You would not report unrealized gains or losses because you havent incurred them yet. And the distribution is subject to the MSA 125 percent.

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

You will need to manually adjust the California income account for the fact that both your employer and TurboTax made the add-back.

California hsa tax. People who choose to enroll in one can add funds to their HSA that arent subject to. Limiting yourself to only Treasury bonds or Treasury bond funds will spare you from worrying about paying California. Employers must contribute an equal dollar amount or equal percentage to ALL employees with HSAs if the employer contributes to ANY employees HSA.

The amount is then added to the income total on Line 16 of California Form 540. Additionally according to Instructions for Schedule CA 540. Using Franchise Tax Board data it was determined that California taxpayers contributed 430 million to HSAs in 2015.

HSA stands for health savings account. This amount was grown to reflect changes in the economy over time resulting in an estimated 600 million HSA deduction in taxable year 2018. That is you report the HSA just as if it were an after-tax investment account for your federal return.

The interest earned on an HSA is tax-free. Not any high deductible plan will do so make sure to look for the HSA sign. California residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis.

The first is an underlying high deductible health insurance plan. A business can allow employees to open a California HSA account only after the employee has enrolled in a qualified high deductible medical insurance plan. Because a tax-free rollover from an MSA to an HSA is unavailable under California law any distribution from an MSA that is rolled into an HSA must be added to AGI on the taxpayers California return.

This means interest dividends capital gains distributions and capital gains from the sale of appreciated marketable securities are all considered taxable income. Hsa and ca state tax. Tax Treatment of Health Savings Accounts HSAs in California.

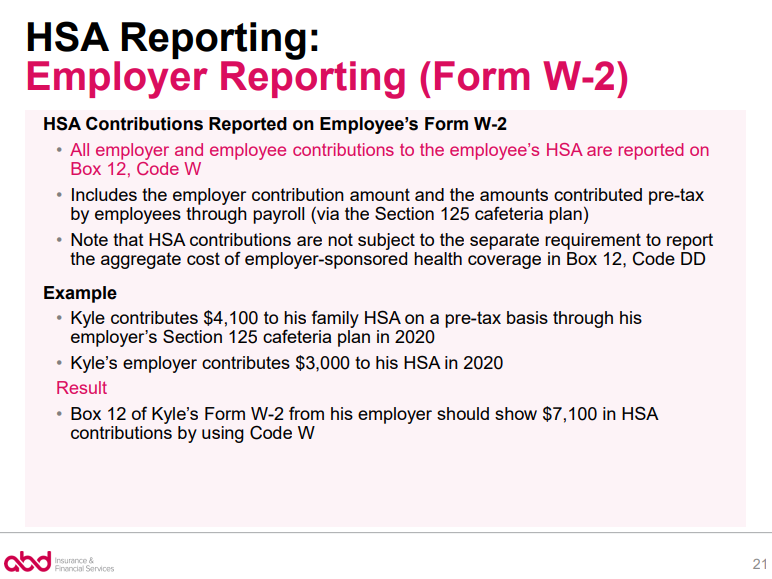

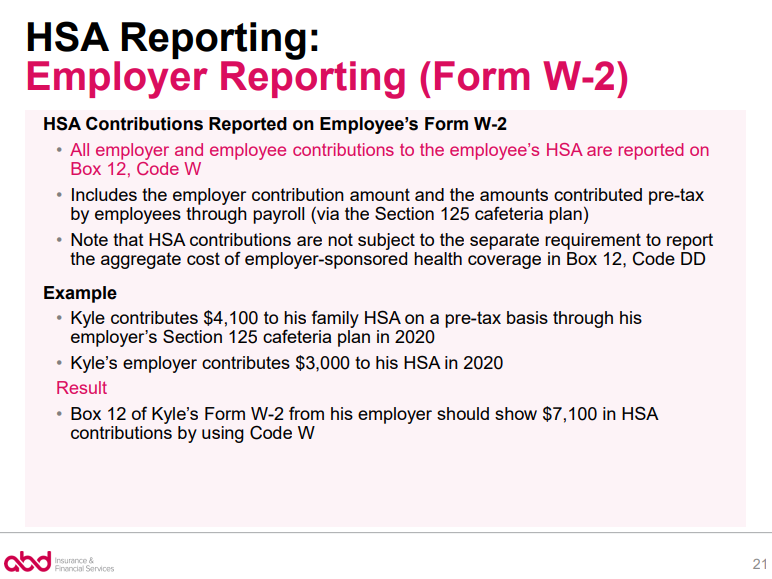

Contributions made on behalf of an eligible individual by an employer are excluded from W-2 wages. Covered California offers these plans at the Bronze level. As you see TurboTax adds the entire amount of the HSA contributions to California income because HSA contributions are not deductible nor excludible in California.

Interest paid by Treasury bonds are exempt from state income tax. Due to the additional tax complexity when you have an HSA as a California resident some people suggest investing the HSA money only in Treasury bonds or Treasury bond funds. Most of the carriers offer these HSA qualified plans and youll see the HSA type next to these plans when running your California health insurance quote for both the individualfamily or Group market.

Interest or other earnings earned from a Health Savings Account HSA are not treated as taxed deferred. As an example in California HSA contributions are not tax deductible yet they are fully tax-deductible Arizona Georgia and most other states. The appreciation in marketable securities is not subject to taxation until realized by sale.

Interest or earnings in a HSA are taxable in the year earned. Jackies employee and employer HSA contributions through payroll are pre-tax and tax-free respectively for federal income tax purposes. Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses.

Federal law allows taxpayers a deduction for contributions to an HSA account. And you may withdraw the funds tax-free for use to pay. Even if the contribution is made by the employer the money within it belongs to the account owner.

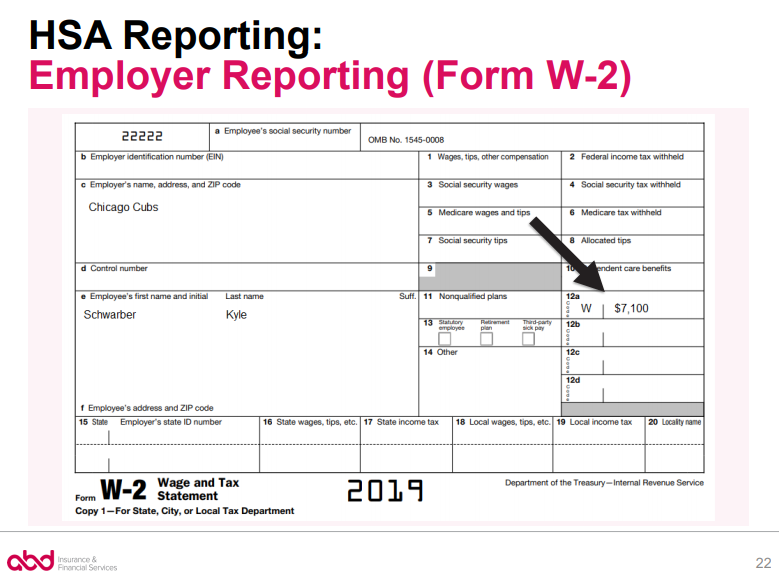

However the employee and employer HSA contributions are standard taxable compensation for California state income tax purposes subject to state withholding and payroll taxes. The HSA allows the account owner to pay for current and future health care expenses with either pre-tax dollars or tax-deductible dollars. California - HSA Contribution by Employer Code on Form W-2 Employer contributions to your Health Savings Account are reported on Form W-2 Wage and Tax Statement Box 12 with a code W An amount entered here will flow to Line 7 Column C of California Schedule CA.

Its offered to people who have high-deductible health plans HDHP. Then you multiply it by the percentage of your California income over your total income. Health Savings Account HSA Contributions Differences Between Federal and California Law Contributions.

An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. Now because the HSA contributions are earned outside of California you are not really taxed on them. So will my brokerage send me 1099s for interest dividends and capital gains in my HSA.

For example suppose you earned 50k in California 47k plus 3k HSA contributions in Minnesota and the California. California treats an HSA as a regular financial investment vehicle. California just treats HSA accounts as if they are taxable accounts.

HSAs are confusing as is but in California they can be even more complex. Lets take a look at how it works. The rules are different for the IRS and for the Franchise Tax Board.

That is the unrealized loss may disappear and I hope it does before you actually sell the stocks or fund shares. You first calculate your California state income tax with income from both MN and CA including the HSA contributions because California sees it as part of your total income. California also charges a mental health services surcharge tax of 1 on incomes over 1 million in addition to the regular tax rate for residents and certain non-residents with incomes over that threshold The tax helps to fund the states behavioral health system.

The Problem With The Hsa Health Savings Account Isn T The Hsa Our Next Life

The Problem With The Hsa Health Savings Account Isn T The Hsa Our Next Life

Why Do California And New Jersey Tax Hsas Impersonal Finances

Why Do California And New Jersey Tax Hsas Impersonal Finances

State Taxes On Hsa Contributions Rocky Mountain Reserve

State Taxes On Hsa Contributions Rocky Mountain Reserve

Health Savings Accounts State Tax Treatment

Health Savings Accounts State Tax Treatment

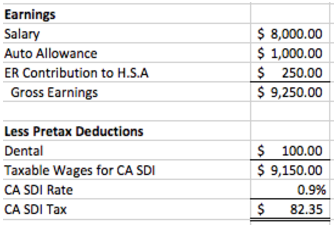

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Hsa Form W 2 Reporting Abd Insurance Financial Services

Hsa Form W 2 Reporting Abd Insurance Financial Services

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

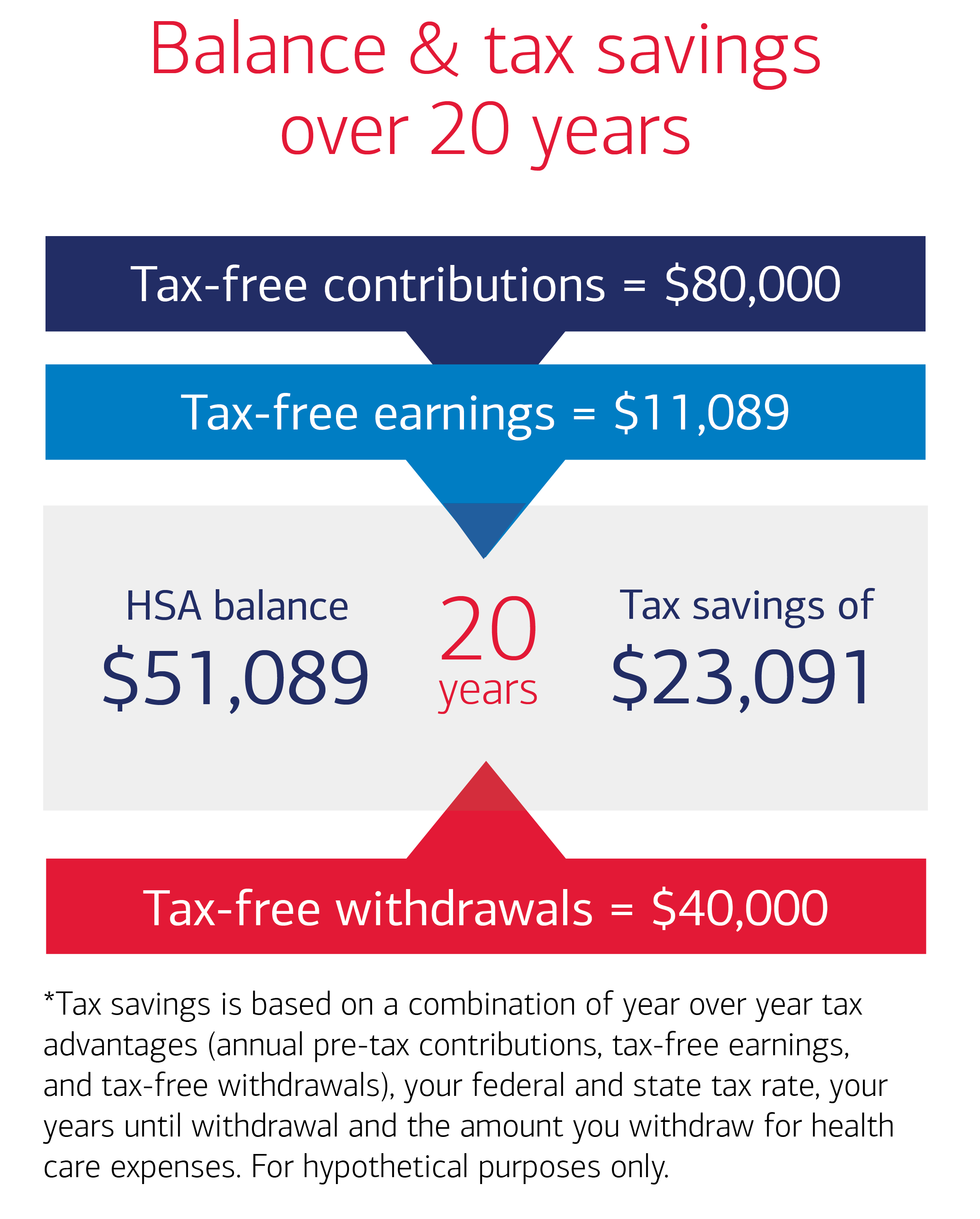

Tap Into The Triple Tax Benefits Of An Hsa

Tap Into The Triple Tax Benefits Of An Hsa

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

Hsa Form W 2 Reporting Abd Insurance Financial Services

Hsa Form W 2 Reporting Abd Insurance Financial Services

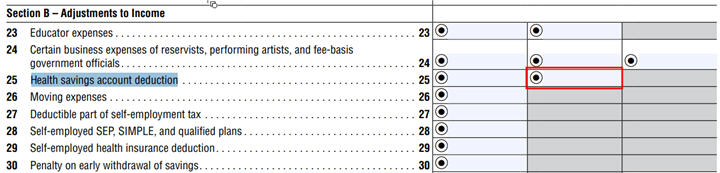

Form 8889 Instructions Information On The Hsa Tax Form

Form 8889 Instructions Information On The Hsa Tax Form

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.