Group health insurance plans for small businesses. When you buy group health insurance you have to have a group.

Small Business Health Insurance Coverage Health For Ca

Small Business Health Insurance Coverage Health For Ca

Monthly premiums are typically shared between the employer and employees and dependents can usually be added to the policy as well.

Group health insurance plans for small businesses. In other words a single individual cant sign up for this kind of plan. You can get the benefits typical for larger groups like surplus sharing fewer taxes and fees and high-cost claims protection. Small Group Insurance 2-50 Employees Small businesses can get comprehensive coverage from CareFirst BlueCross BlueShield.

Self-insured funding built for small businesses Control rising health care costs with Aetna Funding Advantage SM health plans. UnitedHealthcare offers a wide range of group health insurance options designed to help your small business save. Youll see that term quite a bit when researching group health insurance plans for small businesses.

Our health insurance plans for small businesses companies with 2 to 50 employees helps you save money and help keep your employees healthy. Anthem Blue Cross and Blue Shield group health plans are designed to cover both the everyday and unexpected health needs of your employees and bring everyone peace of mind. Plans to Fit Every Small Business Budget When you partner with Blue Cross Blue Shield of Michigan youre selecting the strongest network of providers in Michigan.

From 2003 to 2018 the cost to cover one employee under group health insurance rose nearly 200 percent. UnitedHealthcare can help you build a healthy business. Health insurance is one factor in retaining and recruiting employees and we are here to help you be a smart shopper.

These plans differ in terms of what is covered flexibility cost and reimbursements. Small business group health insurance plans generally work like the group health insurance plans offered by larger companies. All in one offering specially designed with your small business in mind.

Choose from a variety of affordable group health plans to fit the needs of your employees and your business. The National General Benefits Solutions NGBS Self-Funded Program provides tools for employers owning small to mid sized businesses to establish a self-funded health benefit plan for their employees. Here is how small business health insurance is helpful to small business owners.

In most cases this is a business although group coverage is also available for trade organizations and nonprofits. Small Business Health Insurance Our small business plans offer a full range of health insurance options for groups with 2 to 50 employees and 2 to 100 employees in Colorado. Uncover the best plan at the best price with Humana.

For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction. There are several options to get health insurance for employers that include small business group insurance self-funded plans and health reimbursement agreements. Also known simply as group coverage small business group health insurance is a single policy issued to a group of 50 or fewer people.

Small Group Plans We are well aware that small businesses are particularly vulnerable to rising health care costs. Our flexible affordable options will help keep your employees healthy while also controlling your costs. Health insurance for your business and employees Offering health benefits is a major decision for businesses.

Best Health Insurance Coverage Options for Employers 2021. Get health insurance for your small business. But for small businesses there can be as few as two people in the group during the special enrollment period.

An overview in America. No charge no expectations to enroll. Small group coverage is sometimes more affordable than plans purchased on the individual market.

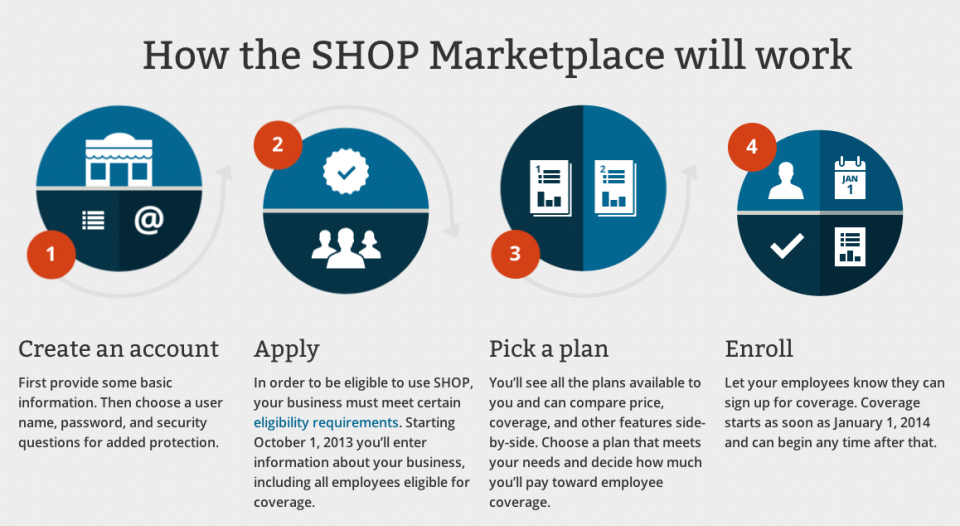

Create a Sense of Trust and Loyalty. The benefit plan is established by the employer and is not an insurance product. Use HealthCaregov as a resource to learn more about health insurance products and services for your employees.

Benefits of Group Health Insurance Plan for Small Businesses. Small business health insurance is complicated we can help. Group health scheme for small businesses contributes to the growth of the company as well as help motivate employees to perform to their best.

Browse group plans online or call a small business health insurance agent for personalized recommendations. In general any health coverage option an employer offers to its employees and their families falls within the group health plans definition.

Group Insurance For Small Business Health Plans In Oregon

Group Insurance For Small Business Health Plans In Oregon

Small Business Health Insurance Requirements 2021 Ehealth

Small Business Health Insurance Requirements 2021 Ehealth

Individual Vs Small Business Insurance California Guide

What Benefits Are Included In A Small Group Health Insurance Plan

What Benefits Are Included In A Small Group Health Insurance Plan

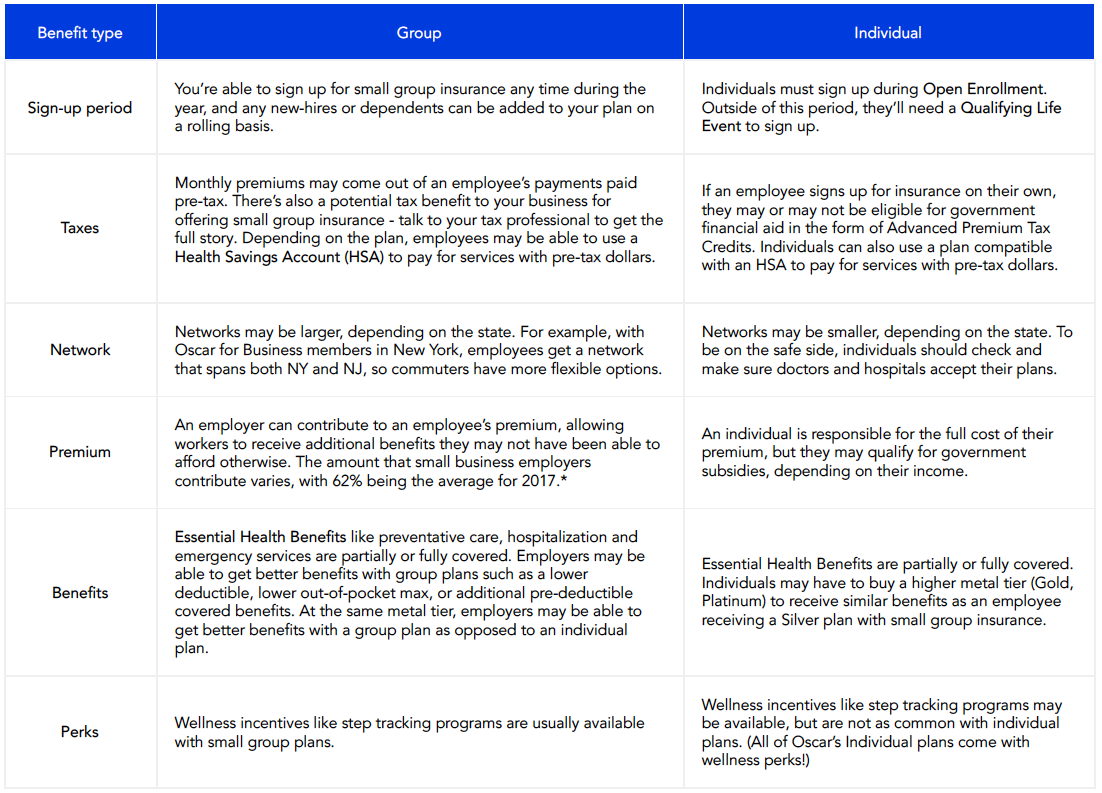

Difference Between Group And Individual Health Insurance

Difference Between Group And Individual Health Insurance

How To Save On Small Business Health Insurance

How To Save On Small Business Health Insurance

Most Popular Small Group Health Insurance Plan

Most Popular Small Group Health Insurance Plan

Small Business Group Health Insurance Plans For Owners And Employers At Matrix Insurance Agency Cal Health Insurance Plans Group Health Insurance Group Health

Small Business Group Health Insurance Plans For Owners And Employers At Matrix Insurance Agency Cal Health Insurance Plans Group Health Insurance Group Health

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Group Health Insurance For Small Businesses By Wnc Health Insurance Issuu

Group Health Insurance For Small Businesses By Wnc Health Insurance Issuu

Group Health Insurance Archives Nefouse Associates

Group Health Insurance Archives Nefouse Associates

![]() Group Health Insurance Coverage Group Health Organization

Group Health Insurance Coverage Group Health Organization

How Much Is Small Business Health Insurance

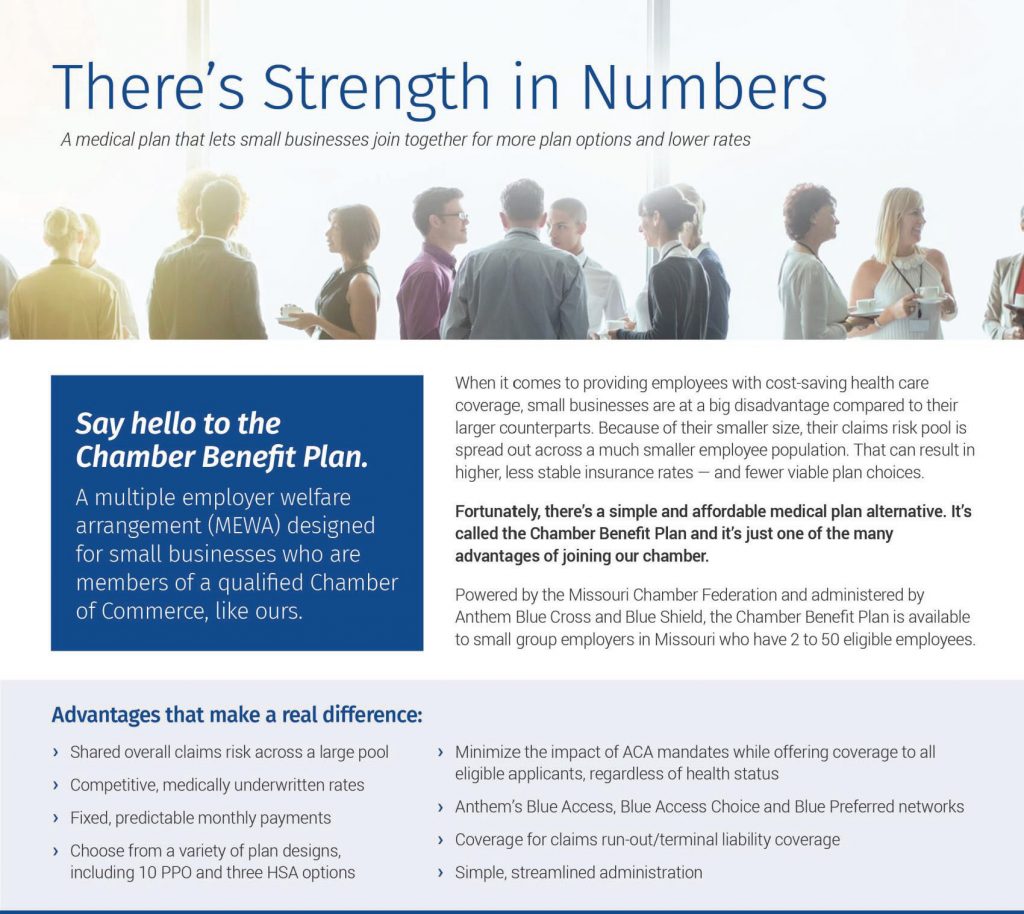

Health Insurance For Small Businesses Springfield Area Chamber Of Commerce

Health Insurance For Small Businesses Springfield Area Chamber Of Commerce

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.