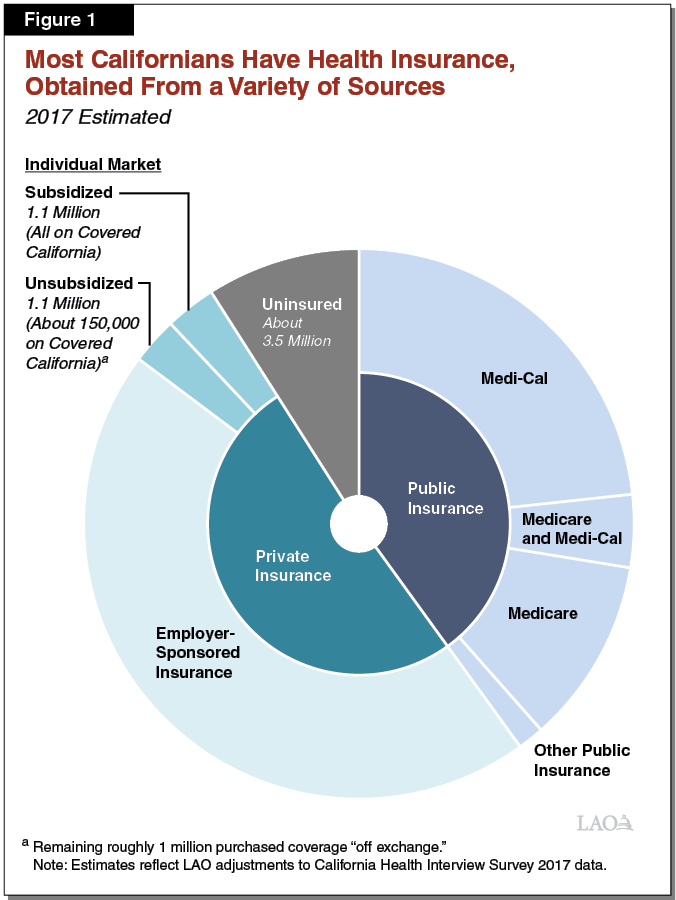

Private health insurance is referred to as private because its offered by privately-run health insurance companies as opposed to government-run programs like Medicare and Medicaid. Operates as a non-profit healthcare organization. Private health insurance refers to any health insurance coverage that is offered by a private entity instead of a state or federal government.

Kaiser Permanente is one of the most well-known health insurance providers and has 842 22 of the healthcare market share coming in second behind United Healthcare. Get a Free Quote. Advertentie Medical insurance for expats in Spain.

Tap into millions of market reports with one search. Access High Levels of Medical Cover in the UK Abroad. In Australia private health insurance is community-rated.

Its important to note that you may have to pay for public health insurance. Advertentie Private International Health Cover. List of health insurance companies.

Advertentie Protect yourself your employees with Islands comprehensive private medical insurance. We offer cover for emergencies abroad previous conditions group policies so much more. Private health insurance companies list Alaska Insurance private health insurance companies Alabama Insurance private health insurance companies Arkansas Insurance private health insurance companies Arizona Insurance private health insurance companies California.

The top-rated health insurance providers include Blue Cross Shield Humana Cigna and UnitedHealthcare with each offering a range of. Check out our affordable health plans and calculate your premium. But as noted above most types of private health insurance have to comply with a variety of state and federal regulations despite the fact that the companies selling the coverage are privately.

Advertentie Compare 50 Global Health Insurance Plans for Expats living abroad. In the US the 2 most common public health insurance plans are Medicare and Medicaid. Advertentie Protect yourself from private medical expenses while living working abroad in Netherland.

Advertentie Get more out of your healthcare insurance. Get a Personalised Quote. Call us for free.

Insurance brokers and companies both fall into this category. Ambulance cover may be available separately combined with other policies or in some cases is covered by your state government. For example people with.

Top 10 health insurance companies in the US 1. Kaiser Foundation Health Plan Inc. Advertentie Unlimited access to Health Insurance market reports on 180 countries.