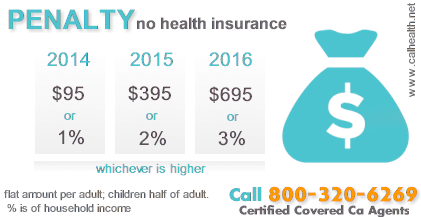

The penalty will amount to 695 for an adult and half that much for dependent children. Starting in 2020 California has enacted their own individual mandate for the state that requires residents to acquire a healthcare policy or pay a penalty.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

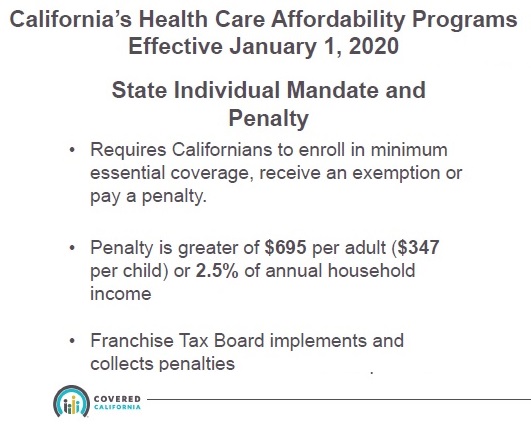

The penalty will be applied by the California Franchise Tax.

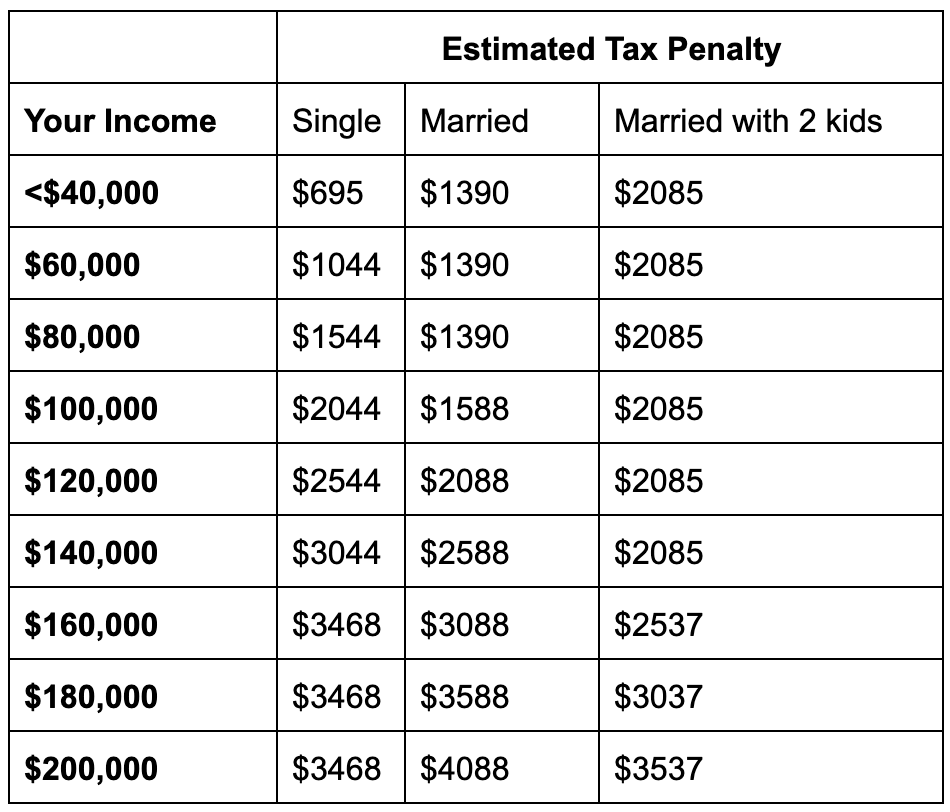

What's the penalty for not having health insurance in california. The federal ACA penalty for not having health insurance was set to 0 beginning in 2019 effectively killing any motivational factor it might have had in driving consumers into the health insurance marketplace. The penalty for a full twelve months of no minimum essential health insurance coverage will either be a flat amount of 750 per adult 375 per dependent or 25 percent of the gross income that exceeds the filing threshold whichever is higher. To find out more about health insurance options and financial help visit Covered California.

The penalty is based on the previous federal individual mandate penalty which is 965 per uninsured adult or 25 percent of the individuals household income. You will have to pay a penalty the Individual Shared Responsibility Penalty when you file your state tax return if. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021.

Get an exemption from the requirement to have coverage. You did not have health coverage. If youre uncovered only 1 or 2 months you dont have to pay the fee at all.

Individuals who fail to maintain qualifying health insurance will owe a penalty unless they qualify for an exemption. Covered California and the Franchise Tax Board each administer exemptions for qualifying individuals. Using the per person method you pay only for people in your household who dont have insurance coverage.

That could make the penalty. The penalty will amount to 695 for an adult and half that much for dependent children or 25 of household income whichever is greater. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

The penalty applies to those months in which you or your family did not have health insurance coverage. A typical family of four that goes uninsured for the whole year would face a penalty of at least 2000. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance.

For at least the first three years the penalty will be used to offset the states cost to provide larger health insurance subsidies. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. If you have coverage for part of the year the fee is 112 of the annual amount for each month you or your tax dependents dont have coverage.

Starting in 2020 California residents must either. If you compare that penalty with paying a theoretical 375 a month for a Covered California plan it may make sense to just pay the penalty for no health insurance. According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household.

Get information about exemptions and the California Individual Shared Responsibility Penalty for failure to have qualifying health insurance coverage or an exemption. If you enrolled on your current plan before March 23 2010 and have not changed coverage then you may have grandfathered status. You were not eligible for an exemption from coverage for any month of the year.

The California individual mandate will mirror federal ACA rules governing penalties. Subscribe to California Healthlines free Daily Edition. The penalty is on the books but no one wants that money.

The 2017 Covered California Tax Penalty For Not Having Insurance

The 2017 Covered California Tax Penalty For Not Having Insurance

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

2017 Health Insurance Penalty Health For California

2017 Health Insurance Penalty Health For California

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Covered California Steps Up Messaging That Tax Penalties Are Going Up In 2015 For Uninsured Californians

Covered California Steps Up Messaging That Tax Penalties Are Going Up In 2015 For Uninsured Californians

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

The 2017 Covered California Tax Penalty For Not Having Insurance

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.