The maximum out-of-pocket amount is 7000 for. Tap into millions of market reports with one search.

5 Things To Know About Health Savings Accounts Thinkhealth

Advertentie Unlimited access to Health Insurance market reports on 180 countries.

Hsa health plans for individuals. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. - Free Quote - Fast Secure - 5 Star Service - Top Providers. However you can only contribute to one if you have an HDHP.

Get the Best Quote and Save 30 Today. Health savings account HSA contribution limits for 2021 are going up 50 for self-only and 100 for family coverage the IRS said on May 21 giving employers that sponsor high-deductible health. Veterans Affairs VA medical benefits received during the previous 3 months.

Easy-to-use FDIC-insured HSAs for individuals and families All of the HSA benefits. HSAs are only available to individuals with a high deductible health plan HDHP. A Health Savings Account HSA is a tax-advantaged personal savings account that helps those with HDHP High Deductible Health Plan save money on many out-of-pocket medical expenses like doctor visits vision and dental care and prescriptions.

For 2020 this means you need to have a health plan with either a 1400 deductible for individuals or 2800 for families. The HDHP minimum deductible for an individual is 1400 and 2800 for a family in 2021. None of the hassle.

In fact you can get started on your path to better financial health without any HSA knowledge at all. Lets look at which HSA eligible plans make the most sense on the individualfamily market with a quick update on why HSAs can provide a benefit for individuals. If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000.

When you view plans in the. Amounts are adjusted yearly for inflation. With a Bend HSA you dont have to be a financial expert to maximize your health savings account.

Advertentie Compare Top Expat Health Insurance In Netherlands. To be eligible to use an HSA you must have a high-deductible health insurance plan HDHP or a plan with a minimum deductible of 1400 for. Current HSA plans for California individual health insurance.

In 2021 the annual minimum deductible for a qualified HDHP plan is 1400 for individuals and 2800 for families. 3 The HDHP coverage can be a traditional major medical plan an HMO a PPO etc as long as it does not cover first dollar medical expenses except for preventative care. To qualify for an HSA health savings account your health plan needs to have a minimum deductible of.

These days more and more consumers are moving to HSA-eligible health plans. Without this youre barred from an otherwise awesome investment vehicle. Generally you are not eligible to open or contribute to an HSA if you are covered under a health plan that is not a high-deductible health plan non-HDHP.

Get the Best Quote and Save 30 Today. Texas residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis. Substantial penalties for pulling from an HSA for non-healthcare related expenses.

HSA funds can be used at any time. A spouses non-HDHP coverage that covers you. For plan year 2019 the minimum deductible is 1350 for an individual and 2700 for a family.

In order to be eligible for an HSA you must already have a high-deductible healthcare plan on the first of the month before starting your HSA account according to the IRS. Health savings accounts provide a way for people with high-deductible health plans to plan for out-of-pocket expenses. HSAs have now been on the market for the better part of a decade and see no real threat of disappearing unless the underlying health plans become uncompetitive.

Advertentie Compare Top Expat Health Insurance In Netherlands. How to find an HSA-eligible HDHP When you compare plans on HealthCaregov HSA-eligible HDHPs are identified on plan cards by an HSA-eligible flag in the upper left-hand corner. To be eligible to contribute to an HSA the taxpayer must be enrolled a high-deductible health plan defined as a plan with a deductible of at least 1400 individual or 2800 family by.

An HSA gives you more control over your health care spending. For plan year 2020 the minimum deductible for an HDHP is 1400 for an individual and 2800 for a family. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

HSA-ineligible health plans include. You can set aside pretax funds use the money to pay medical bills and even.

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

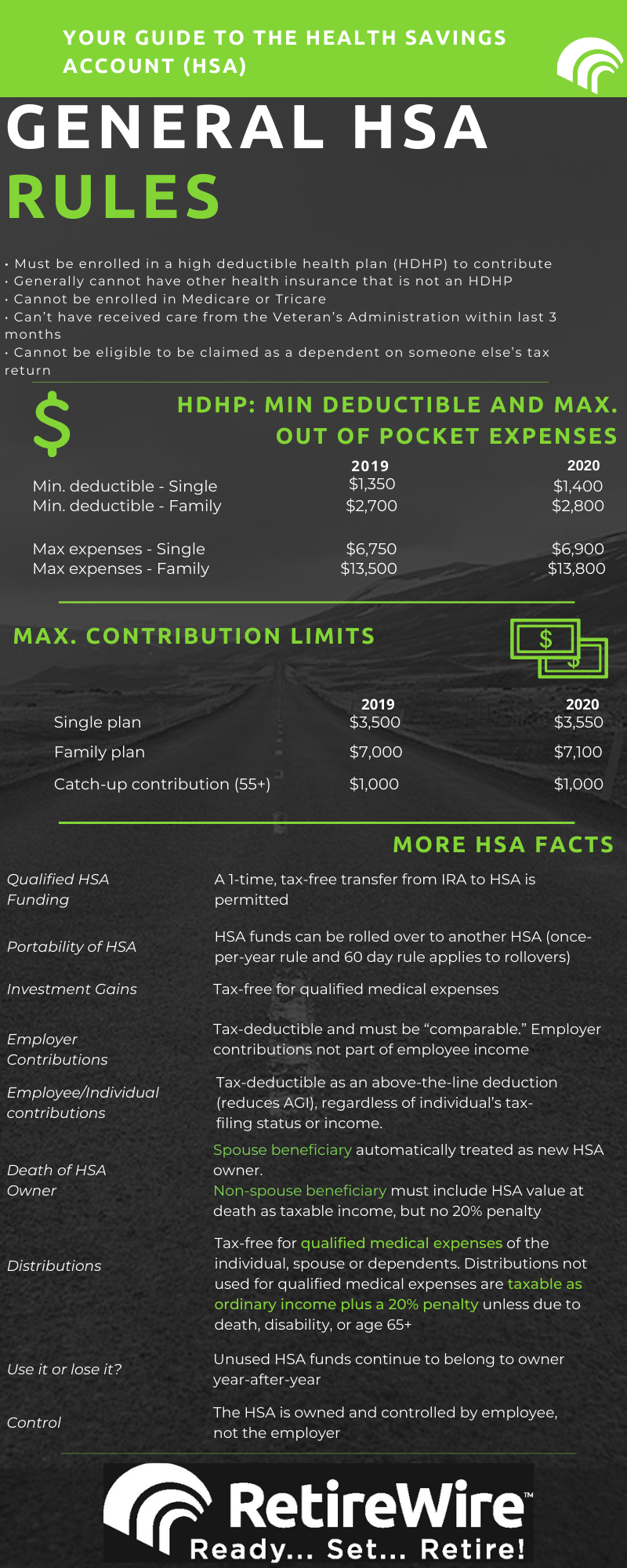

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

Health Savings Accounts How Hsas Work And The Tax Advantages

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.