IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members. This reduced their annual federal subsidy to 20137 and the California.

The tax credit itself is going up across the board.

Covered california tax credit. The American Rescue Plan suspends the repayment of any excess Premium Tax Credit subsidy that may be owed for 2020 by virtue of having a final MAGI higher than originally estimated. First the change in income threshold for 2020 tax credits in California. With Covered California for Small Business CCSB you decide the level of coverage and provide employees with health insurance that fits your budget.

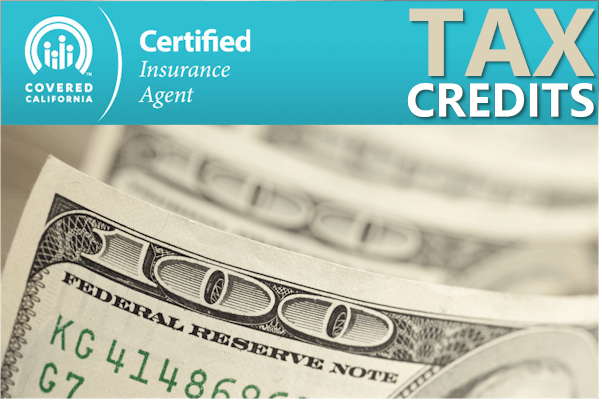

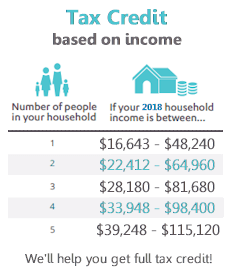

Individuals and families dont have to have any of the tax credit applied to their monthly health insurance premium. Consumers would be eligible for additional APTC when they reconcile for tax year 2020 if they did not receive the maximum allowed APTC during the year. 2018 Covered Ca Tax Credit Income Levels Every year the income levels go up to qualify for the tax credit.

There are limits to the amount you may need to repay depending on your income. 2020 Covered California tax credit expansion. If you end up earning more than what you stated on your application you may have to pay some or all of the premium assistance you received during the year back at tax time.

You will only pay the net premium after the tax credit which is 89 per month. If your income is 1 higher than the cutoff you lose all the premium subsidy which can be well over 10000 depending on your age and your household size. Based on the 1000s of successfully enrolled Covered Ca members a quick snapshot.

Their annual federal Premium Tax Credit was 21115 1760month and the California Premium Assistance Subsidy was 376 31month. 2018 is no different. 51 of Enrollees qualify for Enhanced Silver Plans.

If you live in California you may be able to breathe a sigh of relief in the next few years. Average tax credit of 302. View Covered California income limits to determine if you quality.

In the first scenario the couple entered Covered California with an estimated MAGI of 55000. When the taxpayer went to file their taxes the MAGI was over 400 percent possibly. Show that you were insured so that you dont pay a state penalty for the months you were covered.

Tax Credits Your business could be eligible for a tax credit thats only available through Covered California for Small Business. This new tax credit works differently than most. The amount of credit you are eligible to receive works on a sliding scale.

Please consult the California Franchise Tax Board the Internal Revenue Service or a tax advisor if you have questions about your specific forms penalty amount or tax return. However when they did their federal income tax return for 2020 their final MAGI was 65000. Payments of the premium tax credit went directly to the insurance company to pay a share of.

The biggest change for 2020 deals with the tax credit. This is big for consumers who received a federal subsidy based on a Covered California MAGI of under 400 percent for 2020. Furthermore the IRS only recovers tax credits that have been overpaid.

88 of Californians qualify for a tax credit. Most people are under the impression that if they purchase health insurance through a Marketplace exchange such as Covered California they have to accept all the monthly tax credit offered. It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return.

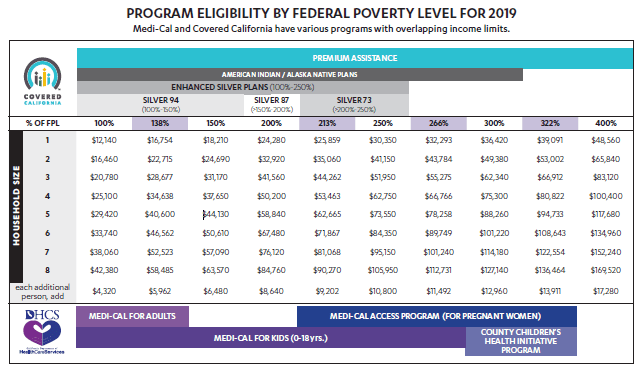

The income threshold for the cap is going up to 600 of the PFL. Lets look at each of these two. If you make over that amount but less than 400 of the federal poverty level based on your household income and number of dependents then you may be eligible for an up-front subsidy also referred to as a tax credit 1.

Here are the new income levels by size of household. It worked like a discount so you could get help paying for coverage throughout the year rather than having to wait until you filed your 2017 taxes. In your case there would not have been an overpayment that is a person received more tax credit than their income justified so in your case no tax would be due Hope this helps you to sleep better.

Covered California has introduced a new link on consumers accounts so they. Small businesses that purchase coverage through Covered California for Small Business may be eligible to receive a federal tax credit to help offset the cost of providing health insurance. Theres a state-sponsored expansion of the tax credit in two ways.

Suspend Federal APTC Reconciliation for Tax Year 2020 For tax year 2020 the American Rescue Plan suspends repayment of excess advance premium tax credit APTC owed to the IRS. Calculate your tax refund or credit or the tax amount you owe. Premium assistance also called Advanced Premium Tax Credits APTC can lower the cost of health care for individuals and families who enroll in a Covered California health plan and meet certain income requirements.

The amount of premium assistance you receive is based on how much money you make your tax household size and where you live. The Premium Tax Credit is cut off at 400 Federal Poverty Level. The premium tax credit was available immediately when you enrolled in a plan through the Marketplace.

Small businesses that purchase coverage through CCSB may be eligible to receive a federal tax credit to help offset the. If you end up earning less than what you told us on your application you may receive a credit.

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

Updated Countable Sources Of Income Covered California 2020

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered California Income Limits Explained

Covered California Income Limits Explained

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.